Industrial and Logistics Market Drive Down Yields: CBRE

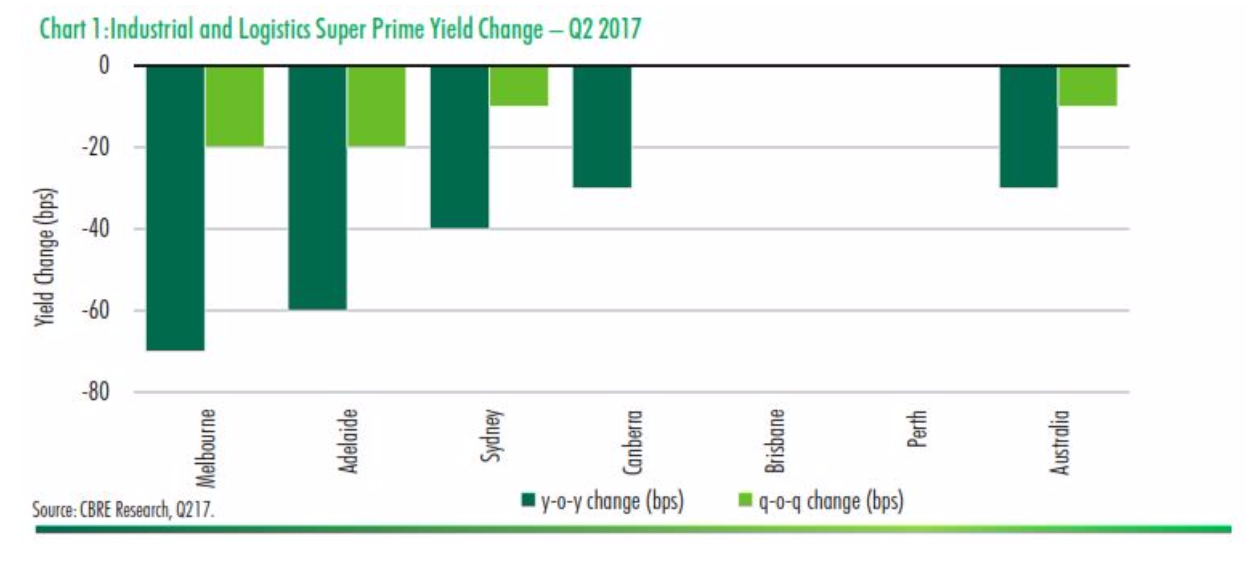

The Australian industrial and logistics market has seen some of the lowest yields on record, according to CBRE’s Q2 Industrial and Logistics MarketView report.

Melbourne’s yields compressed by a further 20 basis points in the second quarter to an average of 5.75%. In Sydney, industrial and logistics yields continued to compress to an average of 5.9% for super prime assets.

CBRE Senior Research Manager Kate Bailey said that the sale of high quality industrial and logistics assets in Q2 helped drive down yields and reinforced the continued demand for high value assets.

“The June quarter for NSW saw stronger institutional level industrial and logistics transactions, with two significant portfolio sales including the Simonson Industrial sale of six outer west assets for $71 million,” Bailey said.

In Adelaide, super prime yield sharpened 17 basis points in Q2, with 58 basis points compression on average over the past 12 months mostly driven by demand in high quality assets, particularly in the North West.

“For the markets that saw even further tightening in Q2, we expect that yields are at, or close to, the bottom of the cycle and any further compression will be minimal,” Ms Bailey said.

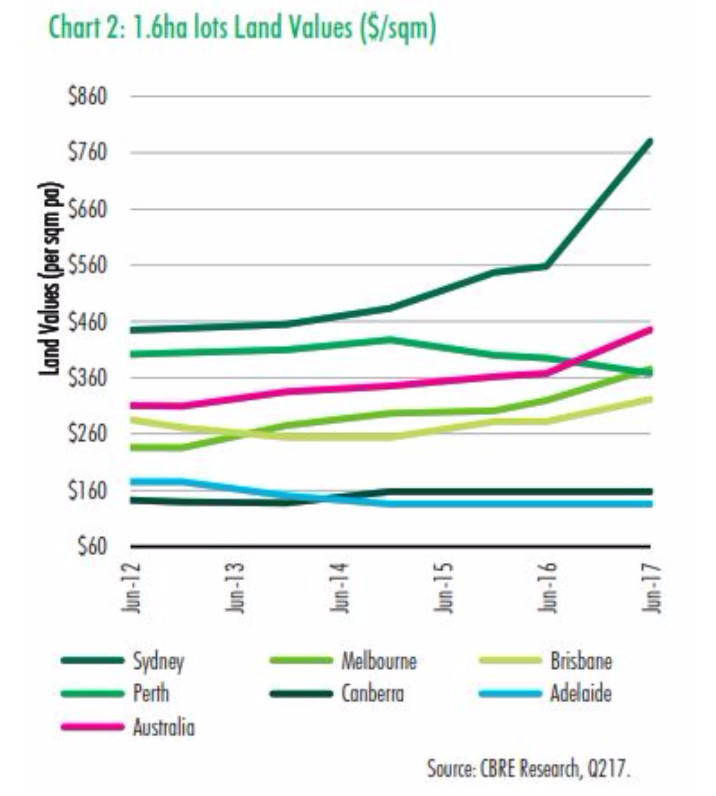

The report stated that land values continued to grow with average prices for 1.6 hectare parcels up 21% year-on- year, driven by growth in the Sydney market which recorded 40% year-on-year growth.

NSW saw 9% annual growth over the past 20 years, with North Sydney and South Sydney the strongest performing regions.

Land values were up 18% year-on-year in Victoria, with eight consecutive quarters of positive growth. Queensland land values rose by 14% annually, with occupiers and developers starting to land bank sites, particularly in the south and west.

CBRE Pacific Senior Managing Director Matt Haddon said that a total of 206,000 square metres of new industrial and logistics supply was released to the market in Q2.

Sydney saw the highest levels, with 37% of all new supply in 2017. Over 680,000 square metres of industrial and logistics stock was added in the first half of 2017 - 66% more than in the same period last year.

However, rent growth remained relatively strong with super prime net face rents increasing 1.3% to $131 per square metre and secondary rents growing 1.1% to $110 per square metre.

“We expect this growth to continue through to the end of 2017 and start to slow in early 2018,” Haddon said.

Melbourne recorded its first quarter of rental growth since Q3 2016, with super prime face rents increasing by 3.9% to $83.1 per square metre.

“This has been driven by increases in Melbourne’s south east which saw growth of 5.9% quarter-on-quarter, with availability of well-located super prime assets tightening," Haddon said.

“The Port of Melbourne and infrastructure investment is driving demand in the west precinct, with strong super prime growth of 3.4% quarter-on-quarter."