Will Stalled Migration Stem Housing Demand?

Recent forecasts from Treasury indicate annual population growth across Australia is set to slow from around 1.4 per cent pre-Covid, to 0.6 per cent through the 2020-21 financial year.

In raw numbers, that implies Australia’s annual population growth will reduce from around 350,000 in 2019 to 154,000 over the year ending June 2021—a reduction of 56 per cent relative to 2019 levels.

If the Treasury forecasts are right, this means the rate of population growth (a proxy for underlying housing demand) will be the lowest since 1917.

Most of the forecast decline in population growth is due to stalled net overseas migration, which is expected to drop from around 232,000 net migrants in the 2018-19 financial year to just 31,000 in 2020-21.

This will be disruptive to housing demand. However, the impact will not be evenly spread.

Nationally, population growth is comprised of net overseas migration plus the natural increase (which is simply births minus deaths).

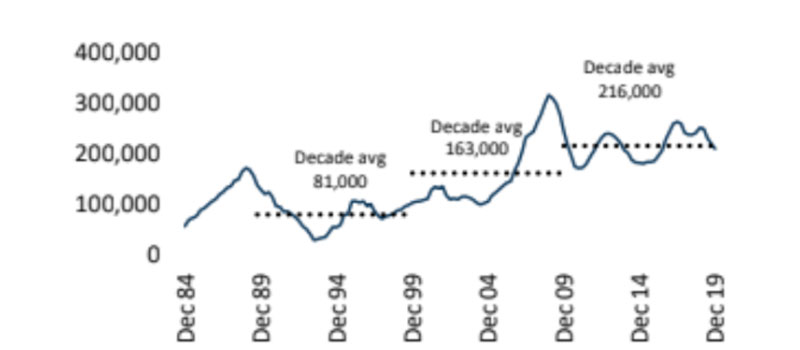

Over the past thirty years, net overseas migration has accounted for 51 per cent of Australia’s population growth. Since late 2016, it has increased in importance, comprising more than 60 per cent of population growth.

To understand the impact of this dramatic shift to a key demand driver of housing, the composition of migration flows—and where migration is geographically centred—should be considered.

Importantly, in terms of composition, temporary migrants comprise the large majority of net overseas migration to Australia.

In 2019, roughly 70 per cent of Australian migrants arrived on temporary visas, with the large majority of these classified as students or visitors.

Permanent migrants comprised around 30 per cent of net overseas migration, with most of these arriving under skilled visa arrangements (45 per cent of permanent migrants) with the second-largest portion arriving under “special eligibility or humanitarian” conditions (28 per cent).

It is reasonable to assume the large majority of temporary migrants will not be purchasing a home in Australia; they rent.

Additionally, it seems most permanent migrants will initially rent.

Previous research from the Australian Treasury showed approximately 85 per cent of recent skilled migrants were renters, and around 80 per cent of those arriving on humanitarian grounds rented.

The same research showed almost 90 per cent of temporary skilled worker visa arrivals rented or lived in employer provided housing.

Intuitively, the longer the migrant has lived in Australia, the more likely they will be seeking to purchase a home.

Considering the substantial skew towards temporary migrants within the net overseas migration figures—as well as the assumption that most permanent migrants will initially rent rather than buy—the greatest impact from a sharp drop in migration rates is likely to be in weaker rental demand than demand for established home sales.

This also implies a sharp drop in demand for new home construction targeted towards the rental market.

Annual net overseas migration

^ Source: Corelogic

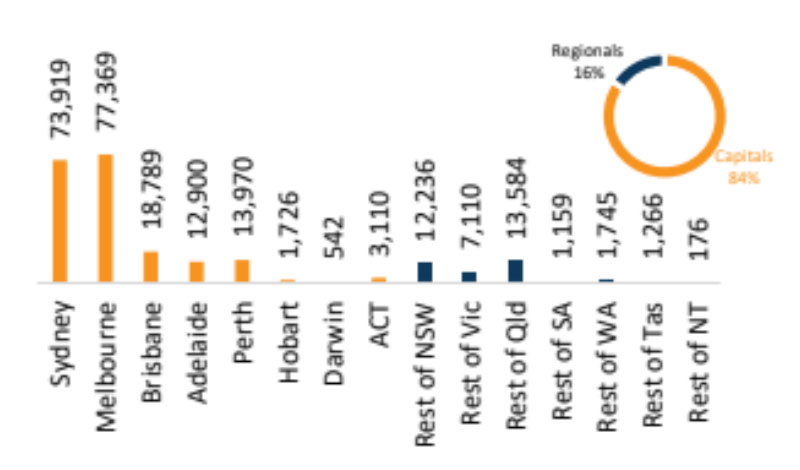

Geographically, stalled net overseas migration will impact on Melbourne and Sydney the most.

Last year, 84 per cent of all overseas migration flowed into the capital cities, with three quarters of those capital city migrants arriving in Sydney and Melbourne.

Within the cities, the largest number of overseas migrants are generally centred around the CBD and nearby precincts—where high density housing options are common—and to a lesser extent, middle-ring suburbs close to educational precincts or transport hubs, such as Parramatta in Sydney, or Clayton in Melbourne.

The impact of the sharp fall in overseas arrivals can already be seen in surging inner-city rental advertisements, with rental listings more than doubling across some key inner city unit precincts.

Between mid-March and early August, the number of homes available for rent in Melbourne’s Southbank rose by 117 per cent to reach 1,230 advertised rental listings.

Rental ads were up 111 per cent across the Sydney CBD/Haymarket/The Rocks region to reach 776, and Melbourne’s CBD saw a 105 per cent lift in advertised rentals, taking the total number of homes available to rent to 2,184.

High density, multi-unit dwellings in these precincts are popular with investors due to what has historically been strong rental demand.

This historically strong rental demand was underpinned by overseas student numbers, but also domestic students, visitors and workers requiring accommodation close to the CBD.

The demand shock in these areas has been broader than the impact of stalled net overseas migration.

Rental demand is also impacted by weaker labour market conditions amongst highly-casualised industry sectors such as food, accommodation, arts and recreation workers.

Workers in these segments are more likely to be renters than home owners relative to other industries of employment.

Additionally, fewer workers may be demanding rentals in the CBDs due to remote working arrangements.

The rise in available rental stock in these precincts is already weighing on rental income.

Every capital city is showing a larger fall in unit rents relative to house rents through the Covid period to date, with a more significant difference in Melbourne and Sydney where unit rents are down more than 4 per cent since March.

The flipside is that outside of Melbourne and Sydney, housing demand derived from net overseas migration is less significant.

Regional markets comprised only 16 per cent of net overseas migration last year, with regional Queensland attracting the highest volume, which is likely due to more significant numbers of long-term visitors and those on a working holiday.

Net overseas migration by GCCSA region, 2019

^ Source: Corelogic

The outlook for overseas migration remains highly uncertain and dependent on international borders re-opening and, potentially, travel agreements being negotiated between countries.

Forecasts contained within the Economic and Fiscal Update from Treasury assumed Australia’s borders would re-open in January next year, but under strict quarantining rules.

Additionally, some states aim to open borders to foreign students, again utilising quarantining procedures to minimise the rise of importing the virus.

Open borders are heavily reliant on the virus being contained domestically and globally, or a vaccine becoming available.

While Australia’s virus curve is once again reducing, the global number of new virus cases is yet to trend consistently lower, although the statistics vary remarkably between jurisdictions.

Additional considerations need to be made based on looser domestic labour markets.

The unemployment rate is expected to remain elevated for several years, implying less requirement for skilled migrants.

Also visitor numbers could remain lower than normal for a prolonged period of time due to less appetite for travel amidst strict quarantining rules.

The implications of net overseas migration remaining well below average are broad-ranging.

Population growth has been a longstanding driver of economic growth for Australia, underpinning residential construction activity and rental demand.

From a housing market perspective, the likely outcomes of low net overseas migration will be:

A higher volume of rent listings, and falling rent values across key inner-city precincts. This phenomenon is already being observed, particularly across inner Sydney and Melbourne.

Once foreign student arrivals start to normalise, rental demand in these areas may improve. In the meantime, investors who own property in these locations are likely to be facing high vacancy rates, lower rents and reduced ability to service their mortgage. This may result in more distressed sale listings in these regions.A higher proportion of units may settle with a valuation lower than the contract price. Many of the aforementioned inner city precincts are toward the end of a surge in new apartment supply. ABS building activity data showed there were more than 50,000 units under construction across NSW at the end of March, and just over 45,000 across Victoria. A large proportion of these are high-rise projects in inner city locations. Many of these yet-to-be completed projects will settle while rental vacancies remain high and rents are falling, which may put downwards pressure on property values.

The residential construction sector is likely to face challenges due to reduced demand, although this impact will be uneven. Demand for “investor grade” unit projects is likely to remain low for an extended period. However, demand for owner occupier style multi-unit dwellings, which are more often lower density, built with higher specifications and in prime locations should be less impacted. Greenfield housing estates are also less impacted from reduced net overseas migration, with early reports that the HomeBuilder grant, together with low interest rates and first home buyer incentives, are providing a solid boost to demand. Developers and builders may need to pivot towards these more active sectors, at least while net overseas migration remains low.

Organic drivers of housing demand are likely to become more important. These include the rate of natural increase and interstate/intrastate migration. Both of these components of population growth are also being disrupted, with expectations of a lower fertility rate due to the recession, and current restrictions on interstate movements. However, it is logical to assume that internal borders will open more quickly than international borders. Internal migration flows are influenced by a range of factors, but local economic and labour market conditions are key drawcards, as well as lifestyle and housing prices. There are already signs that major regional centres are benefiting from increased demand as some people look to escape the large cities, taking advantage of remote working opportunities, more affordable housing options and lifestyle considerations.