Cromwell Sees Increasing Demand for Space at Brisbane CBD Tower

High vacancies and a soft leasing market has burdened Brisbane’s office market over the last 24 months, but Cromwell Property Group is reporting increased demand at its inner-city commercial tower with an uplift in publicly-listed companies seeking out flexible leasing arrangements.

In the past 12 months, Cromwell has signed more than 13 new leasing deals at its 20-level office tower, 200 Mary Street asset, predominantly with ASX-listed professional services companies, with the tower now close to 90 per cent occupancy.

Among the new tenants joining long-standing occupants Arthur J Gallagher, Australian Associated Press, and Retire Australia is financial services firm IOOF, AGL, Computershare, and engineering consultants Northrop.

Related reading: Brisbane Rental Market Keeps Investors Optimistic

Brisbane office market’s ‘flight to quality’

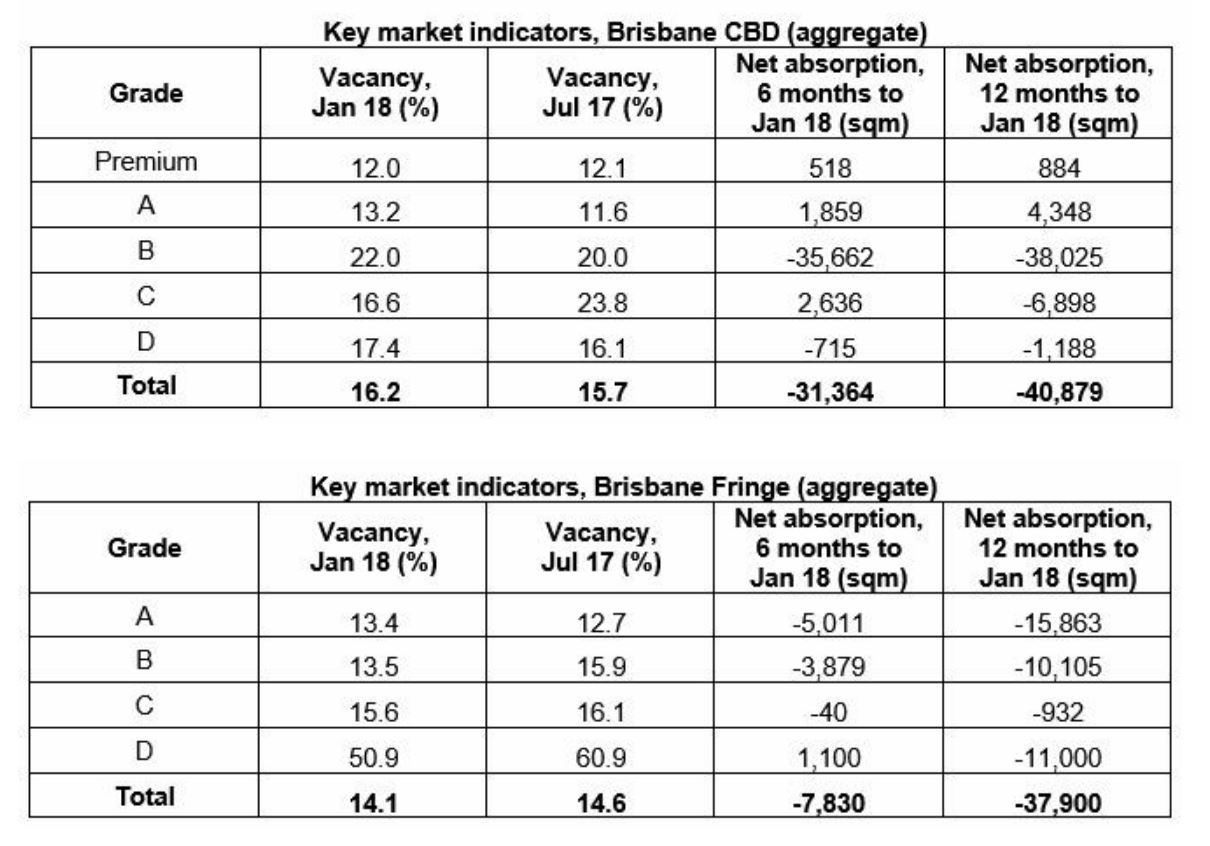

In its most recent Office Market Report, the Property Council of Australia revealed that Brisbane was one of only two CBD office markets to experience rising vacancies over the six months to January 2018, as demand for lower grade stock fell.

Vacancy across the CBD has increased over the period from 15.7 to 16.2 per cent.

PCA Queensland executive director Chris Mountford said that higher-grade office space recorded positive tenant demand over the last six months, with a distinct “flight-to-quality” being observed in the data.

"While Brisbane CBD vacancy is currently high, there are plenty of tenant expressions of interest in the market, so there are positive signs over the horizon."

Cromwell head of property Bobby Binning said the recent deals at 200 Mary Street highlighted the increasing popularity of sub-500 square metre space in the Central Business District.

“Demand has increased in the past few years, particularly from companies looking for creatively designed fitted tenancies of high quality to cater for the growing needs of these professional services firms,” Binning said.

Related reading: Brisbane Office Market Forecast for Growth

Further catering to the needs of smaller tenancies, Mary Street incorporates end of journey facilities and the Cromwell Business Hub, run in partnership with Regus, which provides a conference facility, meeting rooms and flexible co-working space for tenant customers.

Director of Caden Office Leasing David Prosser and Collier International’s Kelly Moon acted on behalf of Cromwell on the leasing deals.

Cromwell purchased the Mary Street asset in 2001 and has since undergone extensive modernisation and refurbishment.

Early this year Singapore-based ARA Asset Management Limited acquired a 19.5 per cent stake in Cromwell Property Group in a $405 million deal which should assist both companies with their local and overseas ambitions.

Cromwell is seeing to boost its European presence where ARA has established a European platform, and also strengthen its new Asian unit.