Inner Brisbane Apartment Market to Stabilise in 2019

Brisbane’s apartment market has been steadily declining since 2016, but as supply and demand rebalance, inner Brisbane’s apartment market is expected to stabilise this year and into 2020.

While development conditions remain challenging, JLL’s 1Q 2019 Apartment Market Brisbane Report expects supply to remain subdued for several years.

“Further declines in supply levels over 2019 help position Brisbane to recover strongly over the medium-term,” the report notes.

Brisbane offers strong fundamentals explains JLL's head of research Leigh Warner, who anticipates underlying demand will continue to be boosted by population growth, particularly interstate migration.

“Increased jobs growth and infrastructure spending are expected to continue to support this growth cycle,” Warner said.

“As the market rebalances, supply levels will continue to contract over the next 12-24 months. Prices are expected to steadily improve and stabilise into 2020.”

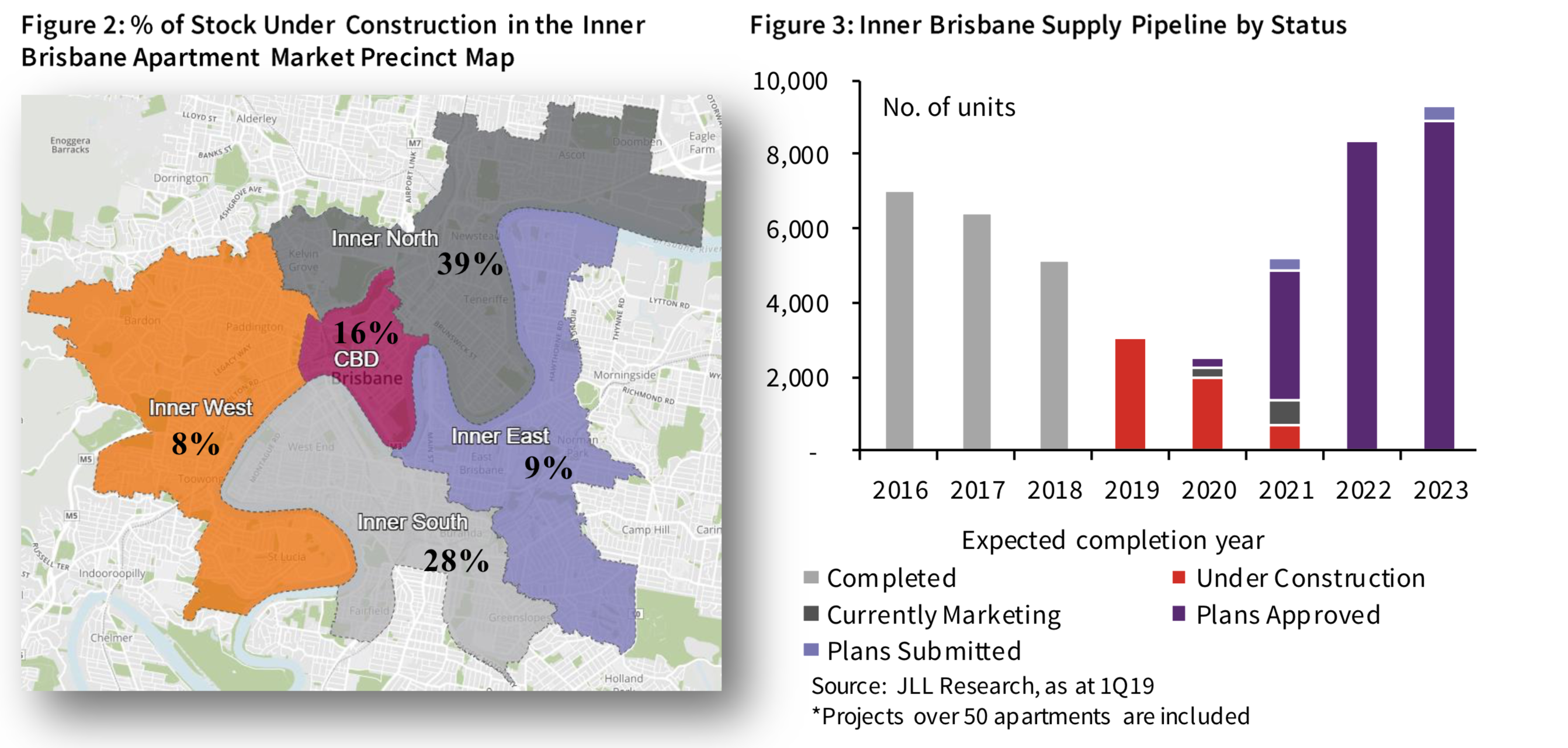

Apartment supply forecasts this year are estimated at 40 per cent below 2018, and less than half of the 2016 peak which saw the market in oversupply.

Related: Confidence Returning to Inner Brisbane Apartment Market

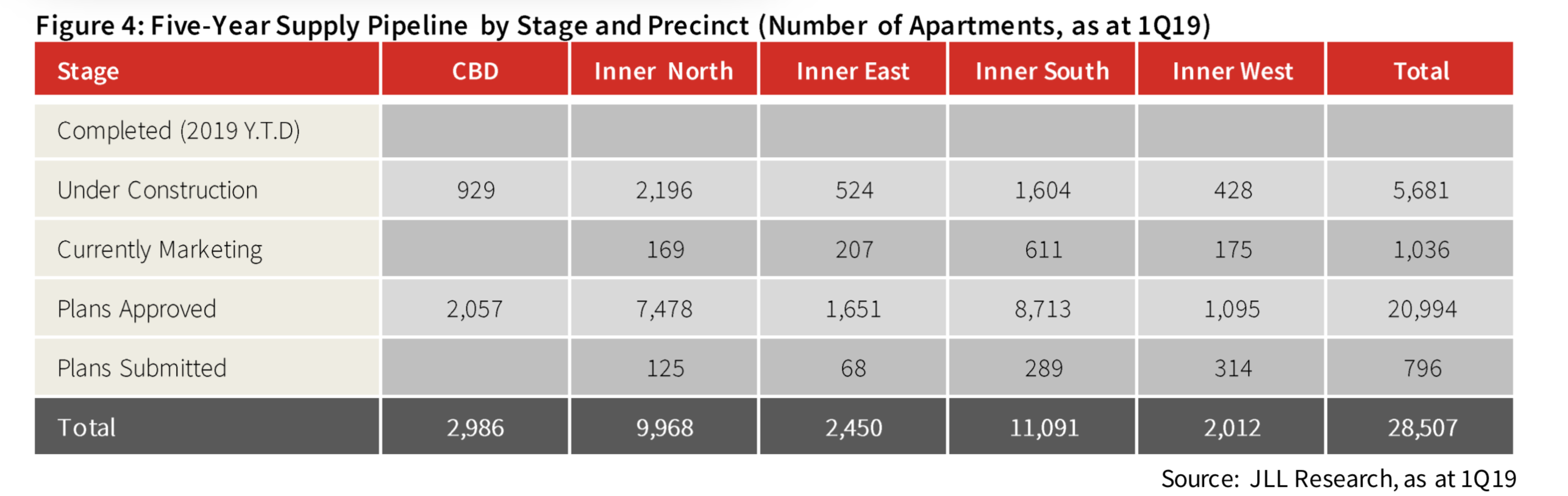

Approximately 31 projects comprising 5700 apartments are currently under construction across inner Brisbane, with the inner south (28 per cent) and inner north (39 per cent) precincts home to the majority of construction.

While 1100 apartments are currently being marketed across nine projects in Brisbane. JLL notes that a number of developments stopped marketing last year, and remain waiting to re-launch.

The first quarter of 2019 saw no completions, but seven projects are expected to be finished in the second quarter, including the Brisbane Skytower (lead picture) at 222 Margaret Street by Billbergia.

Despite slow sales and restricted lending conditions, two projects kicked off construction in the first quarter, including Aria’s 261-unit development, The Standard.

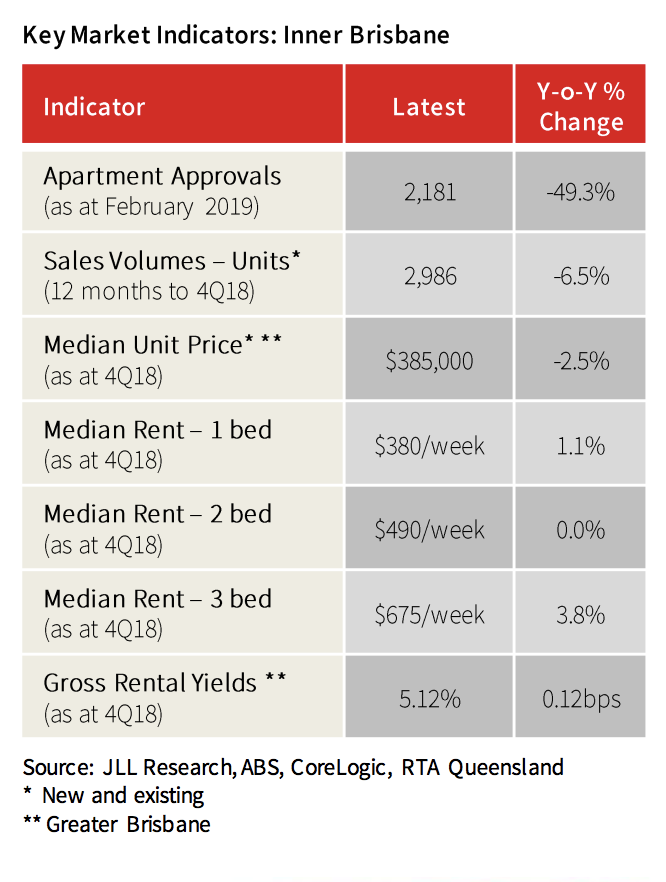

Brisbane’s inner city apartment approvals has declined by 49.3 per cent for the year to February 2019, as projects continue to be deferred amid current market conditions.

JLL notes that a total of 2,181 apartment dwellings were approved over this period, with most concentrated in Fortitude Valley (23 per cent), South Brisbane (17 per cent) and West End (14 per cent).

Related: Brisbane Apartment Market at ‘Turning Point’

“Further declines in supply levels over 2019 help position Brisbane to recover strongly over the medium-term. Nevertheless, tight credit conditions will continue to see commencements suppressed.

“This has likely exacerbated the decline in completions.”

JLL expects apartment completions in 2020 to remain much the same to 2019.

“However the number of completions beyond this is very uncertain considering the current difficult pre-sale environment.”

Outlook for developers

Responding to market changes, many developers have had to downsize the scale of projects to meet market demand and achieve pre-sales requirements, the report notes.

Developers are less likely to pursue high density projects in the coming years, taking the “less is more” approach with a focus on luxury and boutique developments.

“Some developers may need to alter planned products to better suit current conditions in order to attain adequate pre-sales levels,” Warner said.

“Intense competition will mean that developers will need to continue to differentiate themselves in the market and have a strong brand reputation.

“Owner-occupier demand will drive developers to offer specialised, bespoke apartments.”