eCommerce Fuels Industrial Development Boom

Logistics assets continue to rank highly on the radar of institutions and investors, who are actively increasing their exposure to the booming asset class through land acquisition and development.

Driven by a shift in consumer behaviour towards online purchases, e-commerce now represents 9 per cent of retail sales in Australia and is forecast to grow to around 12 per cent by 2021.

The move to online shopping has also placed pressure on physical retail stores with many investors looking to new asset classes.

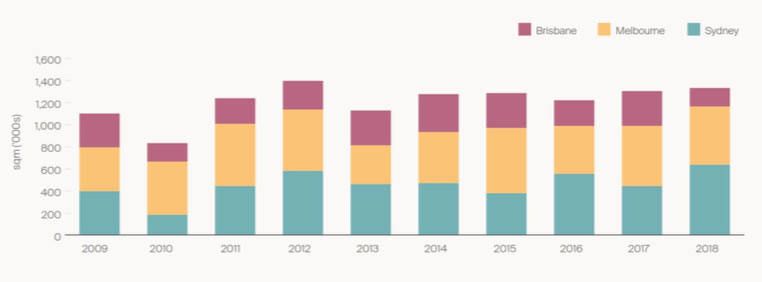

The trend has fuelled a wave of speculative development in the industrial property sector, with 4.58 million square metres added to the market since 2009 and 1.49 million square metres completed in Sydney, Melbourne and Brisbane in 2018 alone.

The exponential growth in online retail has required retailers to deliver direct to customer at faster rates than direct competitors, requiring far greater operational flexibility from distribution centres.

Many existing distribution centres designed for pure business to business activity across Australia now sit at a cross roads with supply chain systems that are outdated or not properly suited to the rapidly changing Australian retail landscape.

Recent industrial development by city, 2009-2018

Knight Frank said industrial development activity growth is now at fever pitch in Sydney and Melbourne on the back of an upturn in speculative development projects.

It is estimated that 422,000sq m of speculative stock was completed across Sydney, Melbourne and Brisbane in 2018, the highest on record. A pipeline of 560,000sq m of speculatively-developed projects are currently under way.

Sydney led industrial development in 2018, reaching a decade high, with total completions, including those triggered by pre-commitments, almost 200,000sq m above the historic average and spec projects accounting for 40 per cent of new total new development in the sector.

“While Sydney is expected to see similar volumes of spec completions in 2019, it is Melbourne that is likely to reach record levels this year with spec development gathering momentum,” Knight Frank head of research Ben Burston said.

Demand for prime grade industrial remains "unsatisfied" in Melbourne particularly in the West and South-East corridors as reflected in the increasing pressure on land and rental values.

“Driven largely by demand for western corridor, where the greatest capacity for expansion exists, the volume of spec projects for 2019 in Melbourne is expected to reach 280,000 square metres, more than double the 110,500 square metres delivered in 2018,” Burston said.

While the commentary regarding e-commerce demand and supply- chain efficiencies is not new, the rise in institutional allocations to industrial real estate assets through development is becoming increasingly topical.

Investment in industrial land recently remains strong with several Australian and offshore REITs purchasing large-scale land banks in Sydney and Melbourne as they look to boost asset allocation to the sector.

Rising rents buoy demand

An increase in imports on the back of e-commerce demand is helping to buoy demand for warehousing and logistics facilities

“Distributors, logistics operators and retailers are increasingly seeking out supply-chain efficiencies to meet the demands of e-commerce, and it is these occupiers creating the strong demand for and take-up of speculative development,” Knight Frank industrial head Robert Salerno said.

“The huge demand for quality logistics space is outstripping supply, however, with a shortage of quality industrial property available and this is really driving speculative development at the moment.”

The report found that across the eastern seaboard nearly 50 per cent of speculative development is leased ahead of its practical completion, with existing prime stock in key transport nodes in short supply.

Ongoing growth in the online retail environment is likely to continue driving demand for logistics assets and Australia's growing population will help to sustain strong occupier demand for industrial options.

Consumer demand will also be key increasing the demand for warehouse and distribution facilities in infill locations around Melbourne and Sydney.

Amazon wants to make one-day delivery the default for its Prime-Now subscribers and Google’s drone company Wing launched their project phase in Australia recently, suggesting that improvements to supply-chain efficiencies to the last-mile will remain at the vanguard of the logistics sector in the immediate term.

Ongoing growth in the online retail environment is likely to continue driving demand for logistics assets and Australia's growing population will help to sustain strong occupier demand for industrial options.

Consumer demand will also be key increasing the demand for warehouse and distribution facilities in infill locations around Melbourne and Sydney.

Amazon wants to make one-day delivery the default for its Prime-Now subscribers and Google’s drone company Wing launched their project phase in Australia recently, suggesting that improvements to supply-chain efficiencies to the last-mile will remain at the vanguard of the logistics sector in the immediate term.