Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Global industrial and commercial property giant Goodman Group has completed the $60.3-million adaptive re-use of three heritage-listed warehouses covering an entire block in Sydney’s south.

Finished last month, the 100-year-old Roseberry Engine Yards at 115-151 Dunning Avenue has leasing commitments for about 75 per cent of the 11,650sq m, according to Goodman.

Those commitments include half-a-dozen high-end women’s fashion labels, Australia’s oldest luxury handbag manufacturer, its first carbon-neutral menswear brand, a boutique ice-cream maker, an importer of hand-crafted European tables, an eastern seaboard croissanterie and a retailer of designer fireplaces and stoves.

That’s a far cry from the days when at various stages the heritage-listed saw-toothed buildings housed suppliers of engine and agricultural equipment Buzacott and Company, the former Commonwealth Weaving Mills and a factory for Westinghouse—for 60 years the maker of home appliances in Australia.

Goodman teamed up with privately owned builder-developer Taylor Constructions to take the vacant and somewhat dilapidated warehouses and turn them into what owner and operator is describing as a “retail and lifestyle precinct”.

At 1.9ha the site—first built between 1922 and 1925—became one of the biggest heritage brownfield developments in the area, and now includes office space, a café, gymnasium and childcare centre.

The development counts retailers including Rebecca Vallance, M.J. Bale, Zimmermann, Gelato Messina, Lune Croissanterie, Aje, Oroton, Viktoria and Woods, Camilla and Marc, Oblica, Saarde, Inartisan and Lofft House—all of which are currently operating or scheduled to do so by the end of the year.

Goodman chief executive Jason Little said the Rosebery Engine Yards was a “unique” space that celebrated its industrial past in a modern and sustainable way.

“It revitalises an old industrial space, and supports circularity by reducing, recycling and reusing existing resources,” Little said.

Goodman’s Rosebery opening comes as research by the Australian real estate investment trust Dexus showed retail (shopping centre) funds outperformed other real estate sectors in a subdued year for unlisted property returns.

In its Australian Real Asset Review for the second quarter, Dexus said shopping centre portfolios were benefiting from relatively high yields, improving rents and renewed investor interest.

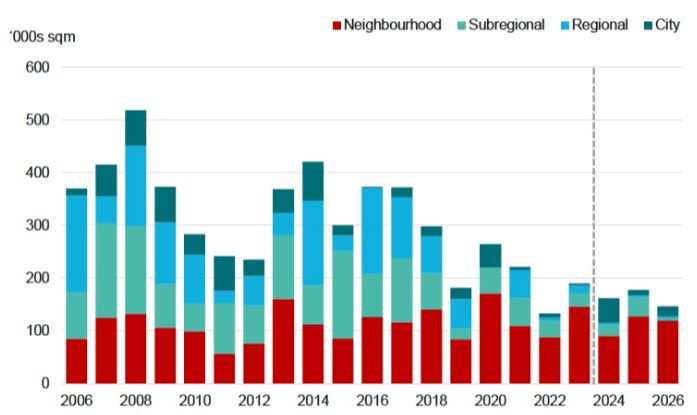

Australian enclosed shopping centre supply

Dexus said a lack of new shopping centre supply—held back by construction costs and planning constraints—was another positive, particularly given population growth was adding to aggregate demand.

It forecast the supply of enclosed shopping centre space over the next two years would be about 53 per cent of the 20-year average.

“The retail sector appears to have reached a significant inflexion point after a challenging period over the past five years,” the report said.

“Shopping centre fundamentals are generally positive, with vacancies across shopping centre types holding relatively steady despite the weak sales environment.”

Retail turnover in Australia grew by a sluggish 1.7 per cent in the 12 months to May, well below the 10-year average. Dexus put that down to cost-of-living pressures, saying discretionary spending remained weak, particularly in electronics and department stores.