Inspections Surge Despite Lower Listings

Droves of potential buyers have continued to show up to open houses despite price growth slowing and auction clearance rates falling sharply off the back of the first interest rate rise in more than 11 years.

While the slowing market has startled vendors, forcing many to withdraw listings and pushing the number of homes for sale lower, inspection numbers have continued to surge as buyers shop around for homes they want at a price they can afford.

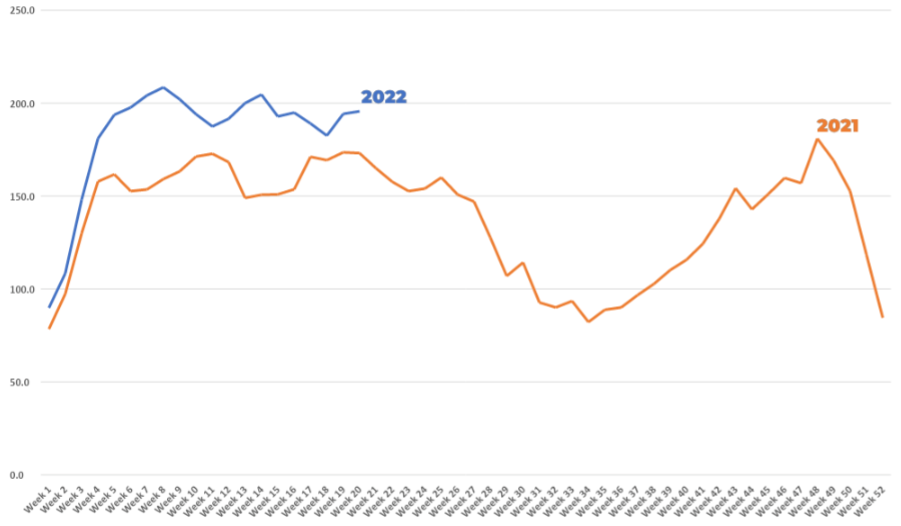

Inspections have soared over the start of the year, with the volume of would-be buyers attending open homes higher every week so far this year than in the same period last year, according to a report released by PropTech Group.

Managing director Joe Hanna said buyers were no longer feeling the “FOMO” that had supercharged the market during the past two years—now that they are able to attend more inspections, they had slowed down their decision making.

“There is still significant unmet demand in the market,” Hanna said.

“Buyers are active, stock is limited and most people still have to visit many open homes before finding what they’re looking for.”

Fewer homes are now selling under the hammer as greater choice reduces competition and the premium prices buyers are prepared to pay.

Nationally, it took an average of six days longer to sell a property in the three months to April, compared to the previous quarter.

Houses in Sydney were on the market for an average of six days longer, while Melbourne homes took an average of four days longer to sell.

Australian inspections index, rolling four-week average

^Source: Proptech Group

Over the quarter, house prices fell in Melbourne, Canberra and Darwin while Sydney’s record breaking price growth has now stalled.

Brisbane, Adelaide, Perth and Hobart all continued to rise during the first three months of the year.

Demand from buyers, however, has remained steady throughout the year, albeit slightly weaker.

This has been supported by the shortage of housing and the significant change in household formation rates—that is, the appetite for bigger homes or fewer people living together in them—due to the pandemic.

A week after the RBA raised the official cash rate, Sydney’s preliminary auction clearance rate dropped by 3.6 percentage points, the weakest result in two years, while in Melbourne the clearance rate tumbled by 3.8 percentage points, the lowest preliminary result since December.

The combined capitals recorded their lowest preliminary clearance rate of the year to date on election weekend, down 40 per cent from the week prior.

However, long queues at polling stations failed to deter potential buyers from attending available open homes.

“This election hasn’t had the same impact on activity as past elections did,” Hanna said.

“During election week, the number of buyers who attended an open for inspection didn’t decrease; it actually increased by 10 per cent over the prior week to a five-week high.

“Property inspections are a direct indicator of buyers’ interest in transacting.

“When inspections are higher, the number of transactions may subsequently increase.”

Many experts have suggested that more cautious households and overseas holidays after two years of rolling lockdowns as the potential drivers for a slowdown in listings and less stock being brought to the market in recent months.

Home buyers’ borrowing capacity has also decreased as interest rates begin to be ratcheted up.

All four major banks raised their variable interest rates for existing customers to match the RBA’s decision to increase the cash rate by 0.25 percentage points, from 0.1 per cent to 0.35 per cent.

ANZ recently confirmed it will only accept home loan applications where the debt-to-income ratio—a person’s total monthly debts and divides this by their monthly income—is less than 7.5.

NAB also cut its debt-to-income ratio limit from nine times to eight times, although the bank will still consider lending at higher levels if credit checks for individual customers are positive.