Labour Shortages Remains the Biggest Challenge: BCI

A critical shortage of skilled labour remains the biggest concern facing the construction industry, a nation-wide survey of builders and developers has found.

The building and construction industry platform BCI Central says 90 per cent of builders surveyed in their annual construction outlook cite labour shortages as the key challenge to their businesses.

BCI’s data—measured from the third quarter of 2021—is backed by calls for increased skilled professionals and migration to meet industry demands.

However, respondents to the survey said the federal government’s response to improving the visa process for skilled foreign workers had been slow.

“Any changes to expedite skilled migration would be a key part of a comprehensive revaluation of Australia’s migration system, addressing the urgent need for reform,” the authors of the report said.

Adam Ashcroft, general manager of the design and construction company Growthbuilt, told BCI the difficulty in finding skilled labour has led to increased pressure on salaries to retain talent within the industry.

“There is an overall reduction in infrastructure spending, resulting in a decrease in industry workload,” Ashcroft said.

“There is a shortage of subcontractors across various trades, hindering productivity and contributing to escalation.”

Deferred and abandoned projects

Kapitol Group directors David Caputo and Andrew Deveson echoed the view.

“If the industry is going to continue to be as busy there needs to be an increase in skilled personnel and skilled migration coming into the country,” they said.

BCI said the after-effects of the global pandemic continued to send shockwaves through Australia’s construction industry, disrupting and destabilising established norms.

Even major construction companies were facing inflation pressures, rising wages and interest rates, and shortages of labour and materials, which were leading to increased costs.

“These challenges have resulted in progressively unprofitable contracts and, in some cases, have contributed to high-profile insolvencies,” BCI wrote.

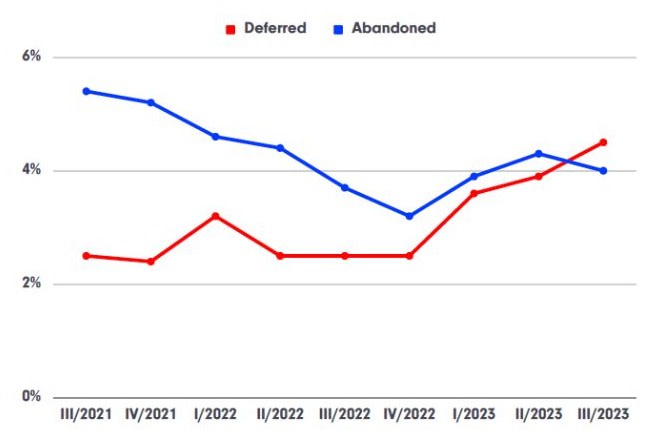

While the number of abandoned projects had begun declining in most states—except Victoria—by this year’s third quarter, BCI said deferred projects were on the increase.

“The steady rise in deferred projects from the last quarter of 2022 is likely a result of increased construction costs putting pressure on project timelines,” the report said.

However, the residential, commercial and hospitality sectors had all experienced higher abandonment rates than deferrals.

BCI said the industrial, infrastructure and transport sectors, with the energy and resources, made up more than 60 per cent of total project values over the next 12 months.

That said, survey respondents wanted to see a greater emphasis on solving the country’s housing supply crisis.

“We need to dramatically increase the supply of a range of housing types that are well-located and affordably delivered,” Deicorp’s executive manager of corporate communications, Robert Furolo, said.

“The best thing governments, including councils, can do to help achieve this is to fix the planning system,” he said.

“We need quick approvals and greater certainty.

“Decisions are slow and expensive and these costs either make projects unfeasible, so they don’t get built, or the costs get passed on to purchasers, making them more expensive.”