Resources

Newsletter

Stay up to date and with the latest news, projects, deals and features.

Subscribe

Industrial sector heavy-hitters have issued a stark warning to governments, saying a chronic undersupply of zoned industrial land across greater Melbourne risked serious consequences for the state’s logistics and supply chain.

The warning comes after the Property Council of Australia released research—commissioned from town planners Urbis—which shows there is only four years supply of industrial-zoned land remaining in metropolitan Melbourne.

The Urbis research—its first into the sector since 2018—indicates the city’s south-eastern region has as little as one year’s land supply available for industrial development, and concludes that in some areas industrial development has already reached the limits of the so-called Urban Growth Boundary.

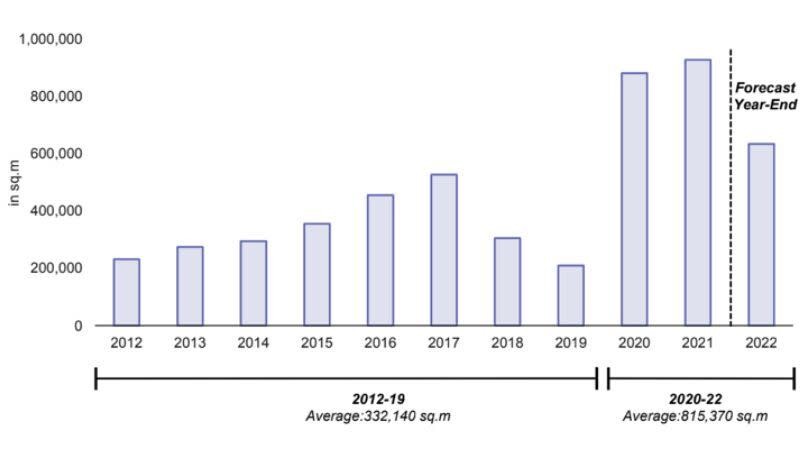

Yet, the warnings come after a record 2.2 million square metres of new developments were added to various industrial corridors of Melbourne between 2020 and 2022.

The council’s Victorian executive director Cath Evans told about 300 members in Melbourne the lack of future industrial land would make it difficult to provide enough jobs to meet the demands of the city’s rapidly growing population.

“Without immediate action to release more land for industrial development, the cost of land and occupier rents will continue to grow rapidly, with many costs unavoidably passed on to the end consumer,” Evans said.

“At the same time, our state risks missing out on further job creation in key growth sectors, and relocation risks will increase due to businesses’ increasing difficulties in finding suitable sites in Melbourne.

She said the council was eager to work with the Victorian government to unlock suitable land, especially in key industrial corridors in the west and south-east of Melbourne.

“This is more than a property issue—this is an economic issue that requires important government leadership to ensure Victoria’s reputation as a great place to do business is maintained,” Evans said.

Charter Hall chief investment officer Sean McMahon said the shortage had led to a national industrial vacancy rate of just 0.6 per cent, well below the rest of the World.

“So we’re chronically under supplied,” he said in a keynote address.

“And if you take a number like 5 per cent as equilibrium—and since there is 100 billion square meters in Australia— that’s five billion square meters of space that’s got to be incrementally created besides that which is coming through at the moment to service demand.

“So it is very likely that we're going to be in this under-supply environment for quite a number of years to come.”

CBRE head of industrial and logistics research Sass J Baleh has been warning for almost 12 months the lack of zoned industrial land was driving up rents across those properties that already exist.

“We’ve seen record rent growth across the country,” she said.

“In Sydney and Perth, the rental growth figures for last year were close to 40 per cent year-on-year as an average,” Baleh said. “And not surprisingly they have the lowest vacancy rate in Australia.”

The researcher said the Melbourne vacancy rate had dipped in the past 18 months and was now sitting at about one per cent.

“We've started to see rent growth in Melbourne of 20 per cent, so it is still very, very strong but not as strong as Sydney and Perth. And this year we do believe we'll see, if not double-digit growth in Melbourne, at least high single-digit rent growth.”

Victoria’s industrial development pipeline

LOGOS Group’s head of Australia and New Zealand Darren Searle warned rents could not keep increasing.

“At some point the chief financial officers around this country are going to say, pause. They’ll say what are we going to do about evolving and making our businesses more efficient,” Searle said.

“I don’t think we’re quite there yet.

“But rent growth will continue in Victoria until such time as we undo some of that supply side,” he said. “And the challenge for government is to start unlocking that land, unlocking the services so as to enable more products coming into the market.”

AustralianSuper’s investment director Natasha French was more blunt.

“Government and authorities need to understand what it takes to, not only acquire, but deliver industrial supply at scale to the market,"she told The Urban Developer.

“The challenge is how planning or services authorities work together to zone land and then connect or supply services. Then what planning overlays exist or can change, especially near residential areas.

"A number of occupiers require 24-hour access to operate, so there needs to be consideration given to how to deal with the supporting infrastructure and truck movements," French said.

"From an occupier perspective looking for efficiencies, they cannot build those distribution networks unless there's an understanding of how to deliver goods or logistics in a cost-effective manner.”

The investment director remains cautious about investments in the industrial sector.

She would only say AustralianSuper—the biggest superannuation fund in the country and the 19th biggest fund in the world—has investments in the industrial sector of “billions of dollars”.

“I think one of the things that is really hard for us when looking at acquisitions, is to invest when there's not a clear timeframe around the delivery of authority services and planning outcomes,” she said.

“We will always have a cautious outlook to our investments, regardless of whether the asset class is showing strong fundamentals.

“And so what we would hope is that the authorities facilitate the speedy delivery of those services or planning outcomes because what you want is economic investment, industrial land supply, and the resulting jobs and employment from those occupier facilities being developed.”

McMahon said the sector had to continue to educate and work collaboratively with all levels of government.

“There'’ no point in sort of bashing each other,” he said. “I don’t think that works. But we definitely have to work collaboratively.

“And it’s not just the zoned land. If the services and infrastructure aren’t there to meet the requirements, be it customers of tenants, then it’s a bit of a false dichotomy.

“I think we already see that change where the industrial logistics sector could be bigger than retail.

“I think you might see industrial being the biggest traditional sector asset class in Australia in the next 10 or 15 years.”