Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeAustralia's largest hotel and resort operator, the Mantra Group have released their end of financial year results which have fallen short of market guidance.

The group's trade fell 5% to $2.77 on Tuesday morning, following the release of their full-year results.

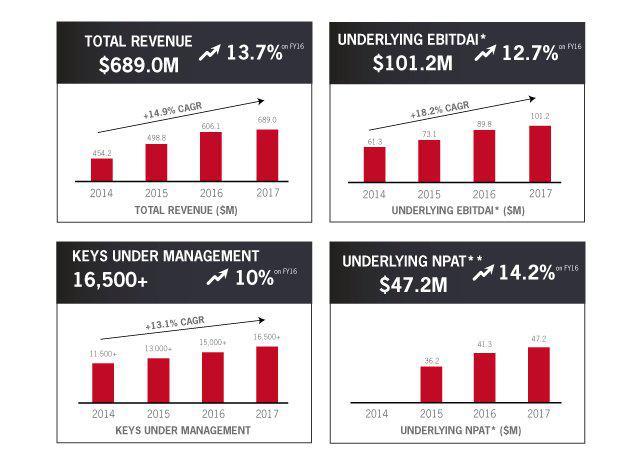

Mantra Group chief executive Bob East said the Group performed ahead of the previous corresponding period in revenue, with an increase by $82.9 million, or 13.7%, to $689 million during the year.

The group’s portfolio increase included six new properties: the 1,176 room Mantra-branded Ala Moana Hotel in Honolulu Hawaii, Mantra Residences at Southport Central, Peppers Kings Square Hotel at Perth, Mantra the Observatory at Port Macquarie, Mantra Club Croc at Airlie Beach and Tribe Perth. Mantra Hotel at Sydney Airport also opened in July 2017.

The Financial Review reported that Mantra's Gold Coast portfolio - which accounts for almost a quarter of its accommodation business (5000-plus rooms) - had been an underperformer.

"This [underperformance] was related to the tragedy at Dreamworld and its flow on effects," East said.

Underlying net profit after tax of $47.2 million was up $5.9 million and 14.2% year-on-year. Statutory NPAT was $45.6 million.

“The majority of this improvement was driven by six new property acquisitions during the year,” East said.

He said it was also supported by strong revenue growth from the key markets of Sydney, Melbourne, ACT, and Sunshine Coast, a $4.9 million increase in revenue from the Central Revenue & Distribution segment, improved occupancy levels, higher average room rates, an increase in the total number of rooms available and improved efficiencies in key areas of the business.

“The Group is in a strong financial position with total assets of $806.3 million, an increase of $37.2 million, and a strong operating cash flow,” he said.

[Related reading: Mantra Buys the Art Series Hotel Group]

Resorts delivered revenue of $316.2 million and earnings before interest, tax, depreciation and amortisation of $45.6 million representing very strong increases on FY2016 (29.5% and 31.0% respectively).

The resorts segment benefitted from increased occupancy and average room rates, along with strong short term domestic and international travel demand and group demand from both corporate and Asian inbound markets.

CBD revenue increased by $5.1 million representing a year-on-year increase of 1.6%.

East said Mantra Group is well placed to continue to deliver profitable growth and shareholder value in FY2018 and beyond.

“Many markets are also experiencing favourable industry fundamentals, including strong inbound and domestic leisure demand, a growing corporate travel market and low supply growth.

“The Gold Coast region is also expected to significantly benefit from the Gold Coast 2018 Commonwealth Games next year.

“By contrast, we expect the markets that have slowed down in recent years, being Perth, Brisbane and Darwin, to continue to experience difficult trading conditions in FY2018.”