Rush to Refinance Drives Mortgage Activity

Mortgage activity is up 11 per cent on this time last year, driven by an uptick in refinancing as mortgage holders take advantage of record-low interest rates.

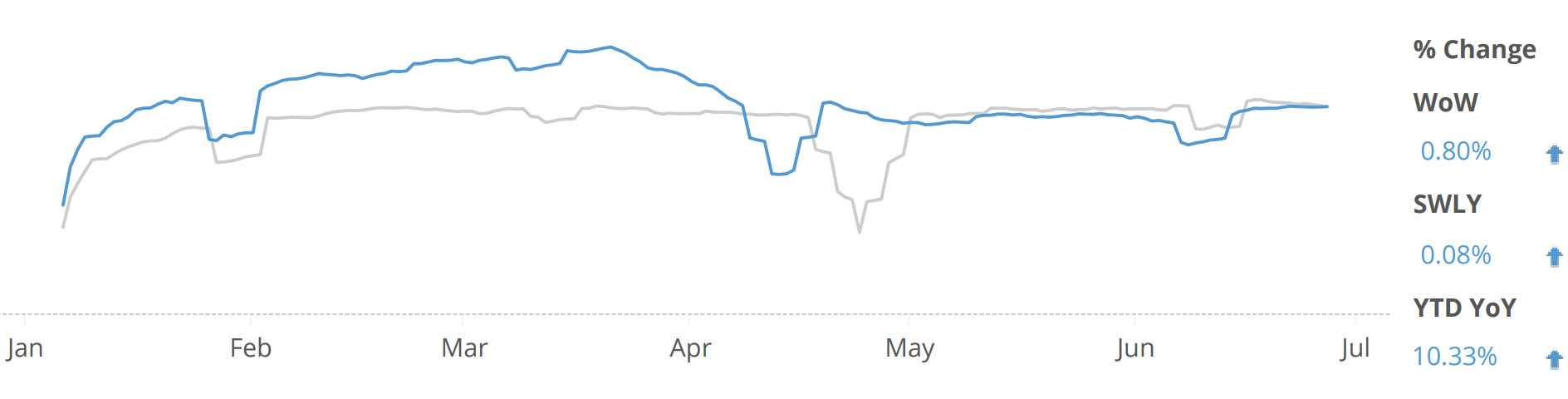

The high-frequency data, collected weekly by data provider Corelogic, revealed that at the end of June, mortgage financing had stabilised to be up 10.3 per cent on the same time last year.

Refinancing accounted for 68.4 per cent of all mortgage commitments, while new purchases made up 23 per cent—up 11 per cent on the same time last year.

This mildly positive result follows a dramatic fall in April which saw mortgage activity drop by 16.9 per cent in New South Wales and 13.8 per cent in Victoria compared to the previous month.

Following a dramatic dip in new stock of 4.9 per cent nationally during April, pre-listing activity also rebounded over June to be

15 per cent shy of the same time last year.

Mortgage Activity - 2020 vs 2019

^ Source: Corelogic

The lift in buyer confidence mirrors the ongoing improvement in seller confidence, with the number of auctions held across Australia hitting its highest level in nine weeks on the last weekend in June.

There were 1,424 homes with auction clearance rates holding reasonably firm under higher volumes, returning a clearance rate of 64.5 per cent.

Melbourne reported a preliminary auction clearance rate of 62.7 per cent last week, despite many of the 623 homes on offer pivoting from onsite to online auctions to accommodate the sudden spike in coronavirus cases.

There were 614 homes taken to auction in Sydney, returning a preliminary clearance rate of 66.9 per cent.

A total of 522 homes were taken to auction in the previous week, returning a final clearance rate of 61.6 per cent.

Brisbane recorded the highest number of auctions, with 84 homes going under the hammer, returning a preliminary clearance rate of 47.6 per cent, compared with 124 homes scheduled for auctions this time last year, with a clearance rate of only 32.4 per cent

Canberra’s run continued with a preliminary rate of 88.5 per cent from 34 auctions.

Banks begin three-month checks

Midway through June marked three months since deferred loans were first offered in response to coronavirus, initially to small business loans and then to mortgages.

According to Australian Banking Association data, 780,000 loans worth $237 billion have had repayments halted of which 485,063 are mortgages, worth $175 billion.

In coming weeks, prudential regulator APRA could be targeting new capital relief for struggling customers in what would be seen as placing a floor under falling house prices.

Banks are preparing to provide APRA with detailed data on deferred loans by the end of June, covering the months of April and May.

It is understood June data will then be reported at the end of July, and so on.

APRA chair Wayne Byres is due to address to the Trans-Tasman Business Circle roundtable lunch on 22 July, where the consideration of any additional capital relief could be potentially announced.

APRA is said to recognise that additional leniency would allow banks to be more comfortable with providing continued support for customers unable to recommence their repayments.