Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeRental vacancy rates have dipped below pre-pandemic levels while rent rates are tipped to rise during the next 12 months.

Vacancy rates are lower in all capital cities except for Melbourne when compared to this time last year, according to Domain’s rental vacancy rate report for April 2021. Nationally the vacancy rate is 1.8 per cent.

Domain senior research analyst Dr Nicola Powell said Melbourne’s rental market had been heavily affected by two lockdowns in 2020 that resulted in the vacancy rate bouncing twice, the second time higher than the first.

“The sustained low vacancy rates across the smaller capitals outside celbourne and Sydney mean conditions will remain tight for tenants but a welcome boost for landlords,” she said.

“Melbourne’s vacancy rate tightened more than any other capital during April, declining from 4.6 per cent to 4.2 per cent … [with] just over 24,000 estimated vacant rental listings across Melbourne at the end of April, a fall of 7 per cent from last month.

“In Sydney, the vacancy rate declined to 2.9 per cent, as 5 per cent fewer rental listings were estimated to be vacant at the end of April compared with March.”

Capital city rental vacancy rates

| City | April 2021 | April 2020 |

|---|---|---|

| National | 1.8 | 2.6 |

| Sydney | 2.9 | 4 |

| Melbourne | 4.2 | 2.8 |

| Brisbane | 1.4 | 2.9 |

| Perth | 0.8 | 2.4 |

| Adelaide | 0.6 | 1.2 |

| Hobart | 0.5 | 1.4 |

| Canberra | 0.8 | 1.4 |

| Darwin | 0.6 | 3.5 |

^Source: Domain Rental Vacancy Report

Dr Powell said there had been strong competition for properties, which had put “significant pressure” on asking rents.

Rents had strong annual growth across the house and unit markets in smaller capitals to the end of the third quarter.

Australia has maintained a two-speed rental market during the past 12 months, with prices dipping in capital cities and soaring regionally.

According to the results of Finder's RBA Cash Rate Survey, half the industry experts believed the rental prices would go up 5 per cent in the next 12 months—about $20 per week.

Head of consumer research Graham Cooke said the rental market recovery would be much slower than the housing market.

“What this market is really dependent on is the full opening of international borders—something we will not see until 2022 at the earliest,” he said.

“The absence of international students and migrants has caused prices to nosedive in the capital cities, and this may continue for some time if numbers don’t pick back up soon.”

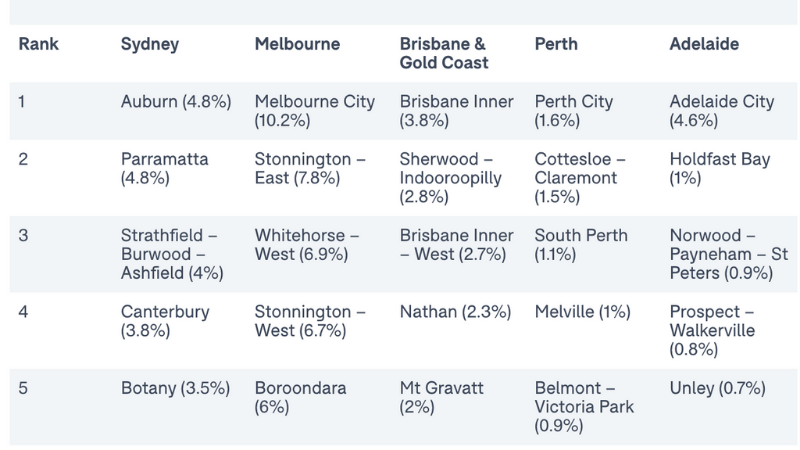

Highest Vacancy Rates Across Capital Cities

^Source: Domain Rental Vacancy Report

BIS Oxford Economics economist Maree Kilroy said the latest Australian Bureau of Statistics Lending Indicators data showed the national total number of owner-occupier loans for dwellings lifted about 1 per cent to 39,902.

“With the tapering of HomeBuilder and deteriorating affordability, first home buyer loans have started to normalise … [while] investor demand continues to gain momentum, up 13 per cent month on month in value terms,” Kilroy said.

“With property listings on the rise, price growth has started to ease back in the latest April data, but remains solid nationally.”