Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeWhile housing affordability constraints still remain acute in many of Australia’s largest housing markets, there are signs of steady improvement.

According to the HIA Affordability Index, a trend of improving affordability is taking root in the major capital cities, due largely to falling housing prices.

House prices fell by their fastest rate in six years in September, down 6 per cent in Sydney and 4 per cent in Melbourne from the same time last year.

The index is now 1.5 per cent higher than in the previous quarter and 2.2 per cent higher than at the same time last year demonstrating an improvement in affordability, particularly in Sydney which posted the biggest improvement nationwide.

“While it remains the least affordable market in the country, by quite a margin, the index is 9 per cent higher than a year earlier which is a significant positive step,” HIA principal economist Geordan Murray said.

Related: Australia Ranked Third Least Affordable Housing Market Globally

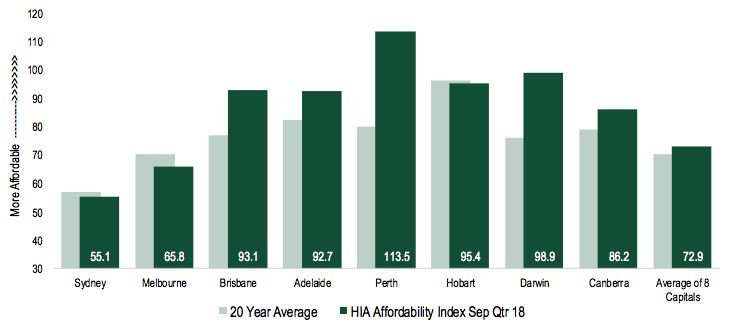

HIA Affordability Index by Capital City, September 2018 Quarter

Analysis also shown improved affordability in Melbourne, albeit to a lesser degree than in Sydney.

Nationally, dwelling prices declined by 1.1 per cent over the September 2018 quarter to be roughly unchanged from a year earlier, down by 0.2 per cent.

“The downturn in home prices is yet to run its full course,” Murray said.

“As the price cycle progresses affordability will continue to improve and this could be bolstered by wages growth.”

While underwhelming growth in wages has been the continued Achilles heel of affordability there have been tentative signs of improvement with weekly earnings growing at an annual rate of around 1.6 per cent between 2014 until 2017.

Interest rates remain relatively steady with a slight increase in lending rates during the September 2018 quarter, largely a result of most of the major banks lifting their variable rates in August and September this year.

“Affordability has been deteriorating over a number of decades and it will take many decades of concerned effort by governments at all levels to reduce the constraints and punitive taxes on housing that have led to the creation of the affordability challenge,” Murray said.

Over the past 10 years, Sydney’s median home price has increased by 89 per cent, more than double the 42 per cent increase in the city’s median household income.

The gap between the two was even larger over the past five years, with prices lifting by 51 per cent, nearly triple the increase in incomes.

The story has been similar in Melbourne with prices up 77.3 per cent over the past decade and 41.5 per cent in the past five years, well above the 34.7 per cent and 12.4 per cent lift in incomes respectively over those time periods.

While Sydney experienced the strongest annual improvement in housing affordability in the September 2018 quarter, Perth remains Australia’s most affordable capital city, followed by Darwin and Hobart.