Profits Fall for Mirvac as Property Cools

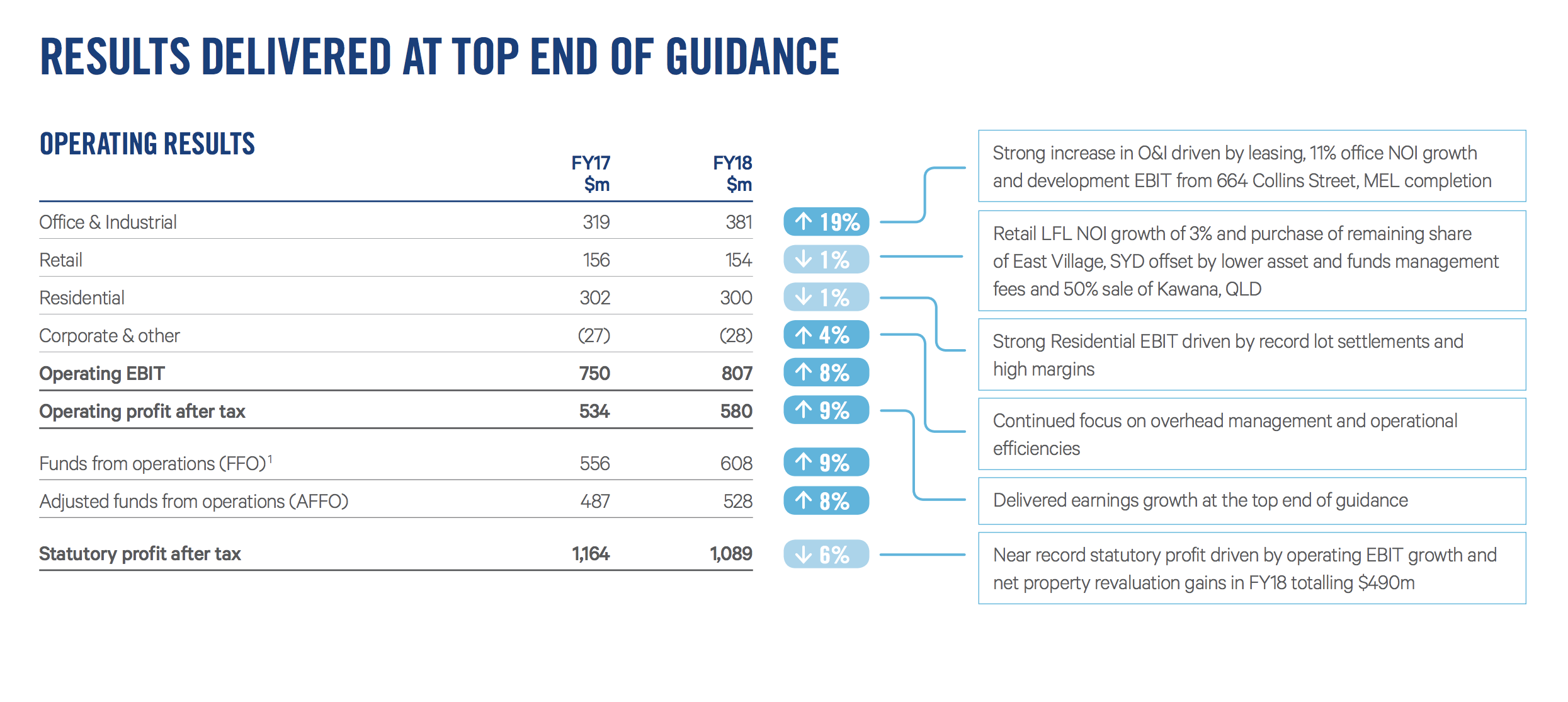

ASX-listed Mirvac reported a net profit of $1.09 billion for the 12 months through to June, with softening residential conditions triggering a 6 per cent fall in net profit for the development giant.

Total revenue was down 7 per cent to $2.8 billion from $3.02 the previous year.

While its announcement reveals Mirvac’s residential sector and retail sector may have slowed, the property giant’s industrial and office strength bolstered its earnings for the financial year.

Mirvac tightened its earnings guidance to 15.6 cents per stapled security, representing an 8 per cent growth increase over the year.

Related: Mirvac Defies Residential Downturn, Affirms Top End Forecast

Office

Mirvac's office portfolio comprises 59 per cent of the company's property portfolio.

Mirvac has a heavy concentration of office space in Sydney (58 per cent) and Melbourne (26 per cent) with a weighted average lease expiry of 6.6 years.

Residential

A slowing residential property market thanks to tighter lending conditions saw Mirvac’s residential development revenues drop to $1.2 billion this year from $1.4 billion.

Mirvac chief executive Susan Lloyd-Hurwitz said this was expected after reaching a target of 3400 residential lot settlements during the financial year.

"And we delivered a return on invested capital of 18.1 per cent."

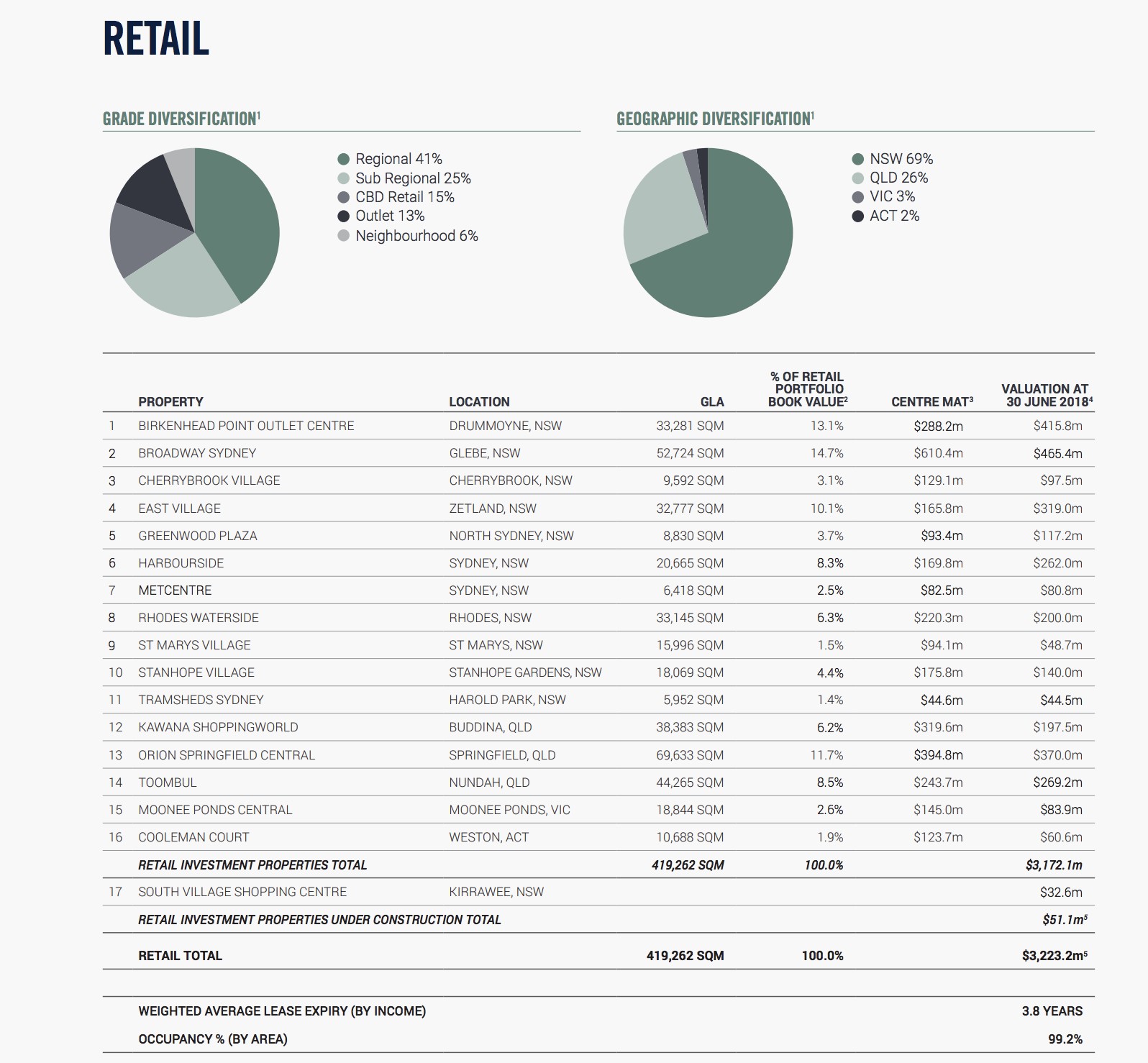

Retail

Retail makes up 33 per cent of Mirvac’s property portfolio.

Mirvac's Retail performance for the 2018 financial year ended with operating earnings before interest and tax of $154 million.

Its retail portfolio is 99.2 per cent occupied with a heavy 69 per cent of its portfolio located in metropolitan Sydney.

Industrial

Mirvac’s industrial component is 100 per cent concentrated in Sydney and comprises eight per cent of its property portfolio.

The total valuation for this sector came back at $809.1 million in June.

Mirvac's industrial segment is 100 per cent occupied with a weighted average lease expiry of 7.1 years.

Hero image: Mirvac’s $800 million 80 Ann Street Brisbane CBD tower recently secured Brisbane's largest leasing deal in more than a decade.