Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

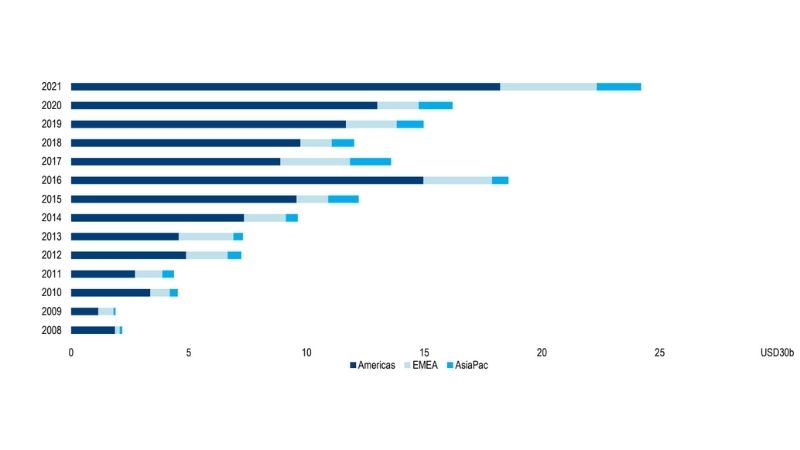

SubscribeThere has been more than $25 billion in life sciences transactions in 2021 globally—and Australia’s burgeoning sector, reportedly worth about $3.5 billion, is luring institutional investors.

Speaking at The Urban Developer’s virtual summit on the healthcare property sector, Real Capital Analytics head of analytics Benjamin Martin-Henry said the Americas had driven the market’s $23 billion growth in transactions in 13 years. And the market is heating up.

“In just over a decade we’ve gone from about $2.5 billion to $25 billion … that’s a big jump,” Martin-Henry said.

“It’s because we’re seeing investors recognise the great performance that you get from healthcare assets and they’re buying into the future income stream.

“The R&D side of things often gets overlooked, but there we do see big transactions—the SAHMRI building, for example, which Dexus picked up for about $500 million.

“I think we’re seeing more money in R&D because it’s a bigger ticket item … we’ve really seen a big boom during the past five to 10 years in that technology space.

“We think of healthcare slicing people up, but there’s so much more that goes into it.”

Dexus head of healthcare partnerships George Websdale, who also spoke at The Urban Developer’s healthcare summit, said life sciences was a “term we’re all getting more familiar with” after a number of key acquisitions in South Australia and Victoria.

Dexus acquired a Monash University pharmaceutical building at Parkville for $138.7 million, and The Bragg Centre in Adelaide for about $500 million.

“That opportunity to partner with the Monash University in that medical research in those health precincts is one that’s very attractive,” Websdale said.

“You know the confluence of issues such as Covid-19, universities are having their challenges and they’re looking at private capital partnering at a real estate level.”

Global life sciences transactions 2008—2021

^Real Capital Analytics

Australia’s life sciences sector, worth about $3.5 billion presently, could double by 2030 with deeper investment and the repositioning of commercial assets, according to JLL research.

These are concentrated in Melbourne and Sydney around universities and major hospitals, with Brisbane, Gold Coast and Adelaide also growing as significant hubs.

New and refitted buildings could double this sector’s worth to $7 billion by 2030, according to a ‘high-growth’ scenario modelled by a new JLL report, Australian Life Sciences Outlook.

JLL predicts strong growth in this asset class as researchers strive to develop products for ageing populations here and in Asian countries, including China.

JLL head of alternative investments Noral Wild said Australia had about 352,000sq m of life science laboratory space, and the pharmaceutical and biotechnology index had grown more than 350 per cent since 2000.

“Rising venture capital investment, broader private investment and IPOs indicate a growing appetite for exposure to life sciences research and development among Australian investors,” Wild said.

“However, we would argue that our life sciences real estate market has lagged corporate market.

“Opportunities to invest in Australian life science assets that are physically comparable to assets in offshore markets are currently limited.

“We anticipate a number of development-led opportunities for scale investment to emerge, with life science occupiers and real estate developers engaging at early stages to develop modern, specialised stock.”

JLL research associate Louise Burke said the life sciences real estate market had matured “substantially in the past 10 years”.

“We anticipate the Australian market to follow several key trends from offshore markets. The most significant of these is clustering, where life science organisations typically cluster around leading university and health precincts,” Burke said.

“Clustering enables professionals from various sectors to come together—scientists, doctors, academic researchers and professional technicians.

“This supports the investment thesis of the sector and ‘stickiness’ of life science tenants.

“The typical long-term occupation of life science cluster anchors (universities and major hospitals) means, that these precincts are here to stay.”