Home approvals in March softened after a stellar rise the month before, according to the latest data from the ABS.

The fall delivered the lowest rate of approvals since 2012, according to the HIA.

The ABS reported that the total number of homes approved decreased 0.1 per cent for the month in seasonally adjusted terms after February’s 3.9 per cent rise.

ABS head of construction statistics Daniel Rossi said the result was driven by a 2.8 per cent fall in approvals for private sector houses, following an 11.3 per cent February rise.

“Private sector house approvals remain 15.0 per cent lower than March 2022,” he said.

“Private sector homes excluding house approvals increased 5.6 per cent in March, after a 9.7 per cent decrease in February.

“This is the sixth consecutive month where the trend result has fallen for total homes approved.

Across Australia in seasonally adjusted terms, total home approvals decreased in Tasmania (42.1 per cent), South Australia (19.1 per cent), and Queensland (6.7 per cent).

Western Australia (27.2 per cent), New South Wales (3.1 per cent), and Victoria (1.7 per cent) rose during the month.

Homes approved, states and territories, March 2023

Approvals for private sector houses fell in most states: New South Wales (-4.0 per cent), Queensland (-3.9 per cent), Victoria (-3.8 per cent), and South Australia (-0.1 per cent). Western Australia was the only state with a March increase (8.7 per cent).

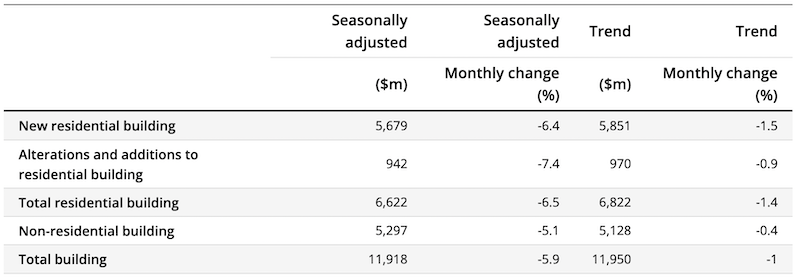

The value of total building approvals fell 5.9 per cent after a 19.5 per cent rise in February.

The value of total residential building approvals fell 6.5 per cent, comprised of a 6.4 per cent decrease in new residential building and a 7.4 per cent fall in alterations and additions.

The value of non-residential building approved decreased 5.1 per cent, after a 41.0 per cent rise the previous month.

The HIA said the March fall meant the first quarter of 2023 had the lowest number of building approvals since 2012, “just as population growth reaches a record high”.

HIA senior economist Tom Devitt said the decline in house approv als “continues the long-lagged response of Australian homebuyers to the RBA’s interest rate hiking cycle, with further declines expected in the coming months”.

“The adverse impact of last year’s cash rate increases is still to fully flow through to the official data,” he said.

“Further cash rate increases this year will have only added further weight to these declines.

Value of building approved by building type

“Total building approvals were down across almost all the jurisdictions in the March Quarter 2023 compared to the same quarter last year.

“In seasonally adjusted terms, decreases were led by New South Wales (-34.1 per cent) and Victoria (-26.6 per cent), followed by Western Australia (-14.9 per cent), Tasmania (-10.8 per cent) and South Australia (-5.7 per cent), while Queensland increased by 8.6 per cent.

“Australian Capital Territory experienced a decline of 35.3 per cent and Northern Territory was down by 19.1 per cent.”

BIS Oxford Economics senior economist Maree Kilroy said that with higher build costs and delays, the appetite of homeowners for renovation projects was waning, with the value of residential alteration and addition approvals falling back 7.4 per cent.

“The start of 2023 has been poor,” she said.

“A protracted downturn for home approvals is forecast that extends through 2023 and into 2024.

“Given the sizeable backlog of work, it will take longer than usual for this to flow through to a lack of work for builders.

“We believe the probability of government intervention to support housing supply is increasing.”

Urban Taskforce chief executive Tom Forrest said the data showed that “the wheels had fallen off the NSW planning system, with the annual approvals figures collapsing to the lowest level in the last decade—even lower than during Covid lockdowns” .

“Today’s data is a red-alert for the new Minister for Planning Paul Scully, Treasurer Daniel Mookhey and Premier Chris Minns, Forrest said.

“It also raises a major alert for the Commonwealth because there will be no downward pressure on rental prices rises without the construction of more homes.

“The ABS data shows the huge gap between the former government’s dismal record on housing supply in NSW and the expectations of the Commonwealth’s Housing Accord—which will see NSW expected to deliver around 62,800 new homes each year for five years from 2024.”