Developers Favour Townhouses in Slowing Property Market

Developers are moving away from high density sites in favour of lower density projects as sales of high-rise, investor-driven development makes way for the owner-occupiers and downsizer demographic.

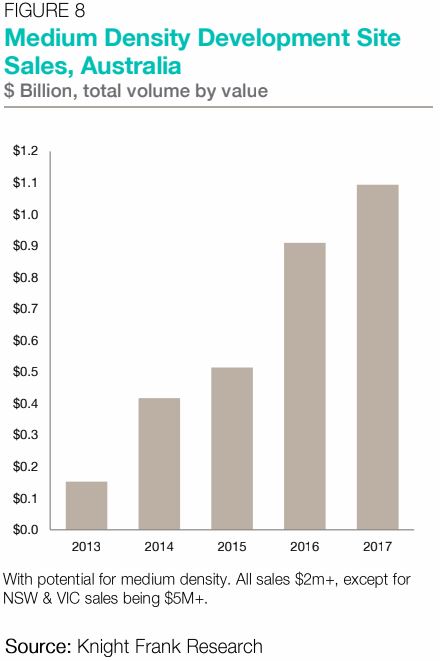

Recent research from Knight Frank’s Australian Residential Development Review 2018 reveals that medium-density sites suitable for townhouse and terraces reached 12.8 per cent of all residential development site sales across Australia in 2017.

This was up from 2.2 per cent in 2013 and 9.6 per cent in 2016.

Knight Frank’s head of residential research Michelle Ciesielski said the volume of medium- density development sites in Australia was $152.8 million in 2013. By the end of 2017, this had increased to $1.1 billion.

“The shift towards low-maintenance living has only just begun, with an aging population in downsizing mode, more first-time buyers and an increasing trend in time-poor communities,” she said.

“We’re seeing a continued trend towards medium-density living. For growing families, upsizing from higher-density living to an attached townhouse with a backyard has become the more affordable option when measured against standalone houses.”

The “missing middle” has long been identified across Greater Sydney, and only recently addressed in a Low Rise Medium Density Housing Code by the NSW Department of Planning.

Site sales and market overview

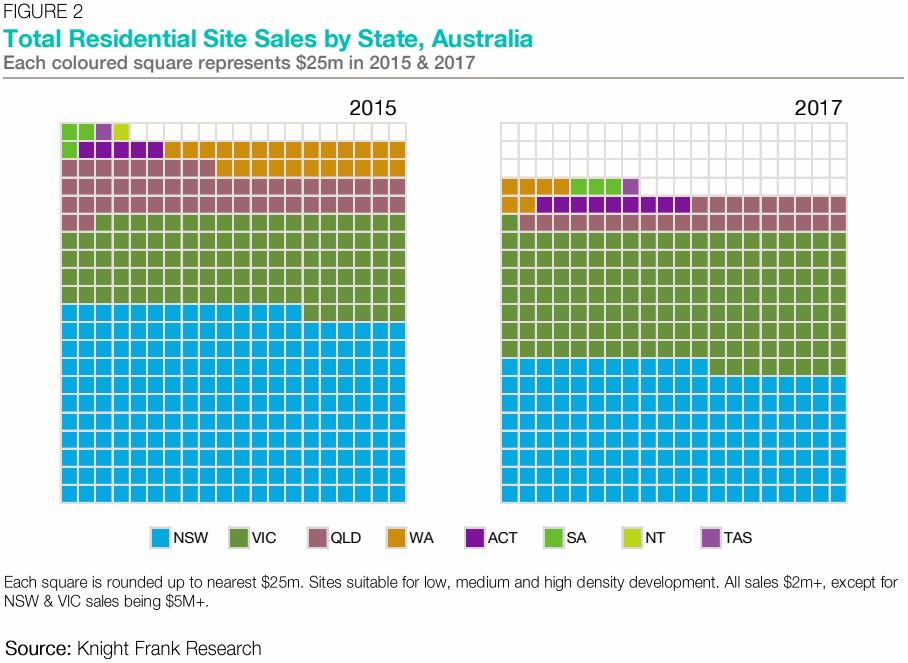

Across Australia, the total volume of residential development site sales for 2017 was $8.56 billion – reflecting total number of sites for low, medium and higher density.

This figure is down 14.3 per cent from the $10.0 billion in 2015 with all states and territories recording a similar, or lower volume of sales with the exception of Victoria.

New low density residential land lots across major capital cities were down six per cent on the previous year with 55,270 released, according to the research. The median price for a land lot was $313,000; an annual increase of 9.1 per cent.

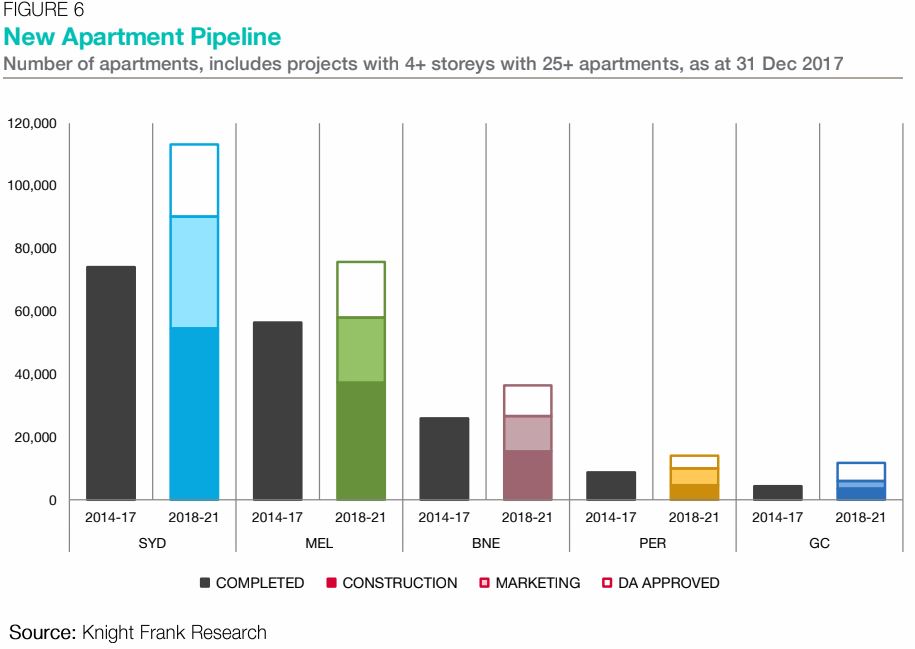

It was a strong 2017 for the new apartment market with a total of 65,700 higher density projects completed.

The full impact of the APRA’s regulations is expected to be felt come late 2018 with projected apartment completions at 58,700, marking a 10.7 per cent annual decrease. The first decline in apartment completions registered in the past seven years.

Investor finance for off-the-plan apartments continues to be a hurdle, as a result of the double-barrelled dilemma, developers are unable to secure funding for their projects. A recent NAB Commercial Property Index report revealed similar sentiment around funding for both debt and equity as still a major challenge faced by developers.

Higher density development sites across Australian cities totalled $5.6 billion in 2017. Down 26.8 per cent on the previous year and well below the $9.2 billion in 2014.

NSW saw the highest volume of sales at $2.8 billion, followed by Victoria with $2.1 billion.

In total, across the five cities, there are currently 115,850 apartments under construction, with another 75,150 currently being marketed potentially due by the end of 2021.