Investor Lending Tumbled by More Than $1 Billion Last Month

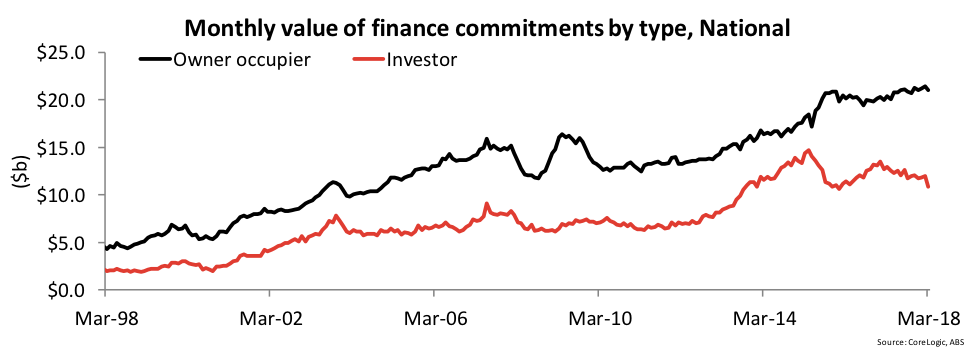

Lending to property investors slumped to a five-year low last month, declining 2.2 per cent from March – a much sharper fall than the 1.8 per cent economists had predicted.

The latest ABS housing finance data showed new lending to investors, in dollar terms, slid to its lowest level since January 2012, taking up 34.1 per cent of all loans.

While the value of lending fell over the month of owner-occupiers and first home buyers, the slowdown was much more substantial for investors, marking a downward trend that has been evident across several rounds of macro-prudential measures.

“Despite the macro-prudential measures in 2017, investor loans held up reasonably well, particularly compared to the response to the previous round of measures in 2015,” Westpac senior economist Matthew Hassan said.

“The March drop puts the segment decline more on a par with the earlier episode.”

Related reading: Incentives for Developers Could Help Create More Affordable Housing

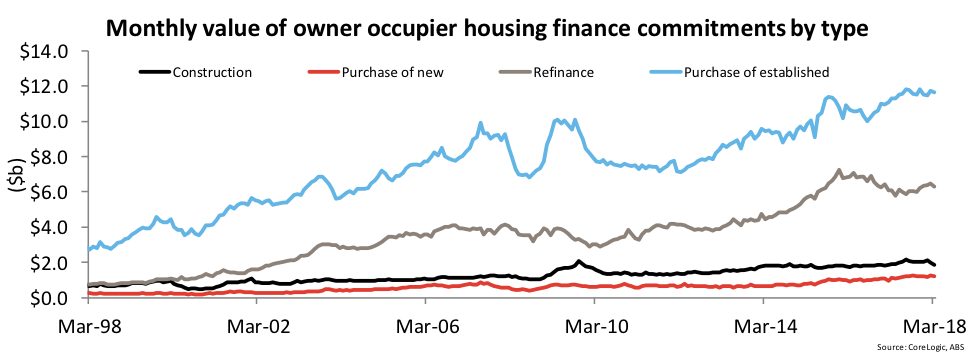

Owner-occupier housing was also softer, down 1.9 per cent over the month. In total, the value of mortgages issued over the month was down 4.4 per cent.

The recent tightening of credit standards demanded by APRA has contributed to the fall in lending. The fallout from the banking royal commission in regard to lax lending standards by mortgage brokers is also a factor.

Property researchers CoreLogic said that dwelling values, particularly those in Sydney and Melbourne, have been falling now for a number of months and that the latest ABS housing finance data indicates that the impact of these falls is now seemingly being felt in demand for new mortgages.

“A month’s worth of data doesn’t necessarily indicate a trend but it was quite a substantial fall in the value of housing finance commitments in March, particularly for investors,” CoreLogic research analyst Cameron Kusher said.

Related reading: Federal Budget 2018: Infrastructure, Investment and Build to Rent

“CoreLogic has believed for some time that investment in housing, particularly in the most expensive markets of Sydney and Melbourne, made little sense given stretched affordability, yield compression and little near-term value growth prospects with values currently declining," Kusher said.

“Despite this, lending finance data (which will be updated next Tuesday) has continued to show investor activity which is well above average levels in NSW and Victoria.

“We would expect that the coming release will show a further weakening of demand in these two states.”