Foreign Investment in Australian Property Tumbled in 2017: FIRB

The value of approvals for foreign investment in Australia's residential property market has plummeted by almost 65 per cent as tighter internal capital controls and state-based taxes curb investment.

The Foreign Investment Review Board's annual report has identified the introduction of application fees in 2015 as the main cause for the drop in the number and value of residential real estate applications.

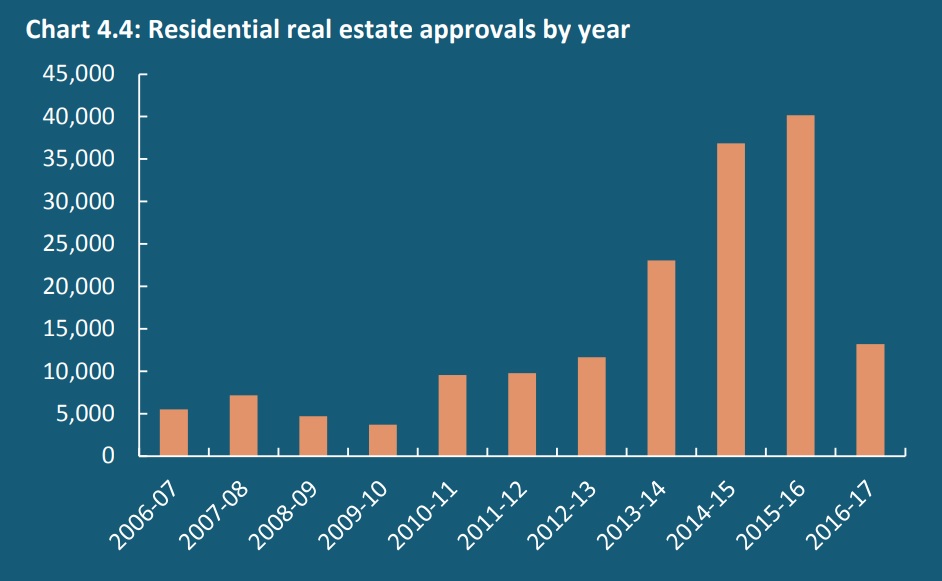

The 2016-17 report reveals a 67 per cent decrease in residential real estate approvals last financial year, down from 40,149 approvals to 13,198, representing a $47.2bn drop in foreign investment, the largest of any industry sector.

“The most significant factor explaining this drop is the introduction of application fees in December 2015, which resulted in investors only applying for properties they intended to purchase,” the FIRB report said.

“Other factors that may also have contributed to a reduction in applications include tighter Chinese capital controls, weaker market conditions, and additional taxes imposed on foreign investor purchases in some Australian states.”

Related reading: Chinese Investment Fell 60% Last Year

Related reading: Are China’s Curbs on Outbound Investment an Opportunity for Australian Developers?

Although Chinese nationals remained Australia’s biggest investors in Australian real estate, the size of their investment plunged from $31.5bn in 2015-16 to $15.2bn in 2016-17.

“The approvals data also reveal a decline in the total number and value of approvals for Chinese applications, largely driven by reductions in residential real estate approvals,” the FIRB said.

“This likely reflects a range of factors, including the introduction FIRB application fees, Chinese overseas direct investment capital controls and changing macroeconomic conditions.”

Lending restrictions by the big four Australian banks had been one of the most significant factors in slowing Chinese interest along with a concern from mainland China that residential prices in Australia had peaked.

Tighter lending restrictions have also taken a toll, with analysts expecting local banks to further review their lending in the wake of the banking royal commission.

Carrie Law, chief executive of renowned Chinese real estate website Juwai.com, said that the market saw a dramatic shift during the 12 months.

“Unfortunately, this year’s FIRB data is not directly comparable to that of prior years, due to the change in regulations and buyer behaviour.”

“The new data probably gives a closer indication of actual investment levels because it includes fewer cases of investors who are just acquiring one property seeking multiple approvals,” Law said.

“The big declines are partly due to lower demand, and mostly due to the changed application fees.

"It’s great news for the bureaucrats at Treasury, as they now have to process fewer applications for a given dollar of investment.”

Despite the total reduction in residential approvals last financial year, the FIRB report said that Victoria and New South Wales remained popular destinations for investment, accounting for nearly three-quarters of all approvals granted.

“This is consistent with recent years and reflects strong demand for residential property in Sydney and Melbourne,” the FIRB report said.

Meanwhile, Chinese investors have turned their attention to Japan and Southeast Asia, particularly Thailand, for better returns than available in Australia, according to a survey of 3403 Chinese residents by investment bank UBS.