Property Values Have Halved in These Towns Since 2008

Australia's resource-rich outback towns once lured a flock of investors attracted to premium rental yields and rising real estate values amid the nation's mining boom.

But a decade on, many have since discovered there was no gold at the end of the mining town real estate rush.

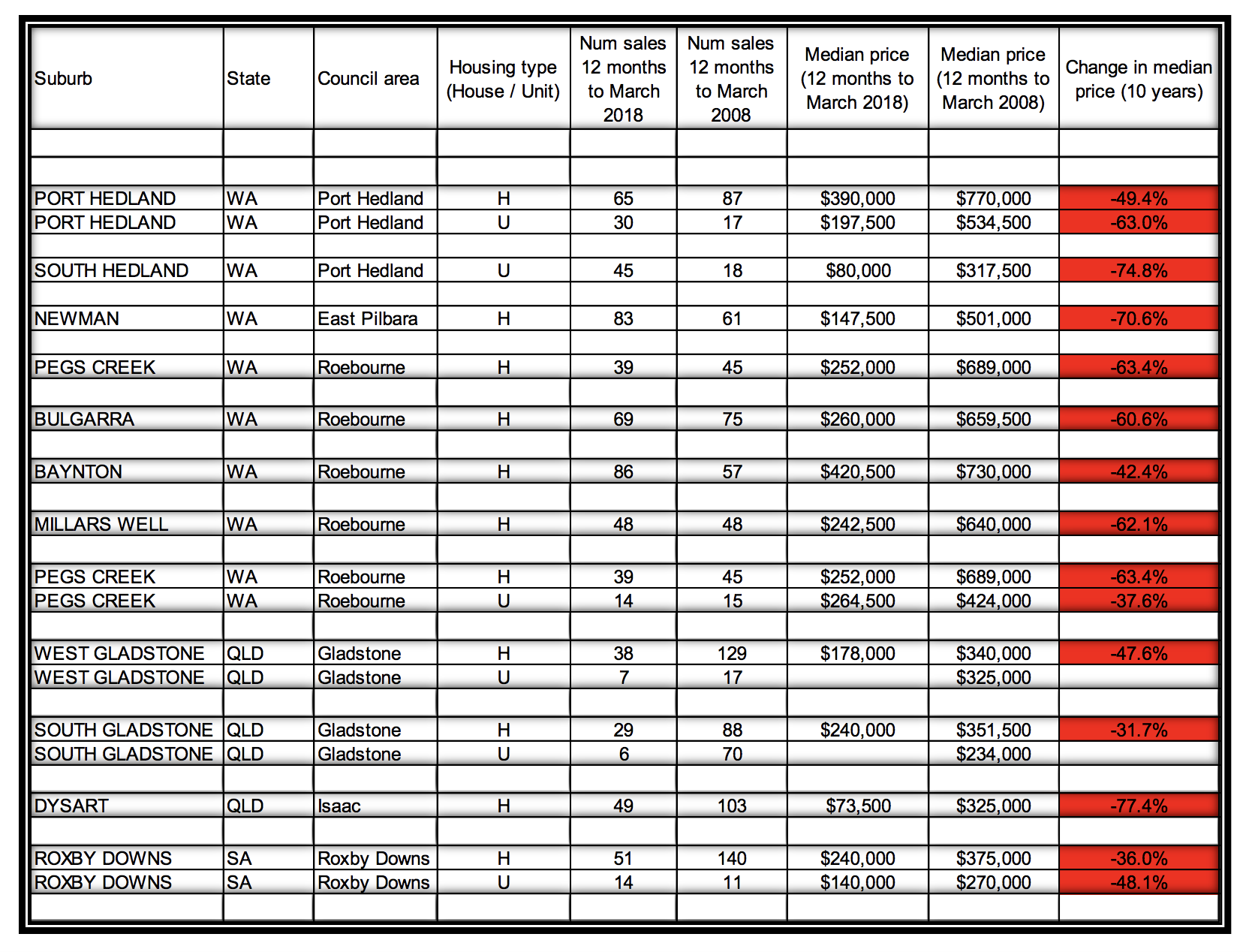

New research shows property prices in many of Australia's mining regions have in fact halved since 2008.

Using CoreLogic data to calculate the best and worst performing areas over the past 10 years, Property Investment Professionals of Australia (PIPA) chairman Peter Koulizos says mining towns consistently placed at the bottom of the findings.

“What this data shows us is that if you had bought property in one of these towns, not only did your property not increase in value over this 10-year period, but it is actually worth less,” Koulizos said.

Related: Coal Mining Giant Pembroke Buys Queensland Cattle Stations for $50m

Western Australia dominates the list of poor performers.

“The worst is South Hedland, a suburb in Port Hedland, where house prices fell a whopping 74.8 per cent,” Koulizos said.

Queensland mining towns have also suffered.

Koulizos says Gladstone was once peddled as a place to invest by property spruikers.

“South Gladstone house prices fell by 31.7 per cent and West Gladstone house prices fell by 47.6 per cent over that time period,” he said.

However, these two suburbs were not the worst performers.

“Property prices in the mining town of Dysart fell a whopping 77.4 per cent, while at the same time Brisbane house prices increased by 24 per cent.”

Related: PIPA Reveals Next Suburbs Set to Gentrify

While the nation's property market is currently facing its own downswing, Koulizos believes buying property outside of capital cities still makes financial sense.

“The moral of the story is successful property investment is about long-term economic fundamentals, not supposed short-term financial gains.

“And that usually means investing in locations with diverse, multi-faceted economies, not areas that financially ebb and flow depending on the strength, or weakness, of a single industry.”