Investa, Manulife Snap Up 39 Martin Place

Investa Commercial Property Fund and Manulife Financial Corporation are moving in on the metro Martin Place precinct after purchasing a 28-storey commercial building from Macquarie Group.

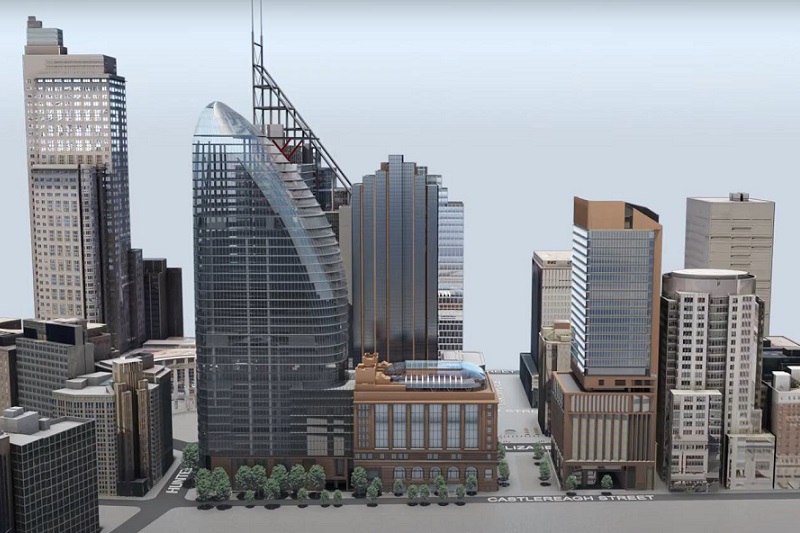

The joint venture reached financial closure on the deal for an undisclosed price, acquiring an 100 per cent interest of 39 Martin Place, Sydney which sits directly above the southern entrance of a new metro station.

It will incorporate 30,000sq m of office space across 28 levels and 2,000sq m of retail and is expected to reach practical completion in 2024 by construction partner Lendlease.

Macquarie Group first gave its intentions to sell the south tower of the metro Martin Place precinct in late 2019 with initial price estimates ranging from $700-900 million or more.

It is one of two new commercial buildings under construction in the precinct, taking inspiration from the heritage-listed 50 Martin Place.

Macquarie intends to be an anchor occupant of the other 39-storey commercial tower at the northern end and plans to integrate it with its existing headquarters.

The project started as an unsolicited proposal to the NSW government, to integrate the buildings with the previously approved metro station plans.

Macquarie Group project director Michael Silman said they look forward to completing the project and continuing to work in the space for many years to come.

“We are delighted with the outcome of this transaction,” Silman said.

“Owners of this calibre demonstrate recognition of Martin Place as a significant commercial centre and a confident, long-term view of this part of Sydney.

“As a long-time resident of Martin Place, we are deeply conscious of its civic, commercial and cultural significance.”

ICPF fund manager Brendan Looby said they are pleased with the interest in the building already, shown by a number of prospective tenants.

“The acquisition of 39 Martin Place is in line with the fund’s strategy given the superior building quality, super prime location, leading sustainability and technology features,” Looby said.

“This combination of factors is expected to deliver an attractive risk adjusted return to our investors, and further reinforces ICPF’s reputation as Australia’s leading prime office fund.”

Manulife head of Asia real estate investments Kenny Lam said it is a landmark investment for the company which has been pursuing opportunities in Australia for the past four years.

“Despite some of the headwinds resulting from the pandemic, we are continuing to focus our expansion efforts on the Asia Pacific region and high quality assets, which are supported by strong long term macro and demographic prospects,” Lam said.

It is the latest investment for ICPF following the recent completion of Sixty Martin Place development, delivered jointly by ICPF and Gwynvill.