Institutional investors are targeting Australia’s booming student accommodation sector, saying it remains a strong hedge against the country’s stubbornly persistent inflation.

Commercial real estate investment manager MaxCap Group believes Purpose-Built Student Accommodation (PBSA) remains one of the best drivers of income growth among trading assets.

Speaking at The Urban Developer’s roundtable in Melbourne recently, MaxCap’s head of direct investment Simon Hulett told industry leaders the fundamentals behind student accommodation were quite different from a lot of other commercial real estate.

“It’s a path we are heading down,” he said, “because when we analyse the market sector we see the best of real estate inflationary hedges combined with underlying income growth forecasts.”

Oxford Economics, the global economic forecaster, reports net overseas migration reached about 490,000 in the 12 months to December last year, as international students and backpackers returned to Australia after two years of border closures.

Economist Michael Dyer said that despite a general settling from that level, net overseas migration is forecast to remain above 250,000 until at least the end of 2026.

Dyer said overseas policy changes had helped accelerate the return of international students, particularly those from China.

In a surprise edict by Chinese education officials in Beijing in January last year, students were told they had to return to on-campus, face-to-face learning if their foreign education credentials were to be recognised back in China.

And that has meant demand for student accommodation remains unmet, with an accompanying sharp rise in rents.

A series of reports from CBRE and KPMG has highlighted the extent of the problem, with CBRE’s research finding that 8000 purpose-built student accommodation (PBSA) rooms will be delivered across Australia between 2023 and 2026.

While this may be a 7 per cent uplift, it is far less than individual global cities, such as Paris, which is expecting 18,000 rooms, and London with a projected 15,000 rooms for the same period.

“After holding flat during the pandemic, rents are lifting as the majority of PBSA buildings operate at or near full occupancy,” Dyer said.

“Our tracking of advertised rents across the major providers indicates they have risen 27 per cent from their pre-Covid levels nationally.”

He said Brisbane led the growth, with Melbourne recording the lowest rate of growth of the three major capital cities, likely reflecting the city’s bigger stock of beds.

That rental growth is part of the appeal for MaxCap.

“We see the sector’s ability to be able to regularly reset rents, whilst maintaining high occupancy rates, as being highly advantageous” Hulett told the round-table meeting.

“The sector is unique in the fact it is underpinned by Australia’s globally recognised higher education sector and provides a dynamic income profile that investors are looking for.”

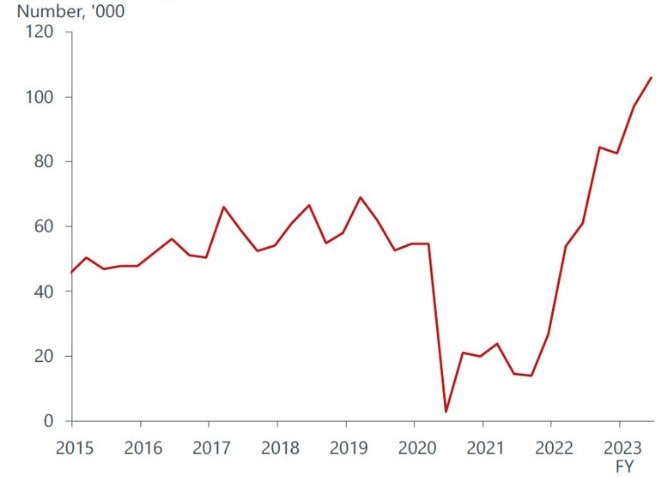

Student visas granted outside Australia

In October last year MaxCap announced it had teamed up with Australian Unity and student accommodation operator UniLodge, with plans to develop a $1-billion portfolio of student facilities.

The partnership began with a site at Wellington Street, Perth, that will deliver 732 beds in a $108 million tower, near Edith Cowan University’s new city campus.

Australian Unity previously partnered with UniLodge—the country’s biggest operator of student accommodation—in 2021 to create the 695-bed Lady Lamington student accommodation buildings at Herston Quarter in inner Brisbane.

Australian Unity’s executive general manager—social infrastructure, Ryan Banting said the driver behind that decision was local area economics, with a product that was purpose designed, and built, to appeal to a particular subset of the student market.

“We acknowledge that education ranks fourth in terms of economic importance to Australia, accounting for around 6 per cent of our exports, and meeting this need with purpose-designed, timely delivered assets is key to a successful development,” he told the group.

“Early procurement and a bias not to be as reliant on offshore supply chains is important for our development decision-making.

“When engaging with the construction market we’re looking for builders that are able to demonstrate efficient procurement, or guarantee supply, as a way to deliver assets according to program.”

Australian Unity, MaxCap and UniLodge are not the only partnership eyeing strong demand for student accommodation.

In June last year the multi-national construction and real estate giant Lendlease unveiled plans for the urban renewal project at Queen Victoria Markets, in Melbourne.

That will include a 28-storey commercial building, 560 build-to-rent apartments with an affordable housing element, and an 1100-bed student accommodation building to be developed by PBSA provider Scape.

While the bulk of the new student beds are being developed by private operators, Oxford Economics’ Dyer said there were signs universities were also gradually returning to the market.

Eight months ago, the University of NSW announced it was partnering with Iglu to develop 1066 apartments across five buildings on 1ha of university-owned land across the road from its Kensington campus in Sydney.

MaxCap’s Hulett said, “Persistent demand is outpacing supply and is doing so in a fragmented sector that has been under-represented by institutional investment over previous cycles. That is where our opportunity lies”.