Stubbornly high interest rates, a far-from-clear economic outlook and a shortage of assets coming to market have failed to dent Australia’s industrial and logistics sector, according to latest figures from commercial real estate and investment manager JLL.

Investor capital continues to flow into the country’s two biggest industrial markets—Sydney and Melbourne—reflecting the resilience of the sector, JLL said in its report released late May.

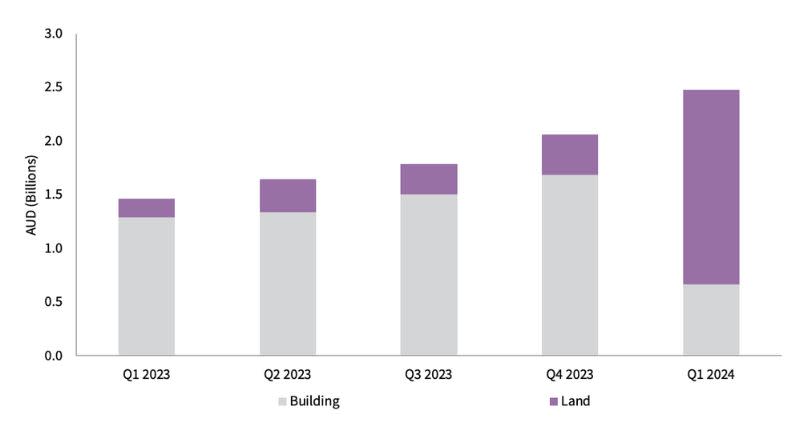

A total $2.47 billion of logistics and industrial market transactions were recorded in the first quarter of this year, the fourth quarterly increase in a row. It represented the strongest quarterly figure since mid-2022.

JLL said it was demand from developers seeking land that boosted quarterly sales, with land transactions accounting for 73.2 per cent of the total, or about $1.81 billion. That was mostly driven by big land acquisitions from Unisuper, ISPT, ESR and Frasers in Sydney and Melbourne.

The two capitals split the bulk of the transaction volumes, accounting for 85.4 per cent of the total national total.

Transaction volumes in Melbourne reached $811.4 million in the quarter, dominated by two acquisitions, both of more than $200 million each.

Superannuation fund UniSuper paid $260.0 million to Orica—a provider of chemicals and explosives to the mining industry—for a 66ha site at Deer Park in Melbourne’s west.

And ESR and Frasers put together a joint venture to secure a 64ha site at Cranbourne in the south-east, paying Salta Properties $230 million.

At $1.3 billion, Sydney’s quarterly industrial transaction volumes exceeded $1 billion for consecutive quarters.

National Industrial Quarterly Transaction Volume by Type

A joint venture between superannuation funds ISPT and UniSuper paid $862.4 million to Roberts Jones Funds Management for a 280ha site within the Western Sydney Aerotropolis in Badgery’s Creek. It was Australia’s biggest industrial land sale.

“The entire industrial sector has demonstrated exceptional resilience during uncertain economic periods, proving its stability and longevity in the face of numerous challenges,” JLL head of industrial and logistics Peter Blade said.

“What we’re witnessing is the growth of a sector that is buoyant and progressive despite the prevailing headwinds.”

In another sign of that resilience, Knight Frank announced Thai-based GF Container Services had leased 48,480sq m of hardstand in Melbourne’s west, which it said was the biggest leasing deal of its kind for the year.

Knight Frank negotiated the off-market deal for space at 79-85 Pipe Road, Laverton North, on behalf of the property owners, pan-Asia industrial real estate managers Hale.

Knight Frank head of industrial logistics Joel Davy said GF Container Services had leased the site as part of an expansion move into Australia. The company already has shipping yards in Singapore and Thailand.

“A number of their customers want a global solution to their shipping and storage, and this is what the Laverton North site can offer,” Davy said.

He said the size of the deal showed the strong demand for the property type. The lack of container-rated sites in Melbourne’s inner-west meant a few groups had shown interest in leasing the property.