Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

It seems there is little holding back house price growth in Australia, as it once again outstrips the international average of 3.5 per cent.

In its latest Global House Price Index for the third quarter of 2023, Knight Frank has ranked Australia at 18 in its analysis of 56 global markets for house price growth.

Australia has chalked up an average 4.9 per cent growth in the past 12 months, well above the global average.

Turkey has held the top spot since 2020, and recorded 89.2 per cent growth in house prices in the past 12 months.

Knight Frank head of residential research Michelle Ciesielski said Australia was one of 35 markets to experience annual price growth, while 21 of the 56 recorded price declines.

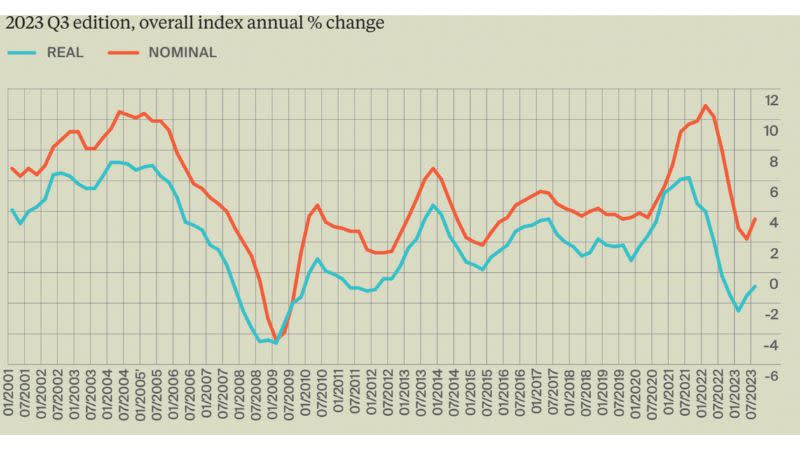

“The rate of annual price growth reached a peak of 10.9 per cent in the first quarter of 2022 but sharply slowed to 2.2 per cent in the second quarter of this year,” Ciesielski said.

“The upturn in the latest quarter indicates strengthening price growth in several markets, including Australia, Ireland, Sweden, the UK and the US, despite rising interest rates and therefore higher costs for mortgage borrowers.

Knight Frank global house price index

“Remarkably, despite the fastest rise in interest rates in history, globally residential prices only dipped slightly at the beginning of this year, and have since resumed growth. Even when adjusted for inflation, real house prices are only 2 per cent below their 2022 peak despite higher rates.”

Knight Frank head of residential Erin van Tuil said sales volumes globally had dipped 15-25 per cent from recent peaks.

She said the constraint on activity was likely to persist next year and potentially into 2025, with a rebound in sales activity tied to a significant reduction in rates.

“In Australia, on one hand, this is the ideal opportunity for first home buyers to enter the market, but overall numbers are down,” van Tuil said.

“Many have seen their deposit absorbed by rental growth, the overall cost of living or they’ve been unable to prove serviceability of the loan required to be borrowed.

“On the other hand, there are a significant portion of cash buyers such as the growing number of downsizers itching to make their low-maintenance living a reality.

“This pent-up demand, plus those currently less active in the market, including families seeking to upsize, and those much-required investors to keep weekly rents at bay as our population grows, will place further pressure on capital values across the country in the coming years.”

At the bottom of the global rankings list was Sweden. The Scandinavian country recorded house price contraction of 11.1 per cent in the past 12 months amid an economic recession and increased costs of borrowing.