Melbourne Takes Sydney’s Spot as Nation's Weakest Performing Housing Market

Regional markets are outperforming capital cities, the market for expensive properties has tumbled and the previously top performing regions are now the among the weakest, according to the May Corelogic Home Value Results report.

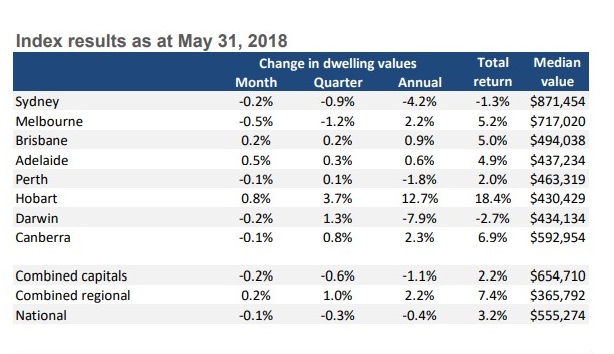

Melbourne has taken Sydney’s place as the nation’s weakest performing capital city for the three months to May 2018 with a 1.2 per cent decrease, the largest decline seen in the Victorian capital city for dwelling values over a three-month period since February 2012.

The nation’s dwelling values slipped 0.1 per cent lower in May, taking the annual change (0.4 per cent) into negative territory for the first time since 2012.

Related reading: Apartment Approvals Fell 11.5% Last Month

The negative growth rate is a sign of waning housing conditions across the capital cities, explains Corelogic head of research Tim Lawless, being led by Melbourne and Sydney.

“Sydney and Melbourne comprise approximately 60 per cent of Australia’s housing market by value, and 40 per cent by number, so the performance of these two cities has a larger effect on the headline market performance.”

Hobart was highlighted as the best performing capital city with a 3.7 per cent increase over the three months to May and 12.7 per cent higher year-on-year.

While, the top end’s Darwin has the highest rental yield for the same period, at 5.8 per cent.

Perth and Darwin recorded subtle falls in dwelling values, in positive news for both cities dwelling values were up over the same period, in a sign that conditions may be levelling out for what has been trying markets in recent years for both cities.

The report shows the annual rate of decline across Perth, at -1.2 per cent, the smallest annual fall in two years.

Related reading: HSBC Cuts Forecast for Sydney and Melbourne Housing Prices

Regional market strength

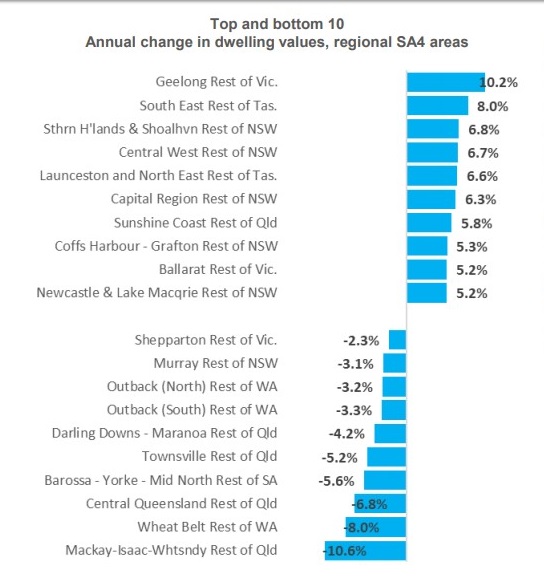

Across the top ten performing regional markets is a mix of satellite cities such as Geelong –with dwelling values up 10.2 per cent over the past twelve months – Ballarat and Newcastle, as well as the Sunshine Coast, Southern Highlands, Shoalhaven and Coffs Harbour.

The report says regional housing trends are also now seeing less drag from the mining regions.

Lawless believes the housing market is moving through a carefully managed slowdown due to tighter credit policies, particularly for investors.

“The concentration of investment activity has been heavily skewed towards Sydney and Melbourne, and it’s these cities where market demand has fallen the most. Subsequently both cities have experienced more substantial declines in property values,” he said.

While housing market conditions have dampened, Lawless believes values aren’t falling off a cliff any time soon.

“Low mortgage rates are likely to persist for some time yet, and we’re seeing high migration rates supporting housing demand.

Lawless says the falling home values will help affordability for many burdened in the previously ‘hot’ Sydney and Melbourne markets.

“While housing credit growth has slowed, the trends remain positive, especially for owner occupiers where housing credit is up eight per cent. We certainly don’t see dwelling values declining significantly.”