Pace of Housing Downturn Slows in March

Australia's falling dwelling values slowed its pace in March, but the scope of the downturn has widened geographically, reveals the latest Corelogic figures.

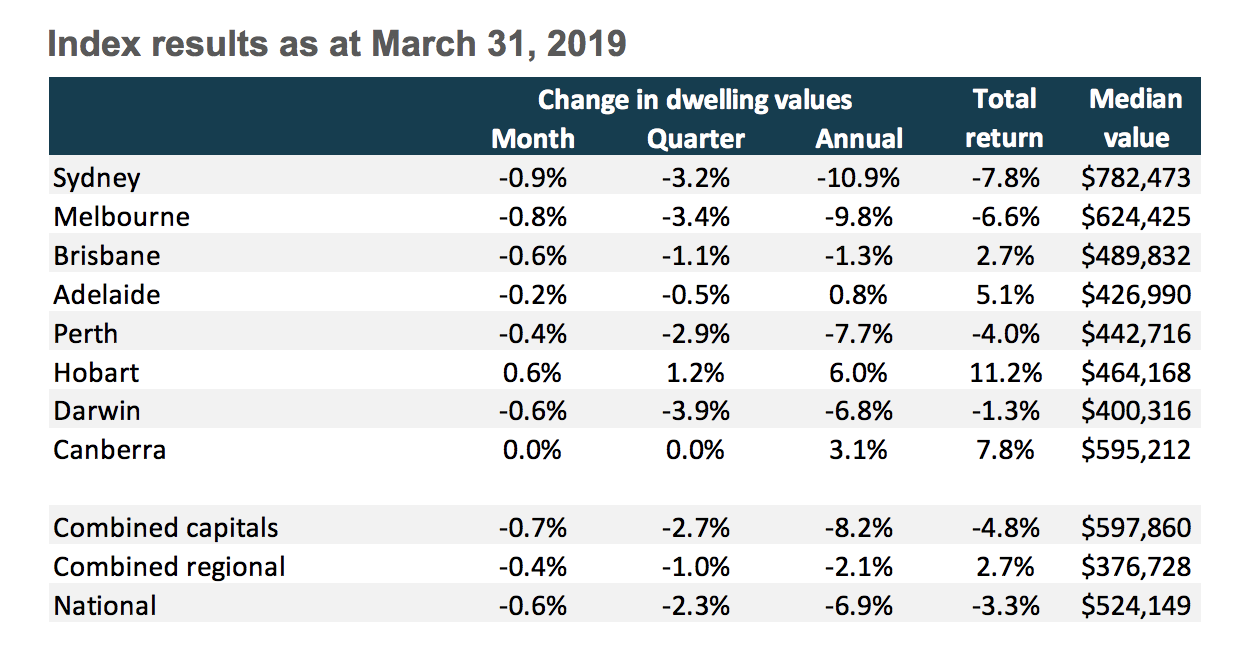

Corelogic’s national home value index results reveals the pace of declining property values eased relative to the past four months, declining 0.6 per cent in March, the smallest of the month-on-month declines since values fell by 0.5 per cent in October last year.

Housing values were down across six of the eight capital cities, with Canberra values holding firm and Hobart values 0.6 per cent higher.

Related: Property Prices Fall at Fastest Rate Since GFC: ABS

Corelogic head of research Tim Lawless said the downturn has become more widespread with dwelling values also down in five of the seven ‘rest of state’ markets over the month.

Most of the “rest of state” regions, the areas outside the capital cities, also recorded a drop in values; with exception to regional Tasmania ( up 0.5 per cent) and regional South Australia ( up 0.3 per cent).

Capital city sub-regions

The weakest areas of the capital cities are now confined to Sydney and Melbourne, reveals the data, with some bias toward the more expensive areas of the cities.

Melbourne’s prestigious inner east has recorded the largest decline in values over the past twelve months (-16.1 per cent) followed by Sydney’s Ryde (-14.7 per cent) and Sydney’s Inner South West (-14.1 per cent).

Dwelling values across the country have now been trending lower for seventeen months and have fallen by a cumulative 7.4 per cent, since peaking in October 2017.

Related: Million Dollar Suburbs Tank as House Prices Fall

Markets, such as Darwin and Perth, where values peaked much earlier have experienced a larger downturn, with dwelling values now down by a cumulative 27.5 per cent and 18.1 per cent respectively since peaking in 2014.

Whereas dwelling values remain at record highs across Hobart and regional Tasmania.

House values dropped slightly in Brisbane, by 0.6 per cent, to be 1.3 per cent lower through the year.

Adelaide was up 0.2 per cent in the month, up by 0.8 per cent over the year.

While the housing market has shown some tentative signs the downturn in dwelling values might be “losing some steam”, Lawless says the housing market's outlook will continue to be affected by “uncertainty related to the federal election, lending policies and more broadly, domestic economic conditions”.