Demand Soars for Industrial Floorspace

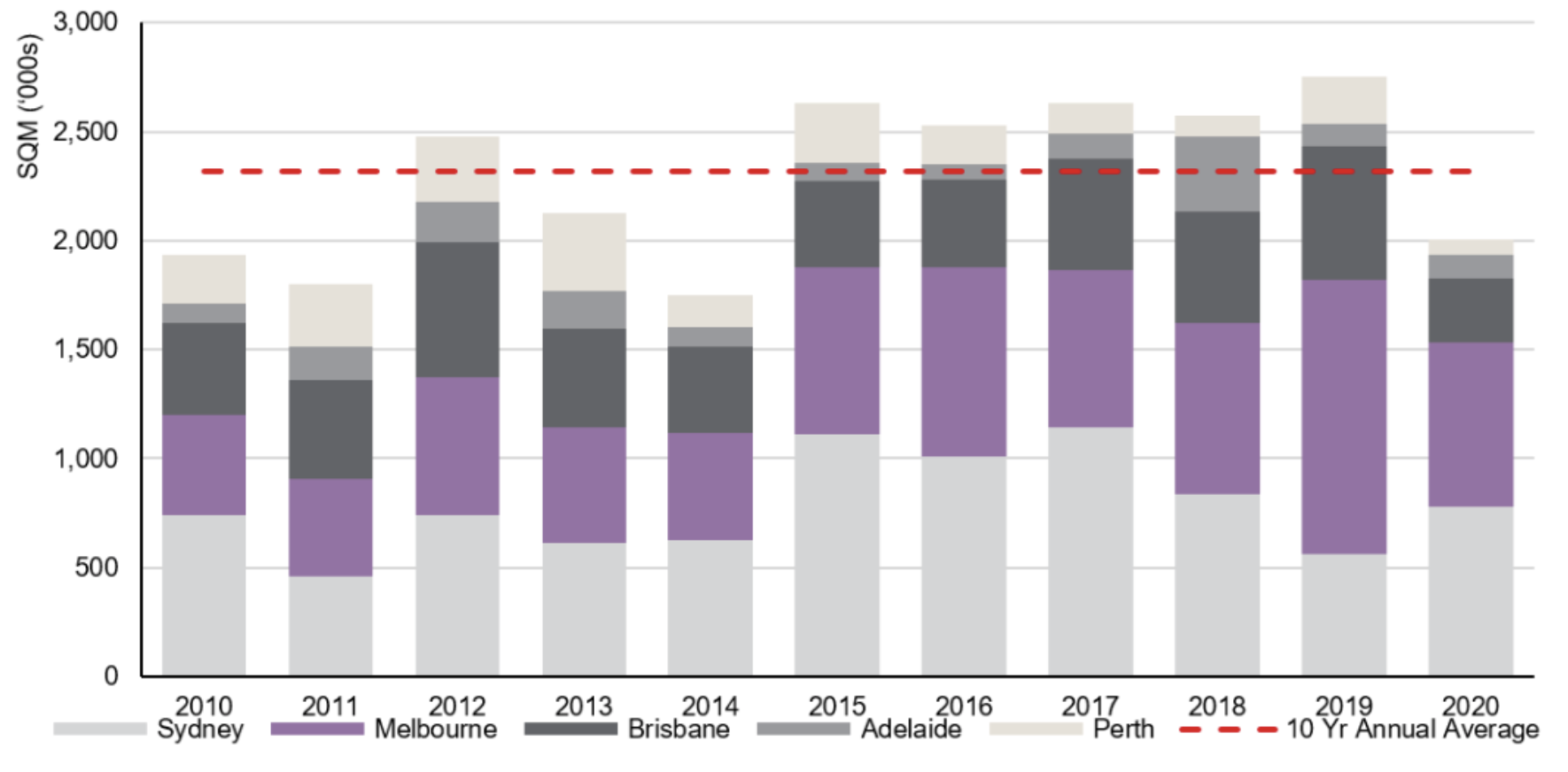

Demand for industrial floorspace has continued to strengthen in the third quarter, with expectations that take-up of space will surpass the 10-year average at year’s end.

According to JLL’s research figures for the September quarter, national take-up so far this year has now reached 2 million square metres, with leasing activity at the highest level recorded since early-2015.

Driving the sector—as it did pre-Covid-19—has been a push for more automated warehouses to cater for the acceleration in online shopping and a more digitally-connected consumer.

Take-up over the third quarter has been led by Sydney, where 225,000sq m of industrial space was absorbed, and Melbourne where 235,100sq m was taken off the market.

Together, Australia’s two biggest cities captured 74 per cent of the nation’s total take-up across the quarter.

In Sydney, retail giants such as Williams-Sonoma and Amazon have signed up to new warehouses in the west, while the tech giant has also moved into a new facility at Dexus’ industrial estate in Ravenhall, Melbourne—doubling its operational footprint in Victoria.

JLL Australia head of industrial and logistics Jamie Guerra said the increase in demand from tenants looking for industrial space had been a nationwide trend.

Industrial Floorspace Gross Take-Up, Australia

^ Source: JLL Research, by city, as at 3Q 2020

“We have also seen an uptick in take-up activity for Adelaide and Perth over the quarter, reflecting a strong return in confidence in these markets post-Covid.

“The Adelaide market recorded a relatively significant rise in take-up—the largest volume since the fourth quarter of 2018.”

In Brisbane, the Charter Hall Prime Industrial Fund recently completed a new facility for a major global logistics company and signed new leases with Amazon and Australia Post at the TradeCoast Industrial Park in Pinkenba.

The acceleration of e-commerce has been driving demand for urban infill locations.

Australia’s e-commerce penetration has now reached a record 12 per cent as of August—a significant jump from 9.3 per cent in January.

JLL said rental growth has been stronger for inner-ring locations across major markets in Australia.

JLL’s Tony Iuliano said global capital will continue to be attracted to Australia’s industrial investment markets due to the country’s “safe haven” status, relatively resilient economy, dynamic industries and high innovation and skills.

“Investment appetite for the industrial sector has been consistently strong over 2020, which is maintaining competition and accelerating the upward pressure on pricing relative to commercial office markets.

“With manufacturing accounting for more than 20 per cent of gross take-up of industrial space in Melbourne and Sydney over the past 10 years, the announcement in the federal budget of the $1.5 billion Modern Manufacturing Strategy will add to growth of industrial and logistics space in both states,” Iuliano said.

According to recent findings from Colliers International, Sydney’s capital values for industrial property lifted to $2,732 per square metre in the third quarter of the year, from $2,700 in the first quarter.

Over the same period, prime Sydney yields tightened to 4.66 per cent from 4.75 per cent.

Melbourne industrial capital values rose 6 per cent between the first and third quarter of the year to $1,733 per square metre, while prime yields tightened by 31 basis points to 5.25 per cent.

ESR Absorbs 11-Asset Portfolio for $300m

Meanwhile, logistics giant ESR has absorbed a portfolio of logistics assets along the eastern seaboard from an ESR-managed partnership, Propertylink.

ESR has outlaid $302.5 million for 11 assets primarily located in the eastern seaboard cities of Sydney, Melbourne and Brisbane.

“This transaction represents a great outcome for our investors in both investment vehicles and our business,” ESR Australia chief executive Phil Pearce said.

“Propertylink Australian Industrial Partnership II (PAIP II), investors are achieving an exit in line with the fund’s original strategy.”

The acquisition will take gross assets in ESR’s Australia Logistics Partnership (EALP) to over $1 billion—spread across 36 properties with a gross floor area of over 500,000 square metres.

Hero image: ESR’s recently-purchased facility at 450 Sherbrooke Road in Brisbane’s Willawong.