Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

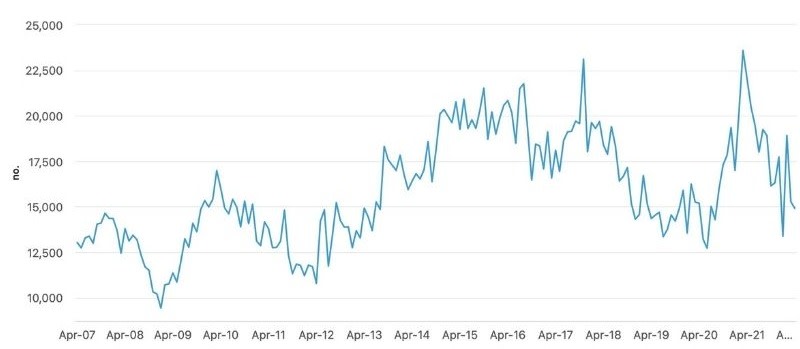

The number of residential building approvals is down 32 per cent on the peaks of April, 2021 as the market softens.

Australian Bureau of Statistics data for April shows the number of houses approved was 0.5 per cent up on the previous month but more than a third down on 2021 figures.

But HIA economist Tom Devitt said approvals figures were still well above pre-Covid levels.

“New work entering the pipeline will keep builders busy throughout 2023,” Devitt said.

“Detached house approvals increased by 1.4 per cent in the three months to April, 2022 to be 16.8 per cent higher than the same three months in 2019.

“Renovations activity also remains elevated … the value of renovations approvals jumped by 6.6 per cent in April to be up over the past 18 months 42.6 per cent on pre-pandemic levels.”

But the high level of approvals activity is meeting a bottleneck—Devitt said there were 75.7 per cent more homes under construction at the end of 2021 than pre-Covid.

“There are now more homes approved and waiting commencement than in any previous cycle.

“Together with similar new home building and renovations booms in other developed economies, this has placed significant demands on the international supply of building materials, along with local supplies of land and labour.

“This has combined to create ongoing increases in the cost of construction.”

Homes approved, seasonally adjusted

Devitt said acute rental shortage and the deterioration of affordability had given rise to demand for high-density apartment developments.

Speaking at an event this week, NAB chief executive Ross McEwan said the big bank had assisted 35,000 first homebuyers in the past 12 months, but said more needed to be done to tackle housing affordability.

“Unfortunately, over the past 40 years, just getting a deposit together has become harder and harder,” McEwan said.

“There is a chronic lack of social and affordable housing, but there are some innovative solutions available.

“NAB has financed now over $2 billion of affordable and specialist housing projects in the last three years.”

NAB is a financial backer of Nightingale, which McEwan said was filling a need within North Melbourne and should be looked at for scaling out to a national level.

McEwan said consistent state planning rules and more rental accommodation would help to ease the burden for low and middle income earners struggling with housing affordability.