Will the First Home Buyer Scheme Push Up House Prices?

The now-bipartisan initiative to provide a leg up for first home buyers saving for a home deposit has been swiftly embraced by the property industry.

Property lobby and interest groups have been quick to support the scheme, which offers a government loan guarantee for first home buyers with a deposit of just 5 per cent.

Economists and property analysts have been less certain, voicing concern that the scheme may inflate house prices and increase the risk of negative equity.

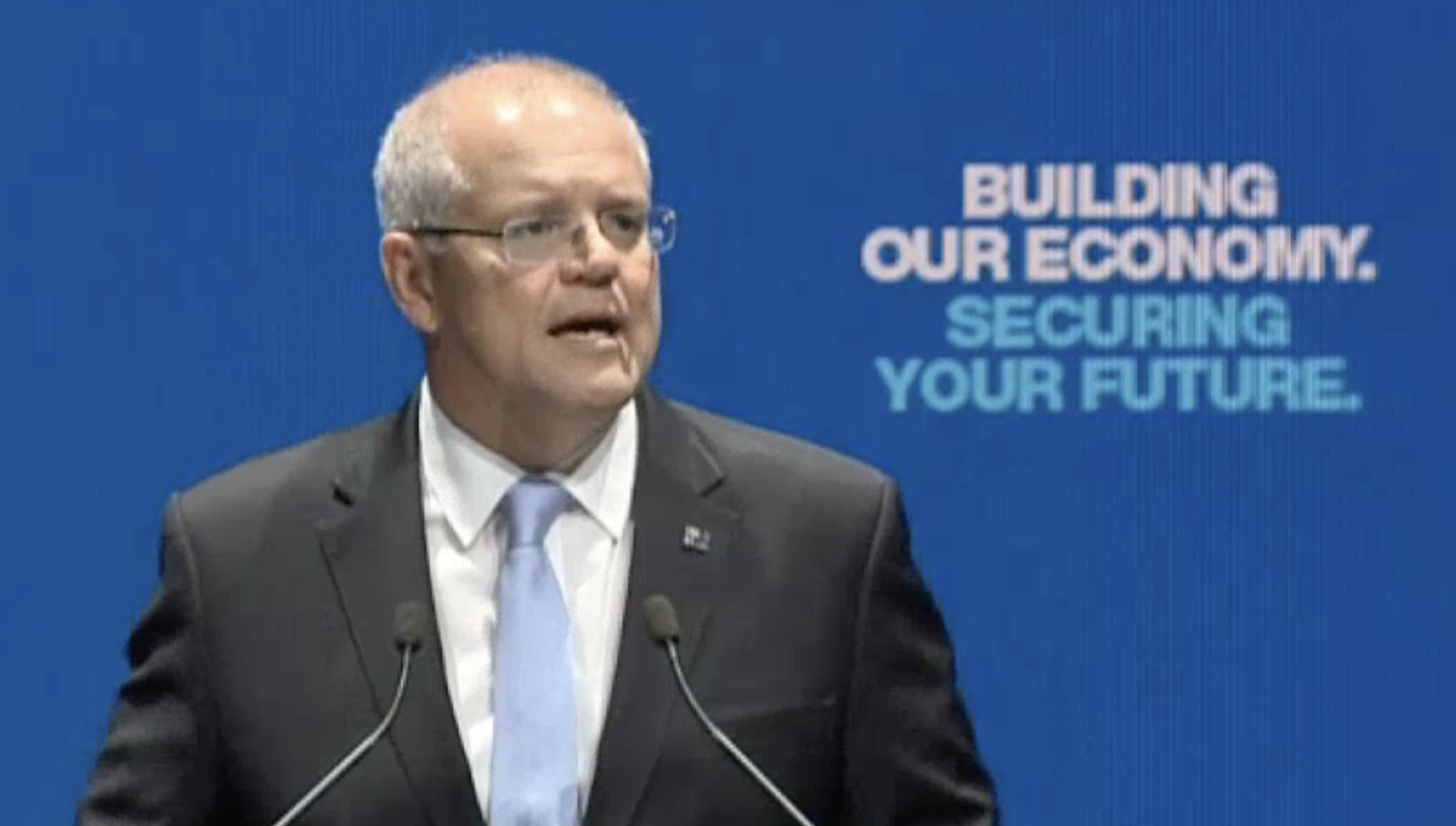

The $500 million scheme, unveiled by the Coalition at its formal bid for re-election on Sunday, will underwrite 15 per cent of the home’s value — allowing first home buyers to more quickly, and easily, meet the 20 per cent deposit requirement.

Modelled on a New Zealand policy, the scheme will be available next year for first home buyers who earn up to $125,000 — or $200,000 for couples.

The scheme will be capped at 10,000 loans annually, which is “pretty small” when compared to the 112,000 loan approvals to first home buyers in 2018, economist Callam Pickering said.

Economist Stephen Koukoulas said the policy would encourage people to take out loans with small deposits.

“There’s a big risk of negative equity,” Koukoulas told the ABC’s Peter Ryan.

“If we were to see this housing decline continue, it adds to the risk of there being negative equity which is, of course, the personal financial poison that caused so many problems in the global financial crisis in the US and UK.”

Related: Negative Gearing Reforms Will Have ‘Little to No Effect’ on House Prices: Treasury

Master Builders Australia chief executive Denita Wawn said the plan was a “big win” for first home buyers and the building industry.

The Real Estate Institute of Australia joined the Property Council in welcoming the announcement, saying it will help boost supply.

“The last time the federal government introduced a special measure for first home buyers was during the GFC.

“This measure saw first home buyers, as a percentage of total loans financed, increase from 20.2 per cent in October 2008 to 31.4 per cent in May 2009.”

Managing director of property analyst firm SQM Louis Christopher pointed out that the scheme relies on the cooperation of the banks and financial institutions.

“This scheme has a feeling like a deposit bond and in the past banks have not been welcoming of deposit bonds,” Christopher said.

The banking association released a statement saying it looks forward to “consultation on the details of this policy”.