Insolvencies in Australia’s construction sector have skyrocketed, up almost 50 per cent, according to a leading credit reporting bureau report.

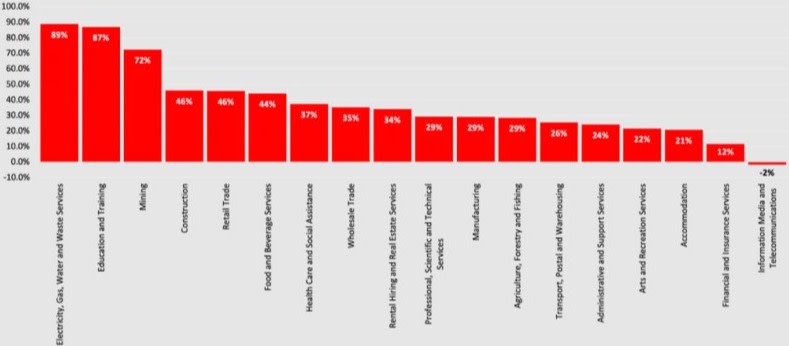

CreditorWatch’s May 2024 report for its Business Risk Index found that insolvencies over the past year to May 2024 for all sectors and industries were up 38 per cent.

Construction sector insolvencies increased by 46 per cent.

Across all sectors, insolvencies rates are 41 per cent above the maximum reached prior to Covid.

Construction, however, is not at the top of the list—electricity, gas, water and waste services have had an 89 per cent increase in the rate of insolvencies, education and training was next at 87 per cent, and mining at 72 per cent.

Only the information, media and telecommunications industry had an improvement with a drop of 2 per cent.

But elsewhere the construction sector did top the list.

In business payment defaults, a record was set in May with an increase of 21 per cent on the April data and a 58 per cent increase during the past year.

The construction sector also has the highest rate of late payments with 10.46 per cent of all businesses in the sector having payments more than 60 days late.

CreditorWatch has identified that a business has a 20 per cent chance of failure within a year if it has a default, a 42 per cent chance of failure if it has two and a 62 per cent chance if it has three defaults.

Percent change in insolvency rate 12 months to April 2024

▲ Source: CreditorWatch

The failure rate for the construction sector has increased by 15 per cent during the year to May.

It is also the second ranked industry for outstanding debts of more than $100,000 to the Australian Tax Office with a rate of 1.21 per cent, just behind the food and beverage services industry a 1.7 per cent.

Court actions have also increased to above pre-Covid levels with a 63 per cent increase over the year.

CreditorWatch chief executive Patrick Coghlan said cost-of-living pressures were part of the cause.

“Multiple interest rate hikes and stubbornly high inflation have forced consumers at all income levels to cut back on spending,” Coghlan said.

“We don’t expect a meaningful turnaround in consumer confidence until the impact of at least two rate cuts has been felt, which won’t be until well into 2025.”

Regions with the least risk of insolvency include regional Victoria, inner-Adelaide and North Queensland.

South Australia’s Norwood-Payneham-St Peters is at the top of that list with a 3.35 per cent chance of default, with Unley also in SA second and Victoria’s Ballarat third.

The highest risk of business failure is in Western Sydney and South-East Queensland with NSW’s Bringelly-Green Valley the top region with 7.53 per cent chance of default followed by Western Sydney’s Merrylands-Guildford and Canterbury.

Adelaide is the safest CBD thanks to low rents and a large pool of workers.

AllRoads is one of the most recent companies to face liquidation in Australia within the construction sector, while overseas the biggest news in the Asia-Pacific region at the start of 2024 was the liquidation of Chinese developer Evergrande.