Is the Housing Market Putting Australia's Economy at Risk?

Australia’s economic growth has been resilient, but risks posed by the weakening housing market has seen the OECD warn financial institutions and bank regulators to “be prepared in the event of a hard landing”.

With 27 years of positive economic growth, the report says Australia has demonstrated a “remarkable capacity” to sustain steady increases in material living standards and “absorb economic shocks”.

However, the nation faces economic challenges that, if not handled well, could see an end to its strong track record, according to the Paris-based group.

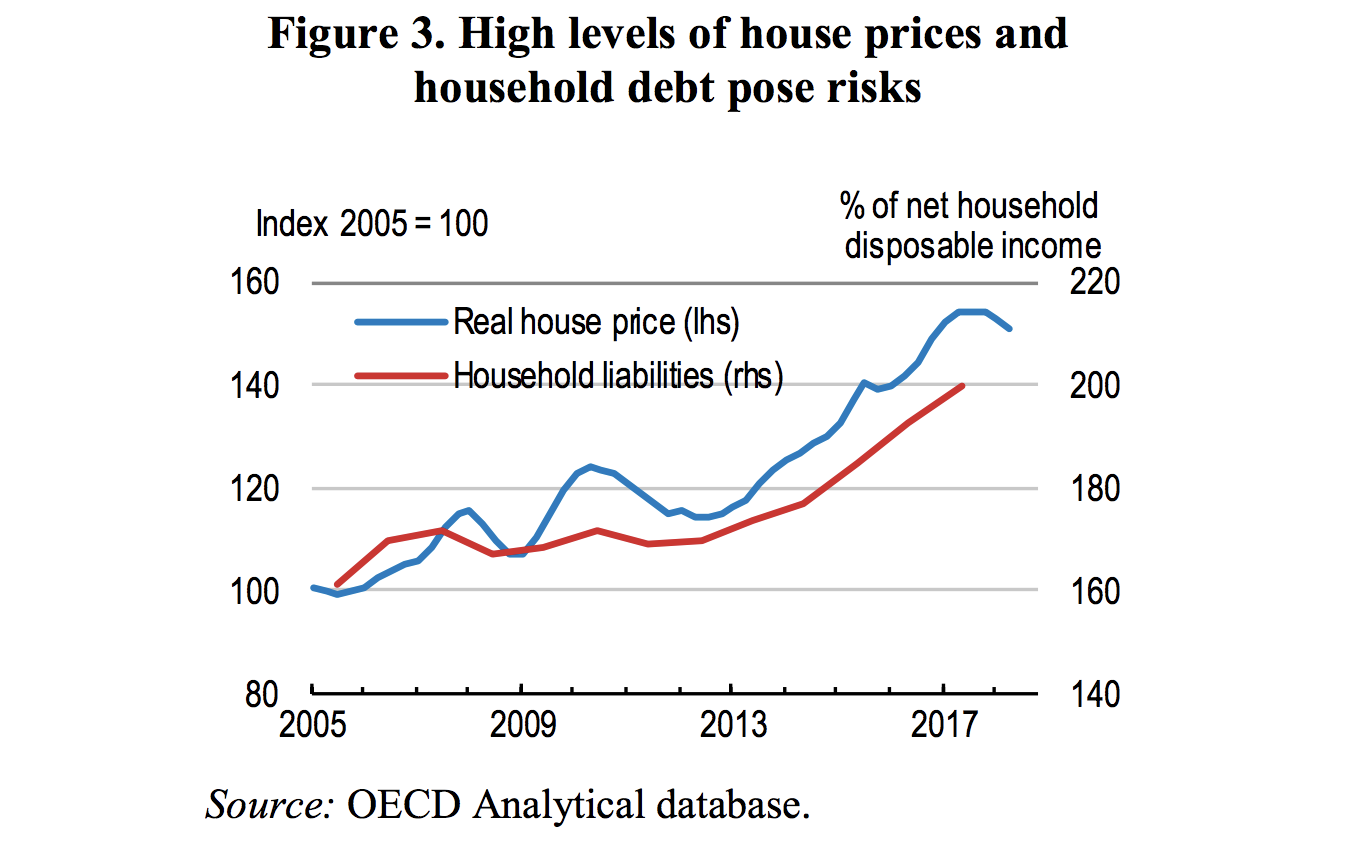

“Risks include potential instabilities from high house prices and large household debt,” explains OECD's 2018 Economic Survey of Australia report.

Australia’s housing market is a source of vulnerabilities due to elevated prices and related household debt.

--The Organisation for Economic Co-operation and Development

The housing market poses macroeconomic risks

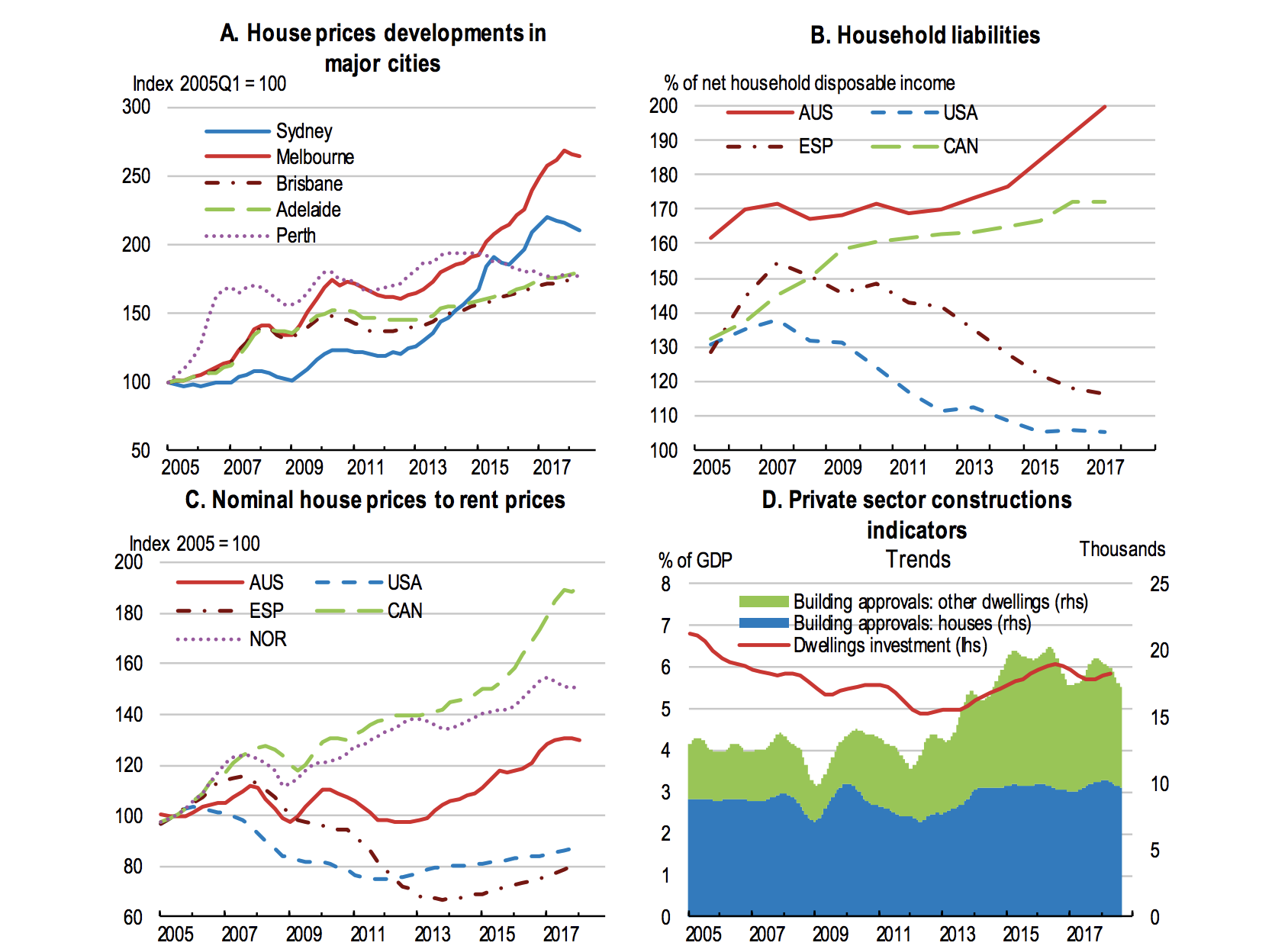

While the nation’s housing prices have fallen, the report notes these decreases have only been gradual since late last year.

“The current trajectory would suggest a soft landing, but some risk of a hard landing remains.”

After several years of rapid increases, most notably in Sydney and Melbourne, the report says a "welcomed cooling of house prices" is under way with average prices in Australia’s two largest capital cities leading the trend.

“Contributory factors include prudential measures taken by the Australian authorities and a sizeable pick up in new housing supply.”

While the report states that a direct hit to the financial sector from a wave of mortgage defaults “is unlikely”, the event would drag the overall economy.

“If house prices collapse consumer spending could suffer... including from exposures to bank shares, which would encourage deleveraging.

“Together with reduced housing-related expenditures, this would put pressure on the whole economy,” the report said.

And in the absence of negative shocks, the report suggests that policy rates should start to rise soon.

“Monetary conditions remain very accommodative, with the risk of imbalances accumulating further if the low-interest rate environment persists.

“In the absence of a downturn, a gradual tightening should start as inflation edges up and wage growth gains momentum.”

OECD also suggest financial supervisors and bank regulators should continue to address shortcomings in the financial sector identified in recent inquiries, particularly competition, misconduct and fraud.

Other challenges?

Australia's socio-economic challenges include globalisation and technological change, and “while overall beneficial”, have brought challenges for some segments of society.

“Certain groups are vulnerable with low labour force participation and high risk of poverty.

“The substantial gaps between Indigenous Australians and the rest of the population are narrowing too slowly.”

The report also cites climate change policy as still lacking “clarity and stability” with Australia making “little progress in reducing its environmental footprint”.