ABS Figures Show Housing Still Australia's Economic Powerhouse: HIA

The latest ABS figures for new dwelling commencements provide a healthy update for our economy, said the Housing Industry Association (HIA).

“New home commencements reached a fresh record in the March 2016 quarter and residential construction is unequivocally the powerhouse of the Australian economy,” said HIA Chief Economist – Dr Harley Dale.

“In addition to being a key economic driver in its own right, new home construction is having a very strong positive impact on many other parts of Australia’s economy and labour market,” Harley Dale said.

“New dwelling commencements reaching yet another record over the 12 months to March this year (nearly 230,000) reinforces the vital economic role new home building continues to play in 2016.”

“There are so many generalisations and exaggeration about purported oversupply in Australia’s housing market that the key point to recognise is lost – Australia’s economy and labour market would be substantially weaker without the new home construction sector.”

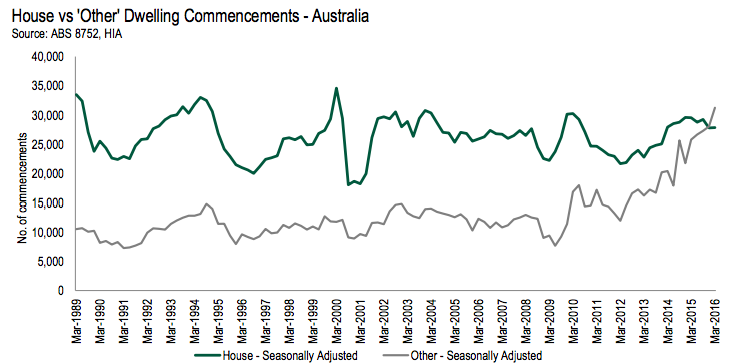

“Based on the latest results, detached house commencements have peaked for the cycle, but remain well above their historical average.

Meanwhile, commencements of ‘multi-units’ continue their stratospheric rise – exceeding the number of detached houses over the last year.” “The stunning headline masks large geographical divergences around the country, but most states and territories are ahead on the ledger,” noted Harley Dale.

Over the 12 months to March 2016, new dwelling commencements increased in: the Australian Capital Territory (+44.1 per cent); New South Wales (+24.1 per cent); Queensland (13.1 per cent); Victoria (11.6 per cent) and Tasmania (+6.6 per cent).

Commencements fell in the Northern Territory (-24.7 per cent), Western Australia (-19.0 per cent) and South Australia (-3.1 per cent). “What goes up will come down and there is unprecedented uncertainty regarding the nature and magnitude of the down cycle that will unfold over 2016/17 and 2017/18,” concluded Harley Dale. “It would be risky to tinker with housing policy right now.”