Market Outlook: What Developers Can Expect for 2018

The development market has undergone some significant shifts over the past 12 months, and 2018 is expected to see these changes solidify with constraints on liquidity and changing buyer demographics becoming the norm over the next 12 months.

Although growth figures may appear to be slowing (with the three months to December 2017 seeing a 0.3 per cent fall in national dwelling values), the 2018 market will likely begin evening out from the unsustainable growth period of the last three years.

Coming in to 2018, developers can expect similar market conditions to what was experienced in Q3-4 2017 – specifically more run-on effects from the APRA constraints and stable interest rates (with the RBA’s cash rate to remain in the proximity of 1.5%).

However, the market is likely to be impacted by shifting buyer demographics and limited geographic oversupplies.

APRA Constraints

In March 2017 the APRA macro-prudential measures came into full force tightening lending on "riskier" projects, and left the development industry to figure out how to fund their projects – and 2018 is going to play out in much the same way.

Throughout 2018, we can expect APRA to continue constraining liquidity, and developers who are accustomed to borrowing 80 per cent with 20 per cent equity are going to feel these constraints the most. Typically, developers are going to need more equity with the APRA regulations – which means they’re likely to be down to 60 per cent borrowing capacity.

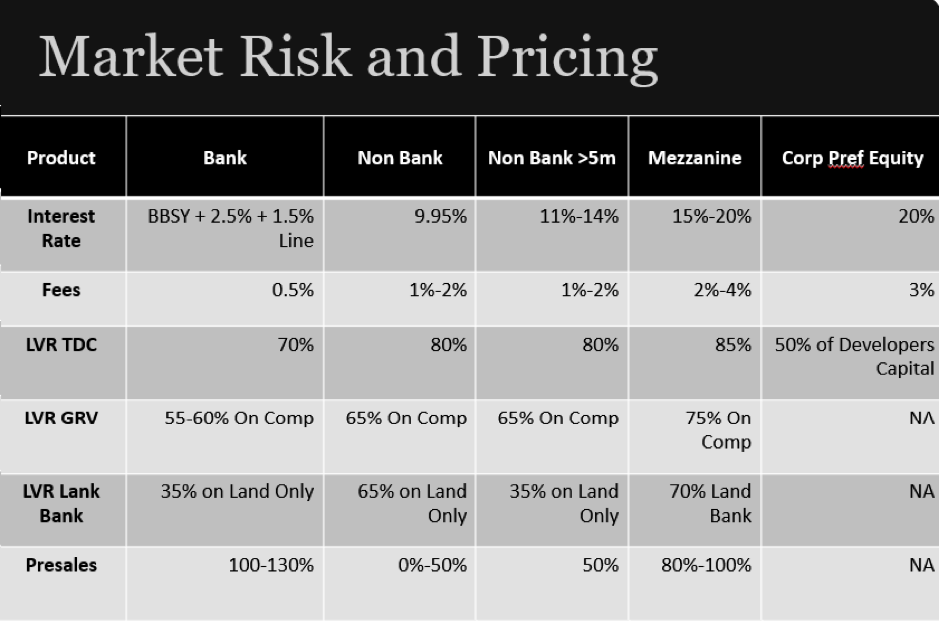

A common breakdown of market risk and pricing for developers’ finance options in this market will look similar to this:

Developers are quick to lash out at banks for their new lending policies, however it is not the banks that are to blame – they’re just adhering to the APRA constraints. Banks will also see some more regulations come into play as the proposed BASEL IV guidelines may further alter the banks approach to risk-weighted assets.

These regulatory changes will see a lot of secondary development funders emerge, and developers will continue to seek out alternative finance options for their projects in 2018 – such as joint ventures, mezzanine lenders or private funds – to ensure their project gets to market.

The APRA constraints are going to take some of the steam out of corporate developers, however it is the smaller, independent developers (that are generally borrowing up to 80% with equity) that will need to amend their financial processes throughout the year to ensure they maintain their viability under the tougher lending criteria.

Hot Spots

As with any market outlook for the residential property market, people are searching for the next "hot spots", and 2018 will definitely provide certain pockets with high growth and rental yields for developers to capitalise on.

Where these hot spots are located is going to be determined by whether the area has a relatively strong economy, strong migration levels and a relatively low available housing stock – and developers should be looking for geographic areas that meet all of these criteria.

The industry must also bear in mind that there are geographical oversupplies where developers may see further compressions on rental yields – and vacancy taxes (like what we are seeing in Victoria with the Vacant Residential Property Tax) may begin having a severe impact on developers trying to push investor stock in oversaturated markets.

In Victoria alone the Vacant Residential Property Tax (VRPT) is a 1 per cent tax on the capital improved value of the taxable property, and is expected to raise approximately $80 million for the government in a bid to free up currently vacant properties and lower average rental prices.

But, on the opposite side of the spectrum, developers should bear in mind that rental rates did increase by 2.7 per cent nationally over the 12 months to December 2017 – showing that there is still growth in the market. Combined capital city rents are 2.6 per cent higher, and combined regional market rents are up 3.0 per cent – showing us that developers, when they focus on delivering the right stock to the right demographic, can be extremely successful in this coming market.

Buyer Demographics

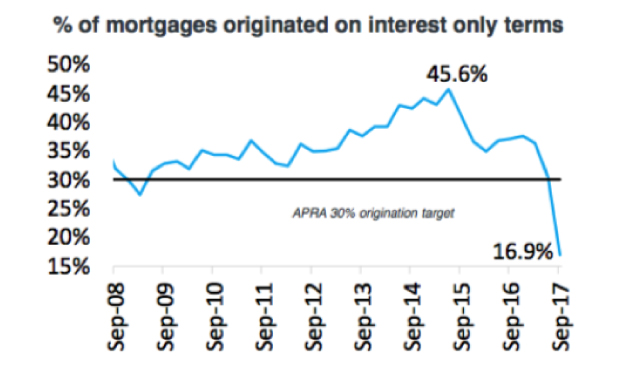

Buyer demographics are expected to continue shifting toward cash based buyers (baby boomers or those sitting on large windfalls) as interest-only lending reaches an all-time low at 16.9 per cent in the September 2017 quarter.

This is the lowest quarterly value of new originations since the March 2009 quarter – showing us that buyers are now taking a more prudent approach to purchasing and investing.

Owner-occupiers and first home buyers are the growing demographic of buyers to watch, and they now take up close to 40 per cent of the market. The number of first home buyer housing finance commitments is now the greatest since December 2009 (accounting for 18% of all owner occupier finance commitments) due to reduced associated costs like stamp duty.

Alongside the first home buyer, another demographic that can’t be ignored is the baby boomers (those aged around 55 – 64).

According to McCrindle research, the average Australian household aged over 55 have a net worth exceeding $1 million, and due to rising property prices over the last few years they are also seeing the fastest wealth increases of any demographic in Australia.

Alongside their primary residence, baby boomers’ parents are now beginning to transfer their net wealth to their children – giving the baby boomer demographic an even larger boost in cash/net wealth to draw upon when purchasing property.

Another demographic to keep an eye on for 2018 is the 2+1: two young executives with a baby. These buyers are looking to take advantage of stamp duty savings as first home buyers, and they want houses with a bit of space while still remaining affordable. This demographic is generally what’s pushing growth in house and land packages in outer suburbs.

So, this shows us who developers should be targeting, but what buyers shouldn’t developers be thinking about?

Generally, developers should avoid targeting foreign investors (specifically the Chinese market with Chinese capital restraints heavily slowing this buyer segment) and self-managed super fund investors – since these buyer groups have the most barriers to enter the market and represent only a small segment of buyers.

According to CoreLogic research, investors on variable mortgage rates are now starting to pay 60 basis points more than owner occupiers (with higher premiums for interest-only loans) – which is a significant contributor to the slowing investor market.

Interest Rates

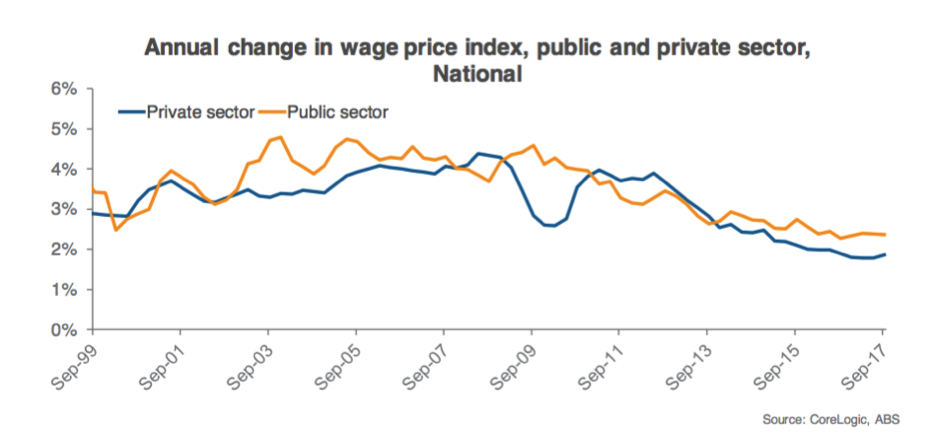

Coming into 2018, it appears interest rates are going to remain steady with the RBA’s cash rate set to stay near 1.5 per cent for at least the next 12-18 months. This is in line with the lack of growth (with inflation stubbornly remaining below 2%), and the lack of wage growth (at only 2.0% over the 12 months to September 2017).

With wage growth remaining slow (only 0.1% away from the historic low of 1.9%), it doesn’t make sense for there to be a rise in interest rates. Especially when a 5 per cent increase in interest rates amounts to a 25 per cent increase in mortgage repayments – heavily impacting household cash flow across the board.

Looking at the macro-prudential guidelines it’s clear to see that we’re not in bad shape economically, but we’re not in great shape either. Businesses are increasing their profitability (with the Australian economy growing by 0.8% over the second quarter of 2017) but they seem to be spending the majority of their extra cash on automation and processes instead of increasing wages. Making it seem clear that interest rates aren’t going to move much over the course of 2018.

The ‘Bubble’

The "housing bubble" is the buzz word the media is throwing around when it comes to the residential market, but don’t let the sensationalist headlines fool you into believing the "doomsday" is upon us in 2018.

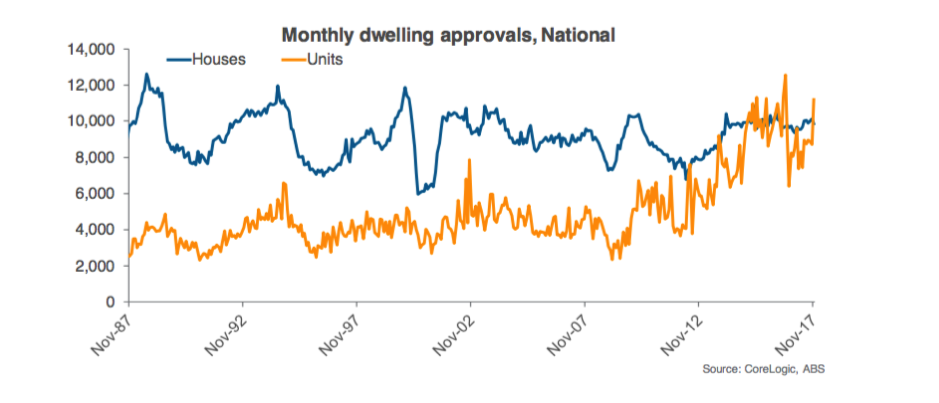

You can read more of our in-depth thoughts on the "bubble" here. But, economically speaking, there can’t actually be a property bubble – we simply don’t approve enough dwellings nationally to create the large bubbles that the media is hyping.

Instead, in 2018 we may begin to see smaller geographical bubbles occur where there is a systemic oversupply of stock in an area that is seeing low interest. These bubbles are likely to only have a microeconomic impact.

There is also an increased infrastructure spend that is helping connect new suburbs to large city centres.

Leppington (approximately 50km southwest of Sydney’s CBD) is one example of this, where the government has invested in a train line, local amenities and schools (an investment in excess of $1.8 billion) to help ensure the location is ripe for growth (especially with the 2+1 demographic discussed above).

This is mitigating the risk of an over-hyped macro housing/property bubble, and providing more opportunity for buyers to come in at entry.

What Developers Should Do

Based on the economic and financial outlook for 2018, developers need to shift their thinking toward catering for baby boomers, first home buyers and other owner occupiers. The mentality of building projects and assuming buyers will come is not going to be a successful strategy for 2018.

The best thing that developers can do in 2018 is move away from investor stock and begin thinking about how to create unique and different projects that will appeal to both future buyers and financial lenders.

Not a lot of banks are looking to lend for development sites – given that they’re concerned about the stock coming online in approximately 2 years – but that doesn’t mean that developers have no options. Financing is available for developers, but they just need to ensure that their project is positioned correctly to be successful in this shifting market.

Draw inspiration from developers that are offering spacious, high-quality apartments that are catering for the demands of the baby boomers and owner-occupiers as a benchmark of success. Also, look at locations that are still experiencing positive growth, and vehemently avoid any areas that are experiencing a geographical oversupply.

Although we may be seeing growth even out in 2018, the market is still strong and developers with the right approach and the right financing can still capitalise on the market conditions.

The Urban Developer is proud to partner with Development Finance Partners to deliver this article to you. In doing so, we can continue to publish our free daily news, information, insights and opinion to you, our valued readers.

For more on DFP visit their website.