More Sales Than Listings in Residential Market

Dwelling sales continue to surge across Australia against low listings levels. In the three months to July, Corelogic estimates there were around 171,100 sales.

This was 53.4 per cent higher than what has typically been seen this time of year for the previous five years.In the same period, there were just 121,200 newly advertised properties for sale in the three months to July.

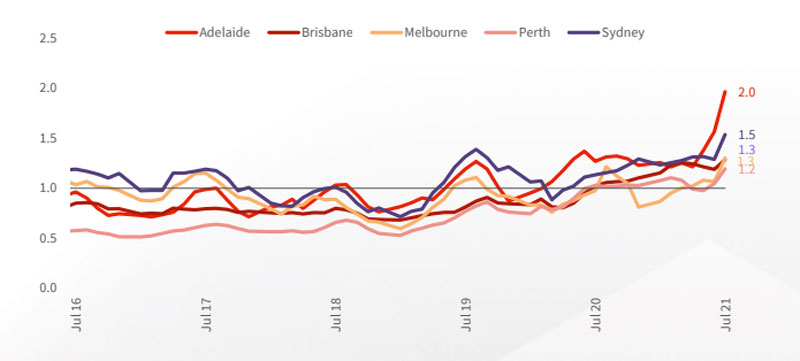

This has taken the sales to new listings ratio to recent highs nationally, at 1.4 over the three months to July.

The sales to new listings ratio is calculated by dividing the number of sales that have taken place over a given period by the number of new listings added to the market over the same time.

For the past decade, the ratio has averaged 0.9, suggesting for each listing added to market there was just under one transaction that took place.

When the ratio is 1, it implies buyer demand and advertised supply is balanced.

A sales to new listings ratio of 1.4 suggests strong selling conditions, as there is more than one transaction taking place for every new unit of supply in the same period.

The sales to new listings ratio has averaged above 1 since June, 2020.

Dwelling sales to new listings ratio, national

^Source: Corelogic, rolling 3-month average excluding December due to excess volatility

Each of the capital city markets currently has a sales to new listings ratio of greater than 1, ranging from 2 in Adelaide, to 1.1 in Darwin.

Capital cities with imposed lockdown restrictions through July saw a particularly strong uplift in the ratio, which may be a result of a disproportionate number of vendors postponing the start of a selling campaign amid lockdowns.

Multiple factors can explain the surge in sales relative to low listings levels from mid-2020.

On the demand side, these factors include:

Low mortgage rates

Increased buyer demand has stemmed from continuously falling mortgage rates.

Despite concerns of an earlier-than-foreshadowed lift in mortgage rates, RBA data shows average new home loan rates for owner-occupiers fell 12 basis points through the first half of 2021 and 18 basis points for investors.

Mortgage rates are one of the most important determinants of housing demand and in the current climate, where GDP is once again expected to decline, the RBA will likely facilitate a low rate environment for longer.

A savings windfall

As social consumption declined through lockdowns, and household financial support was increased, household savings peaked at 22 per cent of household income in the June quarter of 2020, which was above the-then decade average of 7 per cent.

Combined with a range of incentives for home purchases introduced through 2020, increased savings levels may have bolstered borrower deposit levels, triggering additional sales since the onset of Covid-19.

Savings rates remained elevated at 11.6 per cent through the March quarter of 2021, which have supported sales volumes through the first half of this year.

Incentives for first home buyers

Last year saw the introduction of multiple first home buyer incentives, from the first home loan deposit scheme before the pandemic, to various state-based grants and concessions, along with incentives for the purchase or construction of new or off the plan property.

Dwelling sales to new listings ratio, capital cities

^Source: CoreLogic data is rolling 3-month average, excluding December due to excessive volatility

First home buyer purchases would go a long way in explaining the current supply and demand dynamic.

This is because owner-occupier purchasers who already own property would presumably list their existing home around the time they are purchasing a new one.

First home buyer activity, on the other hand, creates additional housing demand without adding new advertised stock to the market.

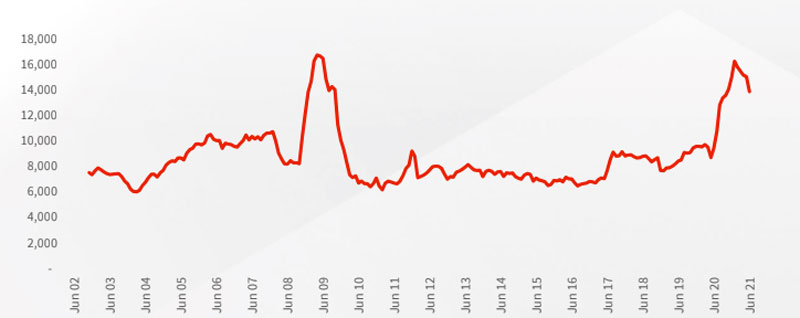

The chart below shows the volume of secured home loans for first home buyers, which shows an extreme uplift in first home buyer activity.

First home buyer loans recently peaked at 16,260 in January 2021, which is almost double the series average of monthly first home buyer loans secured (8731).

Though first home buyer loan commitments have since trended lower, they remained 58.8 per cent above the series average through June.

In the same way that first home buyer purchases increase demand without adding to supply, investor purchasing activity has also trended higher since mid-2020.

Unlike first home buyer activity, investor purchases are not slowing down.

Through June, there were 18,625 secured home loans for investor property purchases, which is a 74.8 per cent increase on commitments in the same month of 2020.

Number of FHB owner occupier loans secured monthly

^Source: ABS

On the supply side, new listings stock was persistently low through 2020, as a lack of mobility and extended lockdowns across Victoria saw fewer Australians list their home for sale.

Through 2021, new stock added to the market has actually hit levels that are on par with previous years.

In the four weeks ending July 4, Corelogic counted around 38,000 new listings added to the market nationally, which is actually higher than the five year average level.

However, recent lockdown conditions have seen new listing counts slip back below the historic average, with Sydney in particular recording a -17.3 per cent drop in new advertised stock during the past four weeks.

Part of the reason listings have remained low through lockdown conditions is the assistance offered to home owners seeing hardship through Covid-19.

Mortgage repayment deferrals and household income support have kept distressed sales from hitting the market, and have more broadly been a factor in keeping housing market conditions stable.

However, it has also contributed to a persistent seller’s market, which is reflected in the high sales to new listings ratio.

The ratio may ease in the coming months as advertised supply moves through the normal seasonal spring uplift and buyer demand is limited by extended lockdowns, and affordability constraints.