Industrial Sector Positive Despite Pandemic

The industrial sector is the only property market to make it into positive territory as Covid-19 affects sentiment across the board.

The latest results from the ANZ Property Council survey, which tracks changes in property market sentiment, shows a modest improvement across all sectors for the September quarter.

However the office, tourism and residential sectors still remain deep in negative territory.

In the survey, expectations for industrial property recorded solid gains in work scheduled, staffing levels, capital values and construction activity going forward.

This was likely due to the shift in consumers shopping online during the pandemic which benefited logistics and warehousing.

Improving sentiment was also seen in the a large number of transactions and approvals in recent weeks including Charter Hall’s $210 million Sydney acquisition, Pelligra Group’s $100 million plans in Melbourne and Dexus’ $173 million portfolio expansion.

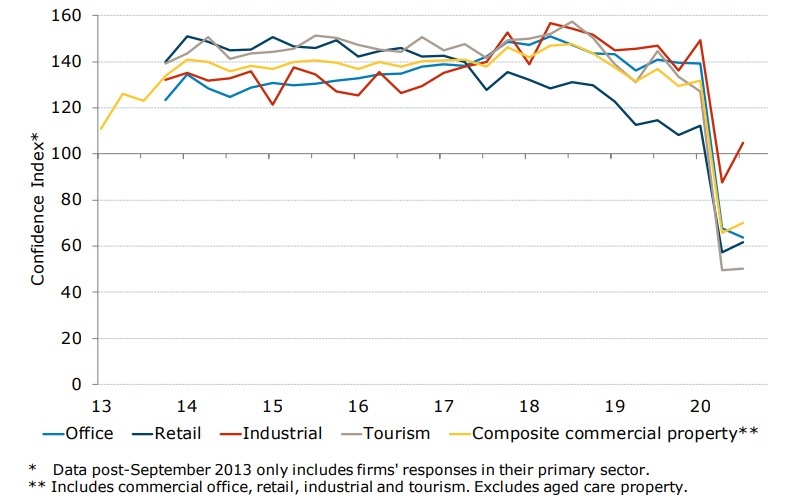

Commercial property confidence

^ Source: ANZ-Property Council

Despite this, the residential and composite commercial property sectors remained well below the key level of 100 index points—which is considered neutral—for only the second time in the survey’s history.

ANZ senior economist Felicity Emmett said the levels were depressed in the wake of Covid-19 and the shutdowns put in place by the federal and state governments to contain it.

“Not surprisingly, the tourism sector has been the hardest hit, although office property expectations have deteriorated further over recent months as businesses reassess the long-term outlook for office space,” Emmett said.

Residential sentiment on the up

The ANZ senior economist said confidence in the residential sector is generally higher, but house price expectations fell further.

“Price expectations were quite negative across most states except for South Australia, where a net balance of 29 per cent of firms expect prices to rise over the coming year,” Emmett said.

“Victorian firms were the most pessimistic, with a net balance of 44 per cent of firms expecting a decline in prices.”

Gains were made in forward work schedules, construction activity and staffing levels.

However, employment levels and property prices remained in negative territory.

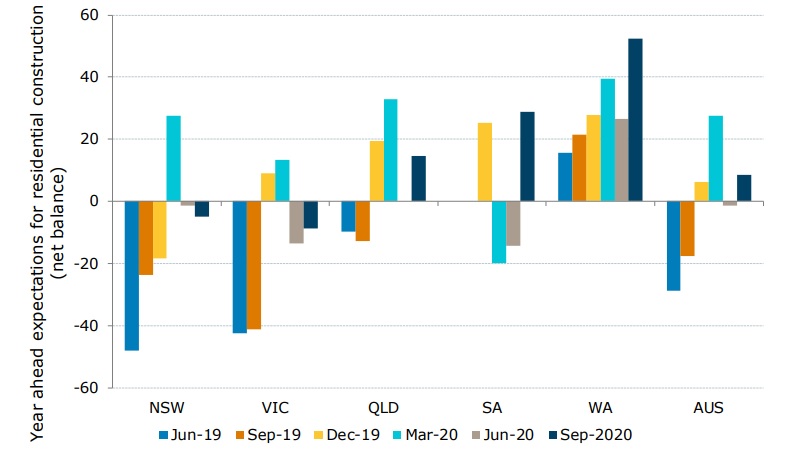

Outlook for residential construction

^Source: ANZ-Property Council

Emmett said the outlook for construction was the strongest in Western Australia, followed by South Australia then Queensland.

“The improvement in construction expectations is likely to take a little while to feed into residential building approvals; they fell 16.4 per cent in May and are likely to fall again in June,” Emmett said.

“The Housing Industry Association, however, reported that new home sales rose 78 per cent in June, suggesting HomeBuilder has breathed some life into the sector and that building approvals should rise in coming months.

“An improvement over coming months looks likely, although any recovery will be crimped by the drop in overseas migration and an extended period of high unemployment.”