Home Ownership to Decline by 4pc: AHURI

Home ownership across Australia is projected to fall despite the possibility of increased affordability brought on by the Covid-19 health and economic crises, a new paper by research body AHURI says.

The report, released on Thursday, reveals how Australia’s overall home ownership rate is projected to decline from 67 per cent to around 63 per cent by 2040, and notably to 51 per cent for those in the 25–55 age bracket, down from 60 per cent in 1981.

The research, undertaken by Swinburne University of Technology, suggests that the continued retreat in home ownership has been brought about by complex shifts through the entire institutional environment—rather than a single policy failure, political decision or market failure.

“Broadly, Australia now has an institutional environment which no longer supports ownership as it did in the past,” Swinburne University of Technology professor Terry Burke said.

“A housing system in which one half—predominantly older homeowners—acquires wealth and the other half—generally younger renters—doesn’t, is a recipe for long-term social problems.”

In the context of the current crisis, events such as the global financial crisis which produced major falls in dwelling prices, did not create a return to ownership.

This was due to fiscal austerity, a lack of finance, weakened household income, and purchasers being outstripped by investors.

Looking ahead, AHURI pointed to the diminishing labour market, issues around affordability and the supported growth of the private rental sector—underpinned by favourable tax provisions, for the impending declines in ownership.

“Either we embrace fundamental and broad-based reforms to rebuild ownership or we accept a retreat from its historical dominance, moving to a system which has more balance between rental and ownership—what we can call a dual tenure system,” Burke said.

“The change has come from complex shifts throughout the entire institutional environment.”

AHURI's projected declines mean Australia will no longer be a near “universal ownership society”, but must become a dual tenure society of ownership and rental.

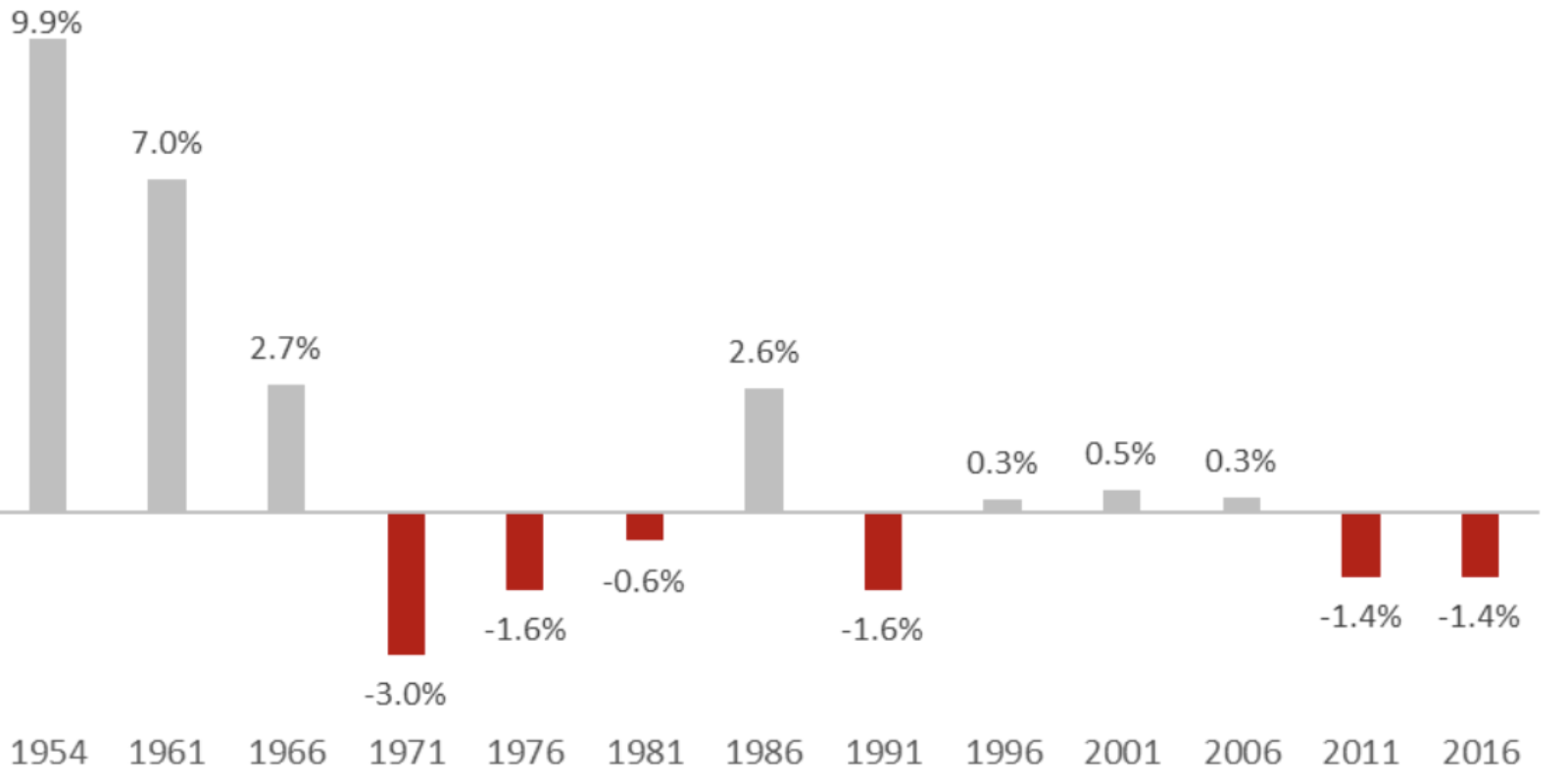

Changes in ownership by percentage points, 1954–2016

^ Source: Original analysis of ABS Census of Population and Housing data, various years.

Twenty years ago only about quarter of Australian households rented.

While those renting, as a proportion of all households, has significantly risen, the proportion of public housing tenants has halved from 6 per cent to 3 per cent of the population.

Housing costs, adjusted for inflation, have continued to increase for home owners without a mortgage, with analysts suggesting that the “demand for bigger homes” was part of the reason for rising costs.

Sydney, Melbourne and Hobart continue to be some of the most unaffordable property markets on the planet, having seen housing values rise at a faster rate than household incomes over the last decade, which has continued to erode affordability.

The report said that despite the challenges of Australia’s changed institutional environment since the late 1970s the overall home ownership rate has held up well, sitting at 67 per cent in 2016.

“The current seemingly high rates of home ownership in Australia are masking a long-term problem of serious housing inequality between older and younger generations and between wealthier and poorer households,” Burke said.

“The financialisaton of housing is an international factor and is best understood as the process where housing is treated as a commodity to be invested in rather than a home, meaning more and more money flows into housing but without any necessary improvement in housing supply or quality.”