Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

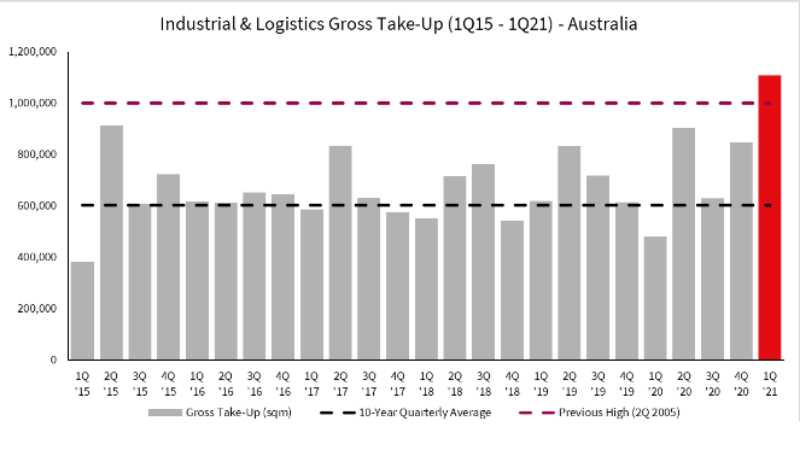

SubscribeThe Australian industrial and logistics market has broken a 24-year record in the first quarter of this year with gross take-up of industrial space tipping over a million square metres.

It is the first time since the demand data was first tracked nationally in 1997 that the market has reached these heights, according to JLL Research.

JLL’s senior director of research Annabel McFarlane said the leasing activity had been concentrated along the eastern seaboard, which accounted for 88 per cent of the figure.

“The activity recorded in the first quarter of the year comes off the back of a record-breaking result in 2020, which saw national gross take-up levels reach a new annual benchmark of 2.86 million sq m over the course of the year,” she said.

“Face and effective rents are increasing across many markets … strong annual net face rental growth was recorded for Sydney’s North at 4.4 per cent.

“Sydney’s outer central west [was] at 3.5 per cent and Melbourne’s south east at 2.7 per cent.

“The ongoing wave of occupier expansion across the country is placing pressure on asset availability, exacerbated by declining levels of speculative stock completions in the early stages of the year.”

Industrial and logistics gross take up for Q1, 2021

McFarlane said most developers in the sector had adopted a ‘wait-and-see’ approach to speculative development last year.

“Given the relatively short build-time for warehouses, this has now flowed through in the form of declining completions of new stock,” she said.

“In fact, the first quarter of 2021 was the first time since JLL started tracking the market that zero available space in new stock has been delivered in Australia as the speculatively developed stock has been absorbed quickly before completion.”

Melbourne’s industrial and logistics market was the strongest performer in the country, recording 546,940sq m of gross take-up during the quarter, representing about half of the national total.

Sydney also recorded high levels of demand with gross take-up totaled at 313,110sq m, which was 55 per cent higher than the 10-year quarterly average.

According to JLL Research the demand for new industrial and logistics properties has been propelled by Covid-19-induced changes to consumer behaviour, driving retail and logistics markets.