‘Tinder for Private Lending’ Platform Launched

A new Australian fintech platform likened to “Tinder for the private lending market” is streamlining this often complicated process.

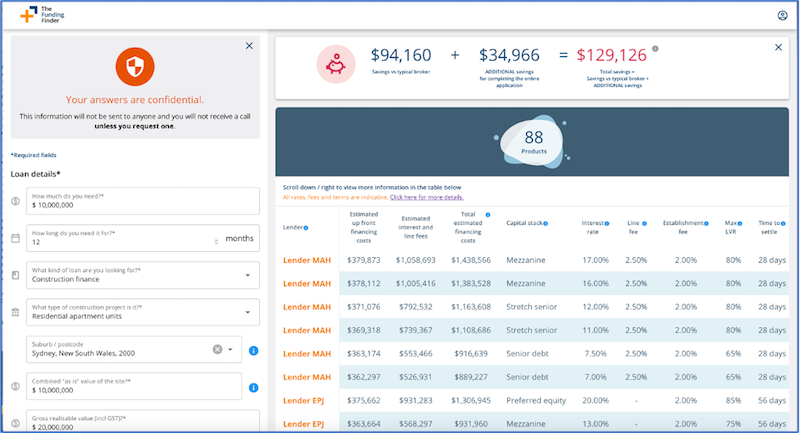

FundingFinder is a free, searchable database that allows users to see all the private, non-bank offerings available in the Australian property market.

“The problem is that the private lending market is confusing and time-consuming,” Sydney-based mortgage broker Louis Teoh said.

Teoh’s firm, Eden Financial Partners, offers full-service brokerage services, referring short-term, commercial, and construction finance loans to private lenders.

“Who even knows which of these guys have money, which ones are just brokers pretending to be lenders, which ones will actually lend to this or that client?,” Teoh said.

“You can waste a lot of time just trying to figure all that out.”

“It works a bit like Tinder,” Karen Borg, CEO of Funding Doctor, which operates the FundingFinder platform, said.

“Lenders and borrowers get a little information about each other, but their details are private until they decide they want to talk further.”

The platform, which currently has almost 400 private lending offerings, uses proprietary algorithms to match projects with lenders.

Because computers do most of the work, the platform offers fees as low as 0.15 per cent, compared to the 1 per cent to 2 per cent commonly charged by finance brokers in the space.

For a $10-million loan, for example, FundingFinder charges just under $35,000, compared to $100,000 or more with a traditional broker.

The platform gives an instant read of the market, telling the user what’s available—and at what price—based on the information they input. The more information the user inputs, the more accurate the match.

The system also makes it easy to compare offerings by estimating the total fees and interest charged.

“Something that drives us crazy is how hard it is for clients to compare offers,” Borg said.

“One lender charges a higher establishment fee, another charges interest on drawdowns but with a line fee, a third charges no line fee but the loan is on a fully drawn basis.

“The system takes all that and estimates the total cost to the borrower. Then the client can see things on an apples-compared-to-apples basis.”

The platform offers complete anonymity and does not require a commitment from the client.

“We don’t know who the users are until they decide to give us that information plus they can come and go as they please,” Borg said.

“Give us a try. If something on the platform looks interesting, then call us.

“At the very least, it’ll help keep your existing broker honest.”

The Urban Developer is proud to partner with FundingFinder to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.