Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

US-based build-to-rent colossus Greystar has begun dealing itself another suit to add to its Australian property investment deck with a handful of industrial acquisitions.

Its purchase of five sites in Sydney, Melbourne and Brisbane—staking its claim to a project pipeline with an end value of more than $500 million—is part of a long-term strategy targeting the last mile and infill logistics sector.

The move aligns with other global investment giants—including Blackstone and Brookfield—who also have been shuffling and expanding their pandemic era portfolios.

Topping their shopping lists are “beds, sheds and meds”—with a view to capitalising on shortages of rental and student housing, demand for warehouse space off the back of the e-commerce boom and renewed focus on medical research and development that is buoying the life science campus sector.

Greystar’s Australian managing director Chris Key said the company’s logistics acquisitions across Australia’s major cities represents a targeted entry into the Australian industrial sector.

“We maintain a high conviction view that there is significant opportunity for Greystar to grow our platform in the last mile and infill logistics sector and this series of investments here in Australia is an exciting milestone for our business.

“We look forward to further progressing our pipeline of projects in the space.”

Key said Greystar had a proven track record of executing a similar strategy in the US, where it began diversifying its real estate business with an industrial platform two years ago.

It now spans 25 development offices with more than $2.1 billion in developments under way comprising one million square metres of development and acquisition opportunities.

Last year, the company also formed a joint venture with the Canada Pension Plan Investment Board (CPP Investments) allocating $1.9 billion to develop life science office and lab buildings in the US.

In Australia, Greystar has swooped on three industrial sites in Brisbane and one each in Melbourne and Sydney over the past 15 months.

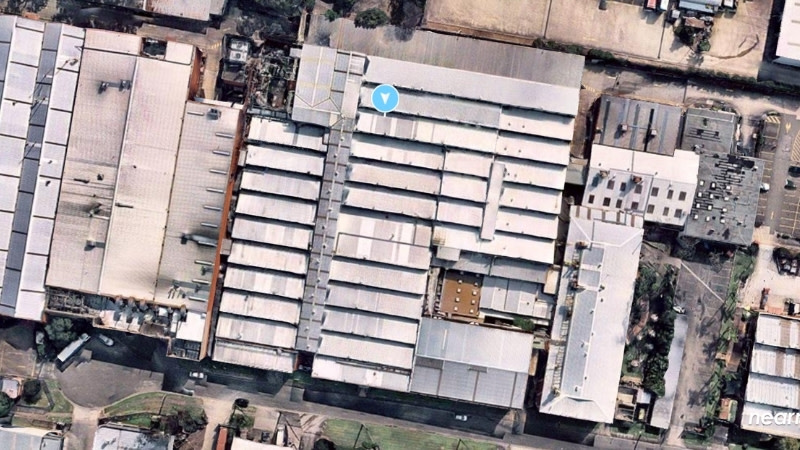

It completed the acquisition of its largest project last month with the settlement of a 5.1ha brownfield site at South Granville in Sydney’s central west, and at the same time, exchanged contracts for a 2.1ha brownfield site in Melbourne’s West Footscray.

The South Granville site at 26 Ferndell Street is surrounded by major infrastructure with proximity to the M4 and M5 motorways and 35 minutes drive from Sydney Airport and Port Botany seaport. It is earmarked for a modern logistics facility.

The West Footscray property at 36-38 Roberts Street—with an existing 7000sq m warehouse plus surplus land to cater for a further 7600sq m facility—is 8km from Melbourne’s CBD and due to settle in December.

Greystar’s three acquisitions in Brisbane’s industrial property market—at 483–485 Zillmere Road, Zillmere; 971 Fairfield Rd, Yeerongpilly; and 175 Dutton Road, Pinkenba—are all near key infrastructure and have approved plans for redevelopment.

Meanwhile, the South Carolina-based real estate behemoth, is quietly carving out a big share of Australia’s burgeoning build-to-rent market.

Earlier this year, it had appointed Icon to build its $500-million residential project on a 6000sq m site in South Melbourne’s Fishermans Bend precinct.

With 700 apartments across three towers plus 4300sq m of indoor and outdoor communal space and 850sq m of retail space, the project will become one of Australia’s biggest purpose-built build-to-rent developments.

Designed by Scott Carver architects, the finished towers—its second build-to-rent project in Melbourne—will house up to 1500 people.

Works are already under way on a $500-million, dual tower project in South Yarra comprising 625 build-to-rent apartments. Together with the South Melbourne project, it is one of two seed projects in the Greystar Australia Multifamily Venture 1 fund, which has ambitions to house 5000 or more dwellings.