China, Severe Drought Not a Problem for Booming Farm Sector

Agricultural assets continue to change hands at a feverish pace with farming asset deals surging to $3.3 billon in 2018 despite the key challenges imposed by severe drought and the slowdown of Chinese economic growth.

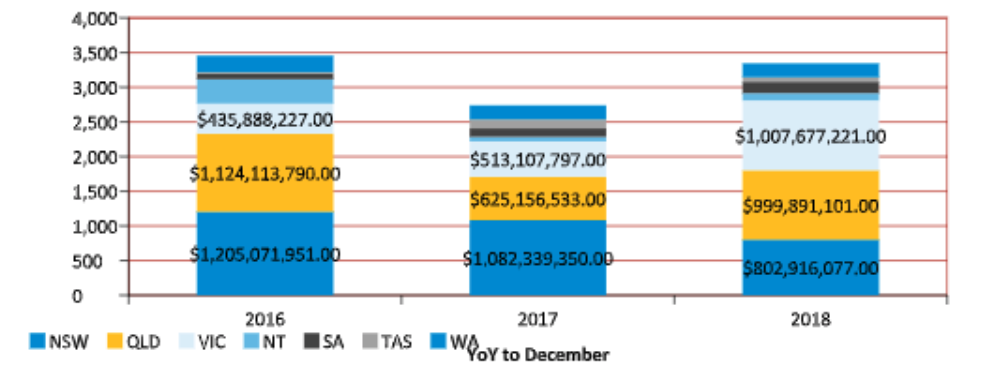

According to the latest Colliers International Agribusiness Research and Forecast Report, which tracks the number and value of farm sales valued at $5 million or more across Australia, 254 deals above $5 million were struck in 2018, almost eclipsing 2016's peak capital investment high.

In Queensland, the value of farmland sales surged by 60 per cent to $1 billion, while farm sales in Victoria doubled over 2018 to also hit $1 billion.

NSW experienced a 26 per cent fall with deals valued at approximately $800 million for the year.

“Australian agricultural trade surplus has grown sharply for the past decade and will continue trending upwards,” Colliers International head of agribusiness Rawdon Briggs said.

“Agribusinesses is now a standalone asset class and will continue to attract investment from offshore and high net worth groups adding capital.”

Related: Sustainability a New Federal Election Property Battleground

Agribusiness Sales Volumes by State above $5 million

The agricultural sector contributed $49 billion to exports in the year to June 2018.

Meat and live animal export were one of the largest contributors with $13.2 billion in exports, including beef and veal exports of circa $8 billion up 11.9 per cent or $848 million for the past year.

Grain products contributed $10.9 billion, down nearly 25 per cent due to the lack of Australian supply of wheat, chickpeas and canola.

Wool, dairy and horticulture contributed $4.4 billion, $3.4 billion and $2.7 billion, with greasy wool, cheese and fruit export activity growing between 10 to 25 per cent.

Industrial crop (cotton, sugar and wine) exports reached $6.6 billion for the year to June 2018, supported by the growth in wine and raw cotton exports.

“Australian agricultural trade surplus has grown sharply for the past decade and will continue trending upwards,” Briggs said.

“Agribusinesses is now a standalone asset class and will continue to attract investment from offshore and high net worth groups adding capital.”

According to the report, the standout performers in 2018 were permanent high-yielding crops such as macadamias, citrus, avocados, almonds and grapes, which benefited from rising commodity prices surging more than 30 per cent in 2018.

Related: Dairy Farm Hits the Block for $140 Million

Vineyards in high demand

According to Wine Australia, in the 12 months to 30 June 2018, the value of Australian wine exports rose 20 per cent to $2.76 billion, the strongest growth for more than 15 years.

“We have seen this segment of the market focus on premium and super-premium assets in recognised wine areas with small to medium wine companies in the $2 million-plus to $20 million range appearing to be more attractive,” Colliers vineyard specialist Tim Altschwager said.

“On a macro industry level, property values are at last showing signs of growth in both vineyard values and in wineries in key locations.”

South Australia remains the largest wine grape producing state, accounting for almost 50 per cent of the overall planted area, while the top five export destinations, China, US, UK, Canada and New Zealand accounting for approximately 74 per cent of Australia’s wine exports by value.

Looking forward

“In 2019, we expect strong demand to continue for properties suitable for sheep and wool production with property values likely to increase further,” Colliers International head of agribusiness Rawdon Briggs said.

“At present demand for high-quality grazing assets in both pastoral and high rainfall regions is currently outstripping supply.”

The report highlighted that interest from offshore capital and high-net-worth groups would bolster the industry with institutional investors continuing to diversify the risk exposure of their investment portfolio.

However, Colliers warned that the consistent drought in many agribusiness regions remains as the biggest threat to future investment mandates.

“Looking forward, agribusiness property values will hold firm in well recognised regions, despite the climatic challenges impacting on cashflows and cash reserves,” Briggs said.

“This drought event has had higher commodity prices than we have seen in previous events over the past four decades.”

“It shows in the resilience of the market data. The weaker Australian dollar and free trade agreements are supporting export activity, partially offsetting the downside risks.”

Offshore demand for Australian products remains on the rise particularly for wine, cherries, avocados, dairy products and beef.

However, the weaker Australian dollar has supported export activity, partially offsetting the downside risks, with China, Australia's main export destination, experiencing a slowdown on economic activity to levels not seen in 25 years.

China still remains the main destination for Australian agricultural exports, reporting $11.8 billion for the year to June 2018, and comprising 24.1 per cent of the agricultural business activity in Australia.