Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

The landscape of property development finance in Australia has transformed dramatically since 2016, when banks dominated 83 per cent of commercial real estate deals.

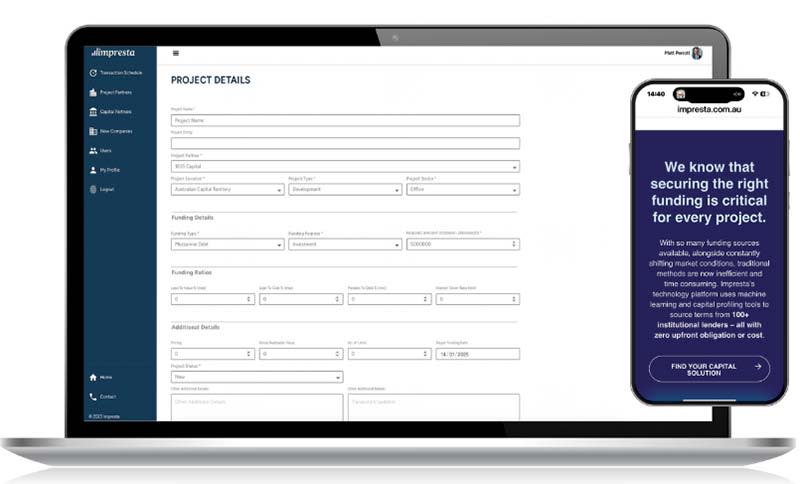

Today, a technology platform is helping developers navigate a markedly different lending environment, where non-bank lenders are increasingly filling the void left by traditional banks.

Impresta, a commercial real estate funding platform operating across Australia and New Zealand, reports that 71 per cent of its transactions now involve non-bank lenders, reflecting a significant shift in development finance.

Impresta chief Matthew Perrott founded the platform after identifying the need for a systematic approach to accessing commercial real estate capital.

“The banks are still there but they aren’t wanting to do 80 per cent of the transactions anymore, and we don’t want them doing 80 per cent of the transactions. This is sort of a coming of age with the Australian property capital landscape,” Perrott told The Urban Developer.

The platform has facilitated funding for more than $5 billion worth of projects, ranging from $1 million to $330 million in value.

It works by matching developers with the most suitable funding sources from over 100 different providers, including major non-bank lenders such as Qualitas, Wingate, MaxCap and Metrics.

“As a developer, you might be going into the capital markets once, maybe twice a year, depending on how many projects you’ve got,” Perrott said.

“We do this every day and it’s hard enough to stay on top of what everyone’s doing, so you’ve got no chance if you’re only doing it once or twice a year.”

Impresta’s approach differs from traditional broking methods by using technology to streamline the matching process.

“Traditionally brokers will just shotgun it out into the market and see who buys, and that’s a horribly inefficient way of doing it because the capital providers hate that,” Perrott said.

“They hate being one of a hundred different groups that they feel are seeing the same deal and used as a stalking horse.”

Instead, Impresta analyses market data to identify the most cost-effective funding solutions, comparing transaction data to match developers with lenders offering the most competitive terms.

The platform’s growing transaction pipeline is also helping to secure better terms for developers.

“We’re using the growth of the platform to benefit the clients because we can push for preferential terms due to the aggregation of the transaction pipeline,” Perrott said.

The shift toward non-bank lending mirrors trends seen in more mature markets.

“If you look at USA, Europe and the UK, all those markets will reflect more of a 50/50 non-bank solution. That’s where we’re heading,” Perrott said.

This transformation was triggered by Australian Prudential Regulation Authority reforms aimed at reducing the banking sector’s dominance in development finance.

While the platform leverages technology to streamline the process, it maintains a human element, with a transaction team supporting developers through the execution phase.

“A lot of that front-end work is where the tech can help because it can cut through all the noise. It can analyse the data quickly,” Perrott said.

“But ultimately, we understand that the execution of these facilities, particularly in commercial real estate, still needs a human element to it.”

Impresta has completed transactions in every Australian state except Tasmania and the Northern Territory, as well as in New Zealand, demonstrating its capability to facilitate funding across diverse markets and project types.

Perrott said the shift in Australia’s development finance landscape shows no signs of slowing, with non-bank lenders continuing to gain market share.

For developers facing the challenge of securing capital in this evolving environment, technology platforms are becoming an essential tool.

“Technology is not going to play a small part in this moving forward,” Perrott said. “The market needs to embrace it because it is the way that this will work. And it is much more efficient.”

The Urban Developer is proud to partner with Impresta to deliver this article to you. In doing so, we can continue to publish our daily news, information, insights and opinion to you, our valued readers.