Apartment Construction Downturn Has 12pc Further to Run: HIA

The lag between residential building approvals and actual commencements has made it difficult to forecast exactly when the housing market will bottom out.

Credit curbs continue to weigh on activity while the construction slump—sitting at around 33 per cent from peak-to-trough to date—has been wider than expected.

Adding to the conjecture, HIA’s latest national outlook has forecast the market to stabilise at around 20 per cent below the peak.

“If economic activity improves, the credit squeeze dissipates, home prices stabilise and the recent stimulus measures take hold, the supply of new work into the pipeline will soon reach its low point,” HIA chief economist Tim Reardon said.

The latest ABS figures show building approvals for the 2018-19 fiscal year are down 19.5 per cent.

The industry association said that housing approvals are experiencing the sharpest contraction since the introduction of the GST in 2000 when the market corrected 43 per cent in less than a year.

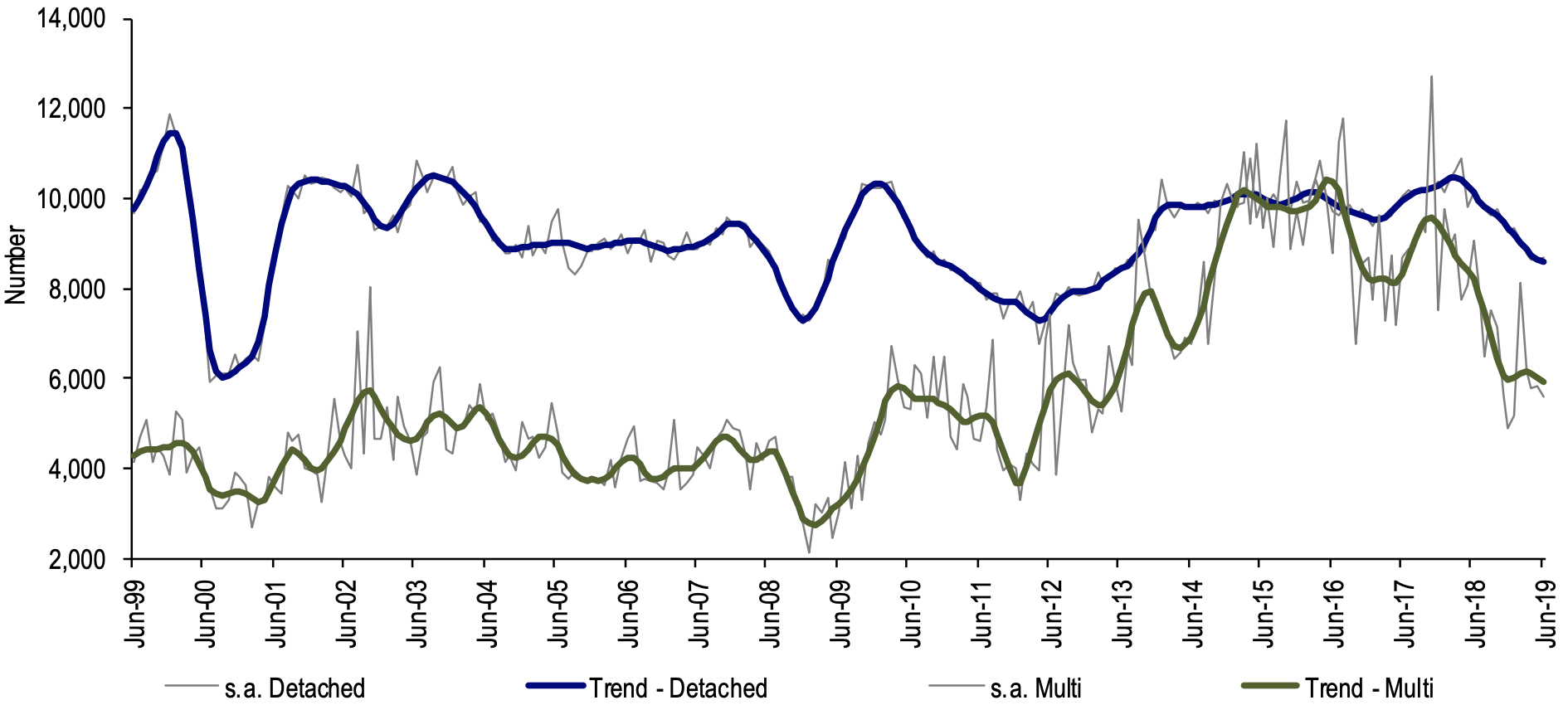

HIA said that the detached housing market appears to have held up well due to the lag between the sale and commencement of houses—detached housing approvals were down 9 per cent.

“A large number of the houses that commenced during the [second] quarter were purchased off-the-plan some time ago, as far back as 2017 in some markets,” the report said.

“This gives the impression that contemporary market conditions are stronger than is the case.”

Building approvals: ABS

Apartment approvals were significantly harder hit, with the number of high-rise residential approvals—buildings of more than 4-storeys—experiencing a 41.8 per cent contraction.

HIA forecasts a further 7.6 per cent decline for house markets, primarily in the first half of the fiscal year, which is set to stabilise over the following two years.

For apartments, HIA estimates a further decline of 12 per cent in 2019-20 before a slow improvement in 2021-22.

Separately, economic forecaster BIS estimates the residential construction downturn has a further 8 per cent to run, with a strong rebound in 2020-21.

“The number of apartments under construction will continue to fall as more projects reach completion and fewer new projects enter the pipeline,” Reardon said.

“The silver lining to this contraction is that there is a convergence of conditions under way in the building industry.

“We no longer have a boom in east coast capitals and stagnating markets elsewhere.

“Interest rates, income taxes and lending restrictions have all been eased in an effort to support activity and economic growth, [which] are now supporting activity in housing markets across the economy.”