House Prices See ‘Subtle Rise’ Across Most Capital Cities

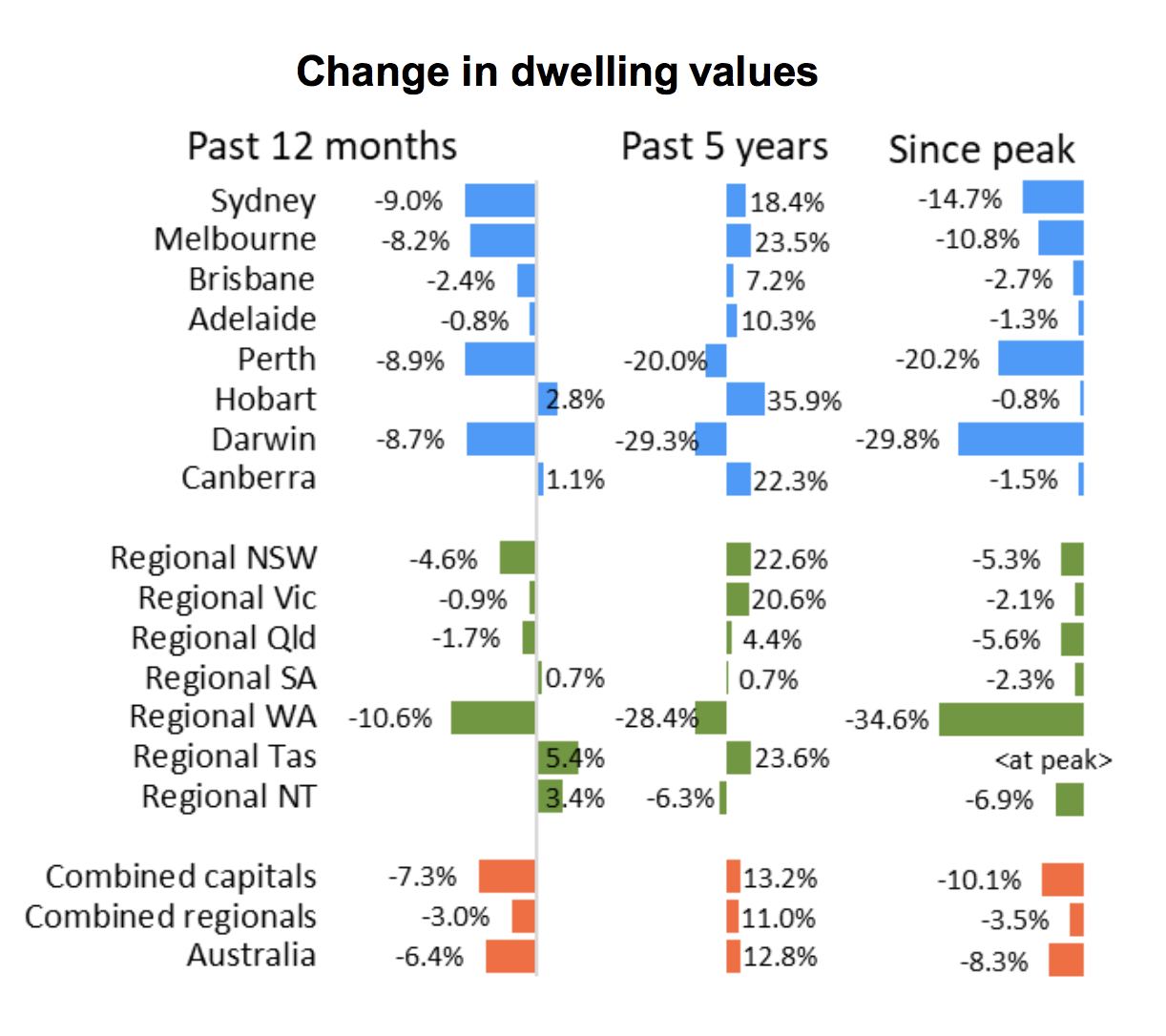

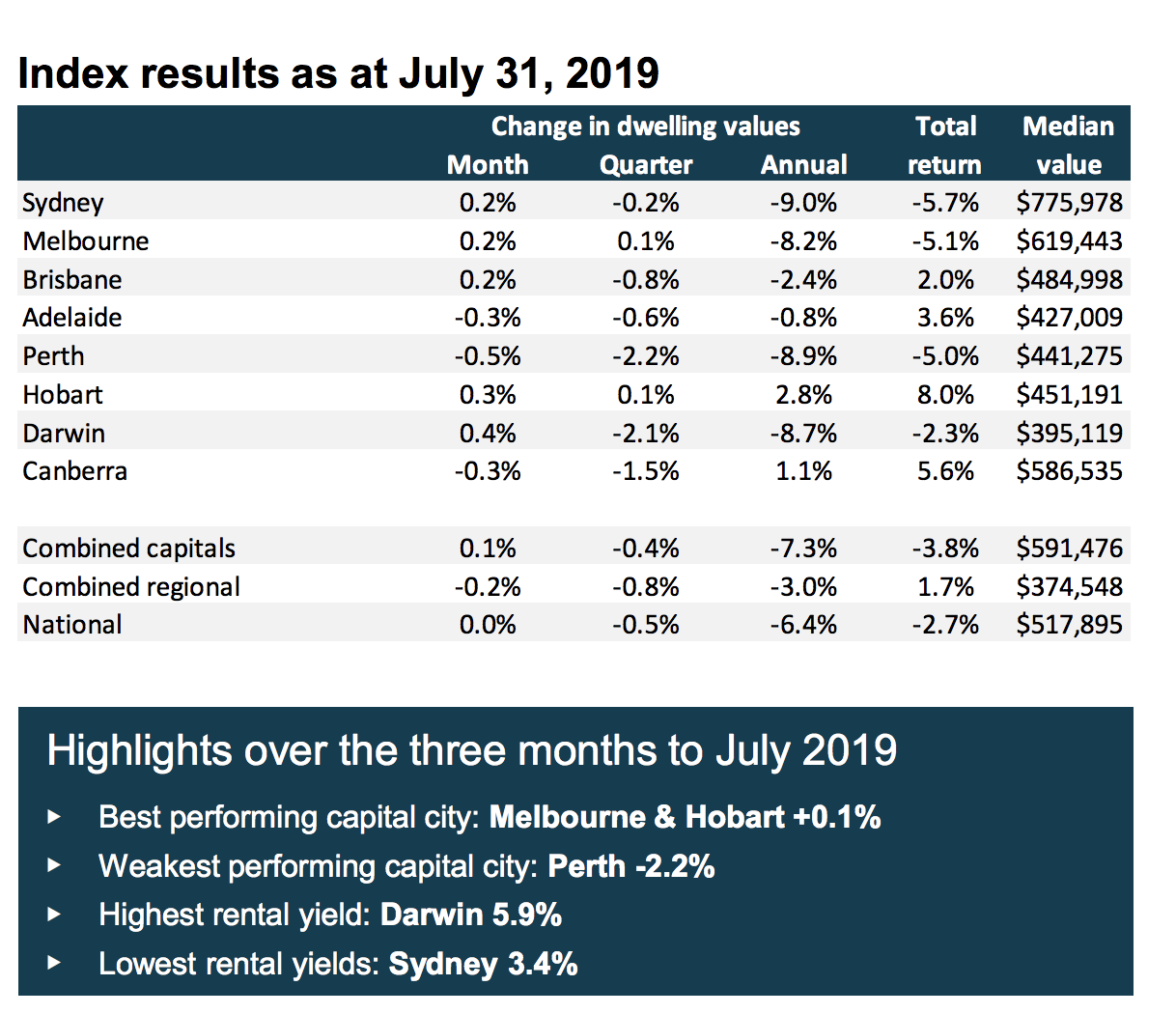

Australia’s house prices look to be stabilising with five of the eight capital cities recording a slight rise in values over the month of July, a trend signalling further signs the housing market recovery is becoming more broad based.

Australia’s two largest cities primarily led the turnaround, with a 0.3 per cent rise in Sydney and 0.4 per cent lift in Melbourne. The two major cities have now seen house values rise over the past two months.

Brisbane recorded a 0.2 per cent rise in dwelling values, an upward move marking the first month-on-month rise since November last year. Hobart saw a 0.3 per cent lift and Darwin a 0.4 per cent uptick, reveals Corelogic’s monthly index.

While national housing prices were flat in July, this was due to a fall in regional markets as the home value index showed capital city values were up.

Lower interest rates, improved access to credit, Morrison government’s recent tax cuts and a subsequent boost in market confidence are largely cited as the primary drivers supporting the turnaround in housing conditions.

Corelogic head of research Tim Lawless says the July results show the nation's housing market has reacted positively to the recent stimulus.

Although the trend towards a recovery in housing values is “relatively fresh and centred within the largest cities”, as Lawless warns “there's no sign of a ‘v-shaped’ recovery”.

Across the sector, residential building approvals hit a six year low, slumping 25.6 per cent over the year reveals latest ABS figures.

Lawless adds housing credit policies still remain much tougher than they were prior to the royal commission.

“The ongoing tightness in housing credit is expected to keep a rapid rebound in housing values at bay.”

Apartment market strength

Sydney and Melbourne’s unit values have consistently outperformed the housing market sector throughout the nation’s downturn, “despite an unprecedented amount of new apartment stock entering the market”.

Lawless notes this trend is continuing into the recovery phase.

“The stronger performance across the unit sector may be attributable to ongoing affordability challenges in Sydney and Melbourne which could be driving demand towards the medium to high density sector,” Lawless said.

“Values for higher density dwellings are generally lower, however we may see some dampening of unit values in coming months across those precincts where supply is elevated as the large number of high-rise off-the-plan apartment sales moves into the resale market.”