Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeThere is seven times the amount of capital waiting to get into Australia’s booming industrial sector than required, despite a record level of building in the past quarter.

Speaking at The Urban Developer’s Industrial and Logistics vSummit, Centuria Industrial REIT fund manager Jesse Curtis said there had historically been an under-representation of institutional investors in the industrial sector, which had fundamentally shifted in the past 12 months.

“There’s $45 billion of capital waiting to get into the market … that’s six or seven times what is required right now,” Curtis said.

“That’s going to put pressure on prices in terms of demand and supply.”

According to an ANREV survey of 84 industrial investors, with $US846 billion in funds under management globally, the Sydney industrial market was the number one area for investment in the Asia-Pacific region.

More than 70 per cent of respondents said they were looking to increase their allocation of funds into the industrial sector.

There was an average of 9.3 per cent of funds allocated to the sector, but most were aiming for a 10 per cent weighting, which JLL head of industrial and logistics research Annabel McFarlane said indicated capital inflow to the sector.

While the appetite for investment is there, the supply of development and investment opportunities is constrained with limited brownfield development sites putting upward pressure on land prices.

“We have a strong desire for urban industrial sites and we have a real problem finding the land,” McFarlane said.

“Pre-lease rents will have to go up … otherwise the numbers won’t stack up.”

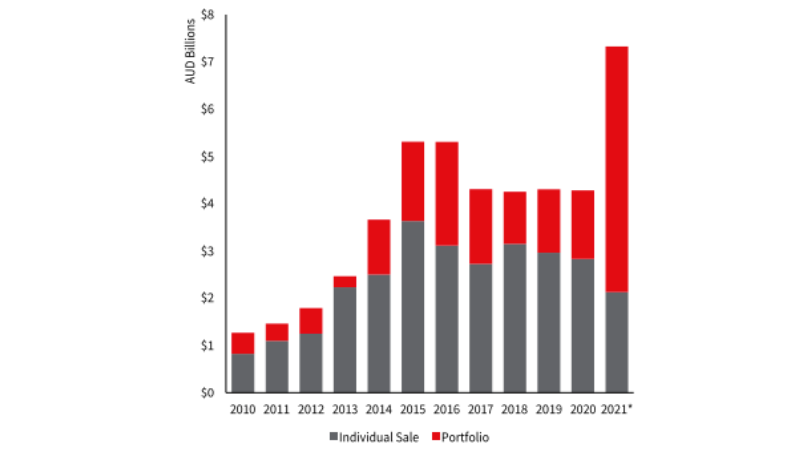

Transaction volumes by sale type

Source: JLL Research

National director of Colliers David Hall said the price of industrial land had increased significantly while land supply dwindled.

Hall said in 2014 land prices were about $315 per sq m, which had increased to more than $1000 per sq m this year for properties greater than 5000 square metres.

“Fundamentally industrial as an asset class the value is underpinned by the land … we’ve got land supply issues for industrial development,” Hall said.

“In Sydney there’s no more land once we get through the land near the airport … this will always be an issue for investors.

“Australia still lags behind what [capitalisation] rates and yields are around the world.”

JLL’s Annabel McFarlane said global figures indicated there was still “room for further yield compression” as the trend of e-commerce continues its accelerated growth, driving demand for increased industrial space.

McFarlane said the second quarter of 2021 had delivered a record amount of commencement rates on new industrial developments with 808,000 sq m across 33 projects.

“About 50 per cent is already pre-committed which goes to the incredibly strong demand we have,” she said.

“We think that by and large that most of this stock will be absorbed by the practical completion … which poses a risk to secondary assets with that flight to quality.”

On average about 83 per cent of speculative industrial development is tenanted at practical completion and McFarlane said she anticipated that this would continue despite the large volume of space that would come online.

“Industrial is the only sector to benefit from the pandemic,” she said.

“The transaction volumes that we’ve seen across markets has been huge.”