Deteriorating Conditions Hit Commercial Property Markets

Falling valuations and an above-average volume of office stock soon to enter CBD markets presents a key risk to the health of the commercial property sector, the Reserve Bank has warned.

The bank’s assessment of the economy in its financial stability review for April paints a rather dire outlook for the “previously strong” office sector as uncertainty surrounding the size and duration of the Covid-19 economic downturn weighs on financial markets.

Disruptions to trading conditions and the impact on rental income flow will hurt commercial property in the period ahead, while a fall in valuations could create serious headaches for highly-geared investors.

“Asset valuations in property markets had increased to very high levels over recent years, both in Australia and overseas,” the bank said in its review.

“Declines in both sales volumes and valuations are likely, reflecting the weakness in the rental market and a repricing of risk by institutional investors.”

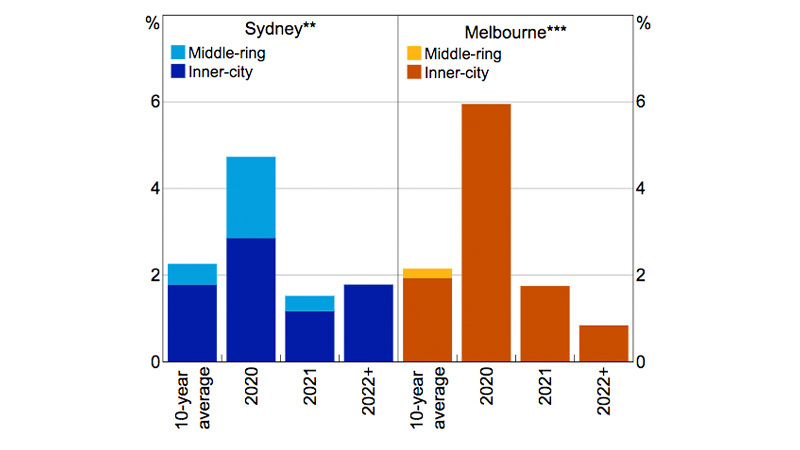

The bank said that office market demand is now “unlikely” to keep pace with the supply due to be delivered into Sydney and Melbourne CBD office markets.

In Melbourne, nearly 400,000sq m of supply is expected to come online in 2020—the largest annual increase in three decades—while 150,000sq m will be added to the Sydney market this year.

The prospect of large declines in property prices presents significant balance sheet risks for lenders—with commercial property taking up around 6 per cent of the banks’ books.

Related: Rent Relief ‘Proportionate’ to Loss in Tenant Revenue

Future office supply

^ Share of 2019 stock. Completed projects and projects under construction. Sources: PCA, RBA.

The Reserve Bank also noted that a range of property funds in the UK—with assets totalling more than £20 billion—suspended redemptions because of valuation uncertainty and the inability to quickly sell assets.

A wave of UK funds moved to temporarily suspend activity in March as valuers lost confidence in measuring the underlying value of commercial assets—triggering “market uncertainty” clauses.

AMP global head of real estate Carmel Hourigan said that while the group is “definitely getting hits to retail valuations” she is optimistic about a U-shaped recovery.

“In 12 months time when you look at allocations across the superfunds and ‘lower for longer’ [interest rates], real estate at the prices we could see is going to be a very attractive asset class,” Hourigan said at a Property Council webinar in early April.

“So I’m hopeful we’ll stand up to this very well as a sector.”

The Reserve Bank said that highly-leveraged retail property owners could struggle if tenants are unable to pay rent.

“Prior to the pandemic the retail commercial property market faced challenging conditions due to weak consumer spending and heightened competition.

“The outlook for tenant demand for retail property has deteriorated given the downturn in trading conditions, with declines in rents and increases in vacancy rates now likely.”

Despite increased risks across the board, the bank detailed the solid starting position of Australia’s financial system.

“Australia's financial system faces increased risks, but is well-placed to manage them.”

The Financial Stability review is published half-yearly by the Reserve Bank.