Investor ‘Twilight Zone’ Forces Accelerated Digital Adoption

One of the major challenges for investors trying to gauge the damage left by Covid-19 is understanding which behavioural changes forced by the pandemic will remain once the virus abates, real estate consulting and software heavyweight Altus Group says.

In its latest global survey, Altus tapped 400 development executives at tier one firms to understand current challenges facing the global development industry as it adapts to the "new normal", and their key initiatives to build resilience.

Altus Group senior director Niall McSweeney said that while the challenges facing development firms shifted from nation to nation, a looming cycle downturn crippling new construction investments remained the primary challenge for Australia.

“This is leading concern for the Australian market and is a standout when compared with other markets,” McSweeney said.

“This should be a concern to both state and federal governments as new developments will help to prop up the economy as we battle our way out of recession.”

Nearly 70 per cent of Australian executives surveyed listed government regulations as the main challenge facing their organisation, with project cost escalation and labour shortages also high on the list.

To date, many businesses have been shielded by the government’s decision to slap a moratorium on insolvent trading laws until the end of the year, in order to help businesses navigate the shock of the pandemic.

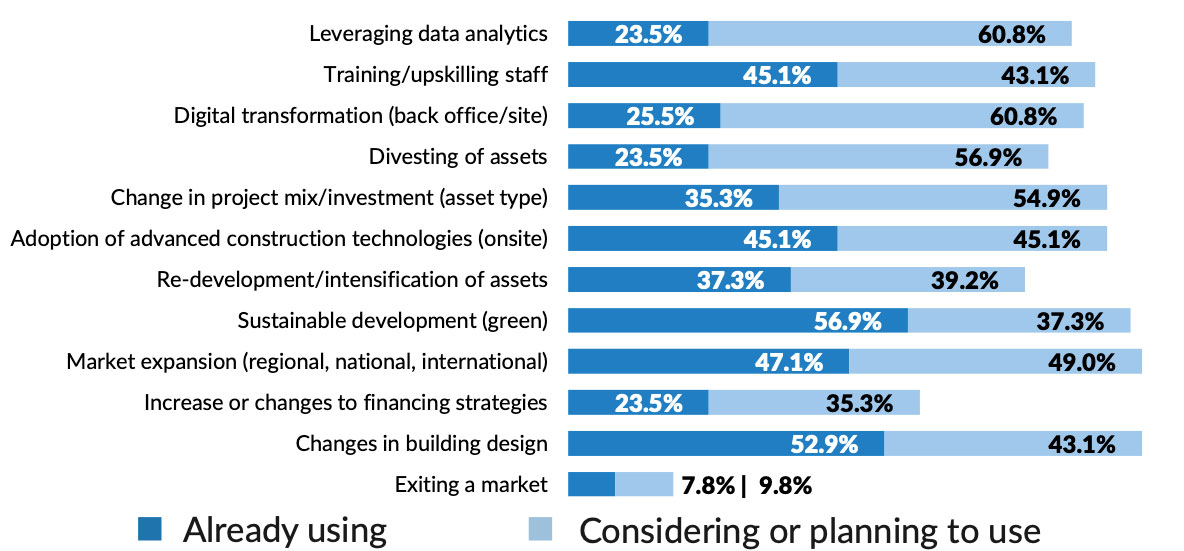

Top strategies being used by Australian businesses to mitigate challenges

^ Source: Altus Group Global Property Development Trends Report

Large listed property groups have also tapped capital markets for billions of dollars in fresh equity to shore up their balance sheets, and insulate themselves against possible drops in property values.

While tough choices lie ahead for many commercial landlords squeezed by reduced rental income due to Covid-19 and a return to loan repayments as mortgage holidays end, Altus’ analysis suggests that “death of the office” commentary is premature.

Most respondents agreed that while workplace culture would allow for more flexibility, the office itself would remain central to fostering company culture.

When asked in early 2020 about strategic investments and decision-making in a downturn, a significant majority of executives saw opportunities—not risks—in acquisitions, asset repositioning and joint ventures.

According to the Altus survey, by mid-year, the desire to make acquisitions hadn’t changed, but macro uncertainty due to the pandemic had resulted in “lots of dry powder”, or cash reserves, waiting on the sidelines.

Respondents from major domestic and global organisations were instead implementing a “wait and see” approach, with limited distressed asset sales and business failures due to government stimulus.

“If changing assumptions and inputs pre-Covid, during Covid or post-Covid produce results in analysis that cause us to pause, we will,” Oxford Properties president Michael Turner said.

“But all the key data inputs and trends underlying our decision-making are being accentuated under Covid, and they are giving us conviction in our prior aims.”

Developers highlighted that the lack of capital in the market was not an issue: instead, the biggest challenge was correctly pricing future acquisitions and determining assumptions such as vacancy rates and future rents.

Despite the economic downturn, nearly three-quarters of respondents said public sector infrastructure investment remained the major influence on development planning over the short term, with tenant and occupier expectations also rating highly.

“There’s always a flight-to-quality and consequently a flight-to-developers that people can trust,” Frasers Property Australia NSW general manager Nigel Edgar said.

“In the short term, customers want to make sure they’re ordering and purchasing from high quality, reliable developers who will be there and deliver on time and on quality.”

The wave of adoption accelerates

The pandemic has also impacted traditional ways that information and business ideas are exchanged, with Australian businesses implementing as much new technology in 2020 as in the entire previous decade.

Many Australian businesses have introduced new workplace practices to ensure the greater use of digital tools had a positive impact on business and workers, such as flexible working hours, initiatives to increase social connectivity, and initiatives to support physical and mental health.

Altus’ survey reveals that half of respondents are currently considering or planning use digital transformation strategies and data analytics to mitigate business challenges, while more than a third of major property groups are already doing so.

“With so much unknown due to the pandemic, there has been a shift in recognition among development industry leaders that the adoption of technology can help development firms stay agile and navigate what lies ahead,” McSweeney said.

“The findings suggest that development executives are broadly acknowledging that digital transformation strategies and tools are the key to building resiliency for the industry in a prolonged and sustained development crisis.”

However, developers are facing significant challenges with data, as 65 per cent said their biggest impediment to collecting or using more data is subscription costs, followed by lack of normalised data formats.

One in five respondents said that manipulating or transforming data is a hindrance because it requires significant time and effort to manage.