Good News on the Horizon for Home Building

Green shoots are starting to emerge after most home building markets passed the trough mid-2024, with exception to two cities.

Housing Industry Association chief economist Tim Reardon said it was only the “heavily taxed markets of NSW and Victoria” that had not experienced a trough in detached home building this year.

“Most housing markets appear to have reached or passed the trough in home building by mid-2024, following the fastest increase in the cash rate in a generation,” Reardon said.

“States with good employment opportunities and relatively more affordable land are leading the charge.

“Western Australia, Queensland and South Australia appear to be past the trough in their cycles. The number of contracts being signed for the construction of new homes has been increasing, at least since the start of the year, seeing a new wave of projects commencing construction.”

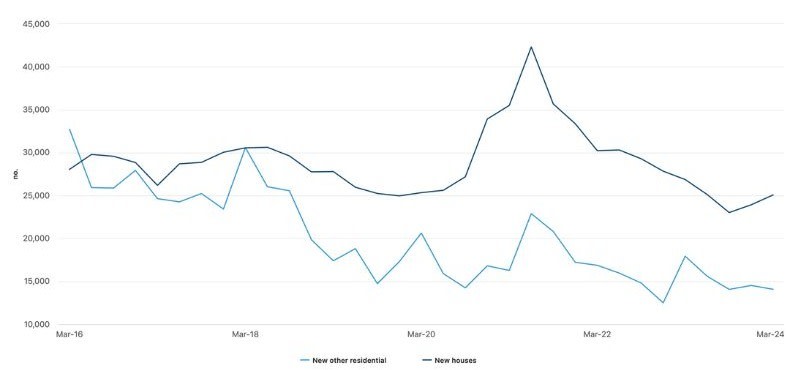

Nationally there were 25,890 detached houses that began construction across Australia in the first quarter of 2024, up by 5.8 per cent on the previous quarter.

Reardon said this figure was forecast to moderate down by 1.6 per cent in the June Quarter 2024 to 25,470, producing a financial year total of 99,060 starts in 2023/24, down by 10.1 per cent on the previous year.

The forecasts are for a modest improvement, up by just 0.8 per cent to 99,890 in 2024/25.

Private homes started, seasonally adjusted

This would mark the end of the two weakest years for detached commencements since 2012/13, more than a decade earlier. Reardon said activity was expected to accelerate beyond this, exceeding 115,000 by 2026/27.

Multi-residiential development recorded 14,240 starts in the March Quarter 2024, down by 6.2 per cent from the previous quarter and the second weakest quarter for the sector in over a decade. It is forecast to follow a similar trajectory to detached housing.

Reardon said new taxes would continue to impair home building in NSW and Victoria.

“Government policies continue to inflate the costs of land and construction in NSW and Victoria,” Reardon said.

“Policy changes are also adding to market uncertainty delaying a return of investment into new home building and exacerbating the shortage of housing.

“Against a backdrop of an acute shortage of housing, households are slowly returning to the new home market.”

But Reardon said the nation’s home building volumes could be significantly greater if inflationary policies were unravelled.

Reardon said productivity and material price rise shocks had improved and labour shortages that had crippled the industry in the past few years were starting to ease as activity levels declined.

“These factors are setting the scene for an increase in home building later this year as confidence is restored,” he said.