Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

SubscribeMelbourne’s CBD office market is in free-fall, recording its largest drop in demand for space on record, according to the Property Council of Australia.

Melbourne’s CBD office vacancy rate has increased to 10.4 per cent, which Property Council chief executive Ken Morrison said was concerning especially with new supply in the pipeline.

“Demand for space in the Melbourne CBD dropped by more than twice as much as its previous largest six-monthly fall on record,” Morrison said.

“As a result, vacancy in Melbourne CBD increased to 10.4 per cent, which also has some 220,000sq m of new supply coming online over the next six months.”

According to the Property Council’s Office Market report the net absorption of CBD office space in Melbourne was -96,635 square metres.

CBRE’s head of office leasing in Victoria Ashley Buller said the number of enquiries compared to the same time last year was up 40 per cent, with about three-quarters from tenants seeking less than 1000 square metres.

“More than 140,000sqm of 1000sq m [or more] leases have been completed in the CBD since the start of the year,” Buller said.

“This is a significant improvement on last year, and demonstrates larger tenants are back in the market and finalising lease commitments.”

Buller said Medibank and Australia Post had signed big leasing commitments in the Melbourne CBD but it was government and government-associated tenants who had been the most active in the market.

Buller said face rents had “held up relatively well” and incentives were expected to level out.

Savills state director for Victoria’s office leasing Mark Rasmussen said there continued to be steady enquiry in the Melbourne market despite a 25 per cent occupancy cap and multiple lockdowns.

“A significant proportion of the market are catering for work from home models however others including IT and some professional services are expanding their office requirements,” Rasmussen said.

“Demand is strong for fitted tenancies and well-presented accommodation … tenants are taking advantage of the current conditions and upgrading to higher office grades to attract the best and brightest staff.

“We expect inquiry levels to improve to cater for pent up demand after lockdown.”

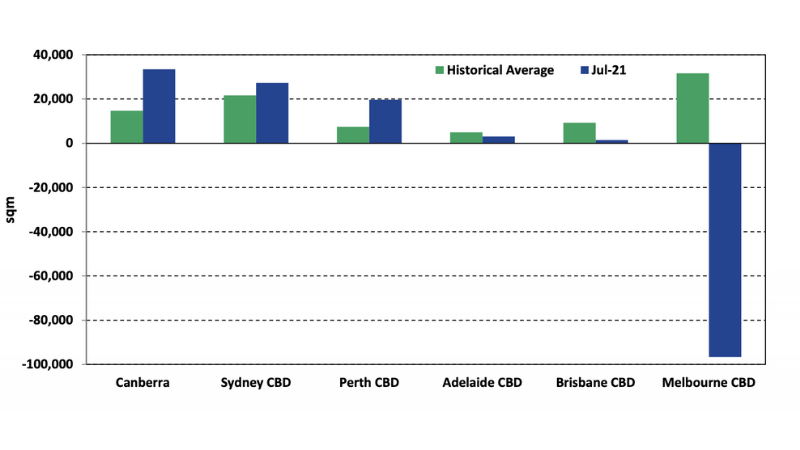

Net CBD absorption to July 2021

^ Melbourne recorded a negative net absorption of -96,635 square metres. Source: Property Council of Australia.

Elsewhere the market outlook was not as bleak, with most Australian capital city office markets continuing to show resilience with a small increase from 11.1 to 11.2 per cent, despite the impacts of Covid-19 and lockdowns.

Morrison said Australia’s aggregate vacancy rate for all office markets had increased only slightly from 11.6 per cent to 11.9 per cent over the six month period to July 2021.

Net absorption over the six month period was 11,742 sq m, which was low compared to the historical average of 147,051 square metres.

“Australia’s office markets have shown remarkable resilience over the past six months, with overall aggregate vacancy levels only increasing slightly,” Morrison said.

“Excluding Melbourne, demand for CBD office space grew by 85,000sq m over the six months, a result that few would have predicted given the impacts of the pandemic.

“While Sydney was the only other CBD market to experience an increase in vacancy, this was the result of a significant amount of new office space coming online – demand actually grew by 27,000 square metres.

“Vacancy in other capital cities all declined: Brisbane to 13.5 per cent, Perth to 16.8 per cent, Adelaide to 15.7 per cent and Canberra to 7.7 per cent.”

Morrison called on governments to do more to encourage the recovery of Australia’s city centres to underpin the economy.

Savills national head of office leasing Graham Postma said the negative effects of lockdowns were decreasing as it became the “new normal”.

Postma said there had been increased activity in the “spec fit-out” market, particularly in small- to medium businesses.

“Occupiers are moving towards making strategic longer term decisions, which will continue to see the office as the dominant and critical workplace,” Postma said.

“We anticipate post lockdowns business sentiment will continue to improve and many employees suffering from work from home fatigue will actively look for and embrace the opportunity to return to the CBDs around the country.”