Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Sydney’s property listings remained steady last month in what is normally the busiest month in the year for selling.

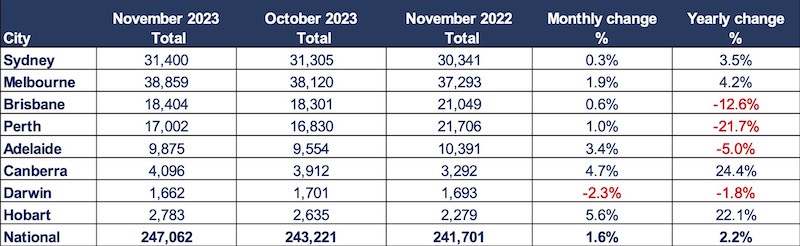

Total residential property listings modestly rose in November led by some larger percentage increases in Canberra and Hobart.

However, Sydney’s November was softer than the previous month, down 2.7 per cent. Year-on-year was brighter for the Harbour City, up 17.5 per cent.

Melbourne recorded a 1.9 per cent increase in total listings for November, which represented the largest absolute contribution to the national number.

Hobart recorded the largest percentage rise of 5.6 per cent increase in total listings, driven by an 8.9 per cent increase in new listings.

During the course of a 12-month period, residential property listings across the nation recorded a 2.2 per cent rise.

Listings have risen substantially for the year in Hobart (up 22.1 per cent ) and Canberra (24.4 per cent ), while Perth has recorded the largest yearly decline, falling by 21.7 per cent.

Total property listings

Nationally, new listings (less than 30 days) rose by 1 per cent in November, adding 80,487 new property listings to the market. Sydney recorded declines of 2.7 per cent. Melbourne also recorded a decline of 2.2 per cent. Hobart recorded the largest increase in new listings for the month, rising by 8.9 per cent.

Old listings

During November, older listings (properties listed for more than 180 days) decreased by 0.4 per cent but it still represented a 10.7 per cent increase over the past 12 months. Notably, all cities experienced a decline in older stock during the month.

Distressed listings

SQM Research's latest report reveals that as of November 2023, the number of residential properties being sold under distressed conditions in Australia has fallen marginally to 5467, down 1 per cent compared to the 5521 distressed listings recorded in October, 2023. Notably, Western Australia and Queensland continue to record substantial declines in distressed selling activity.

Asking prices

In November, the national combined home asking prices remained steady to record a median home asking price $805,712.

Asking prices for capital cities also remained steady at $1,116,866.

Canberra asking prices for houses recorded the most notable change, rising by 8.3 per cent. This is the second November in a row where house prices have recorded an abnormal surge.

Sydney and Melbourne recorded falls in home asking prices for the month, possibly indicating more sellers are interested in meeting the market in what SQM believes will be weaker markets for 2024.

The value of new owner-occupier loan commitments for homes rose 4.9 per cent in October, while the number of these commitments rose 2.8 per cent, according to fresh data from the Australian Bureau of Statistics.

ABS head of finance statistics Mish Tan said the growth in number and value of new owner-occupier loan commitments in trend terms had been relatively strong since February 2023, reflecting rising prices and demand for housing.

The number of new owner-occupier first home buyer loan commitments rose 5.1 per cent in October 2023 and was 6.8 per cent higher compared to a year ago. The value of these commitments rose 6.2 per cent.

“In October, average loan sizes for first home buyers grew 0.3 per cent from $506,000 to $507,000, while average loan sizes across all owner-occupier loans grew 2.1 per cent from $553,000 to $564,000,” Dr Tan said.

The number of refinanced owner-occupier loan commitments between lenders fell 12.4 per cent to 20,518. This continued a decline from the all-time high of 28,150 of July, 2023.