The Haves and the Have Nots: Mortgage Stress Hits these Areas Harder

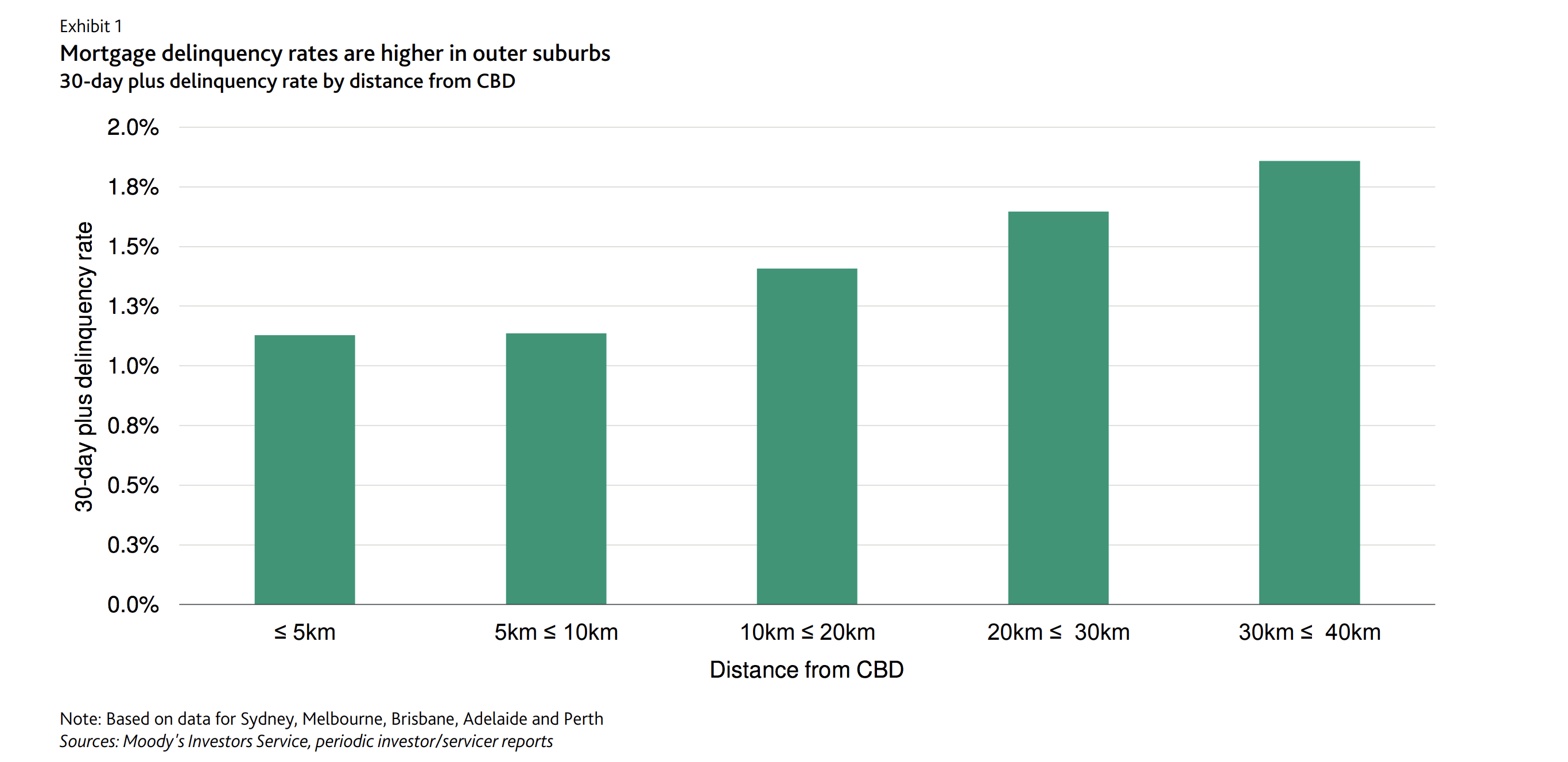

Across the country, mortgage delinquency rates are significantly higher in outer suburban areas in comparison to their inner-city counterparts, reveals a new report from Moody’s Investors Service.

While Australia’s current mortgage delinquency levels are low in comparison to historic levels, there are areas feeling the mortgage squeeze much harder.

On average across Australian cities, Moody’s associate managing director Ilya Serov says mortgage delinquency rates are lowest in areas within five kilometres of the CBD.

"And highest in areas 30-40 kilometres from CBDs,” Serov said.

Lower average incomes and weaker credit characteristics are acknowledged as factors increasing the likelihood of mortgage stress, especially if faced with an economic downturn.

In its October report, Pimco said it expects housing prices to continue to fall moderately by 10 per cent in the next couple of years, with mortgage serviceability expected to deteriorate due to rising mortgage rates.

Related: Escalating Costs, Construction Skills Shortage Lead Global Developer Concerns

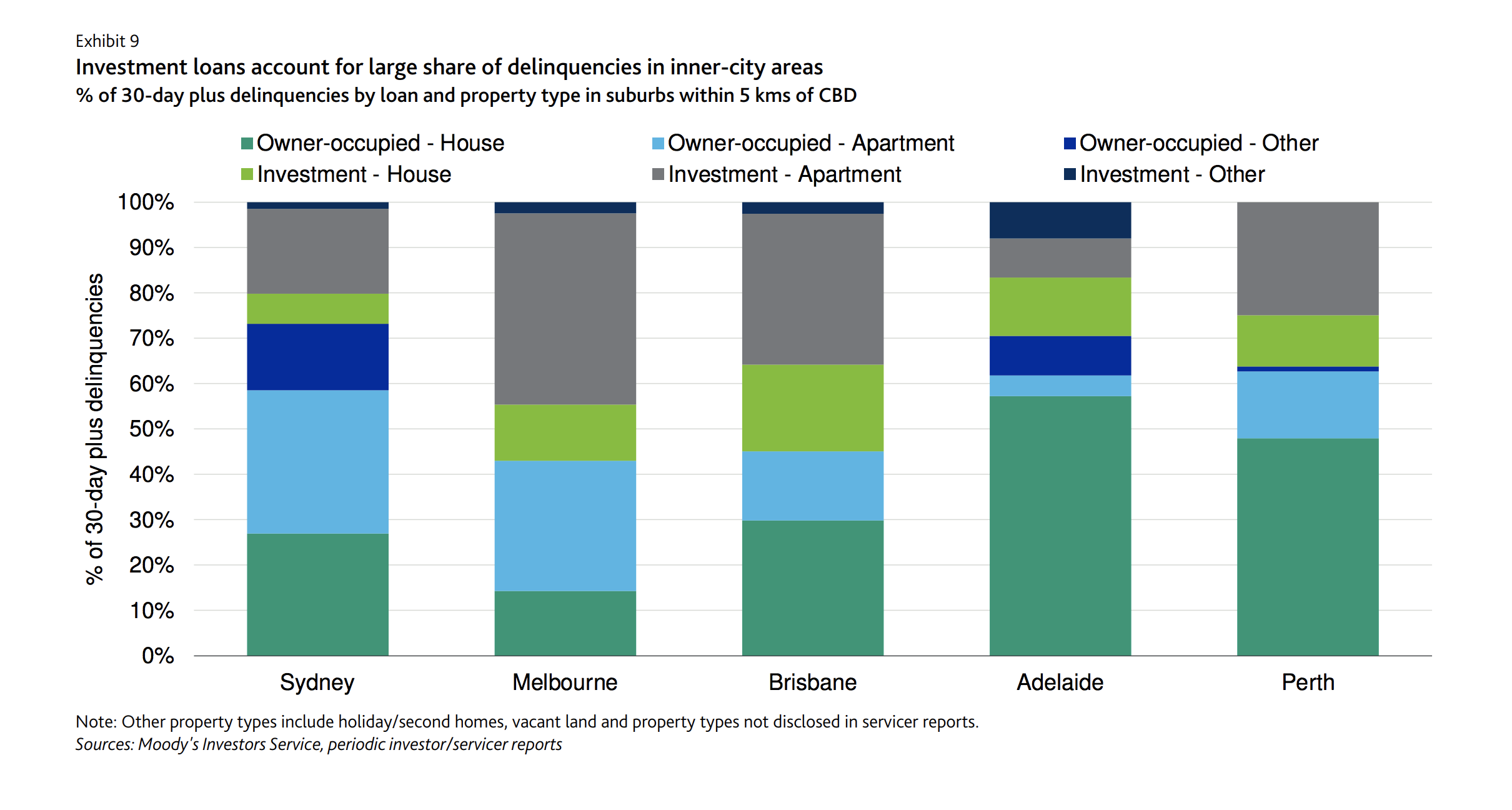

On the other end of the scale, a minimum of 50 per cent of mortgages are extended for investment purposes in suburbs within five kilometres of the CBD in Sydney, Melbourne and Brisbane.

The report attributes this to a high share of interest-only loans, typical for investment properties in these inner-suburbs.

A large number of interest-only mortgages are due to convert to principal and interest in the next two years, which Moody's says will increase the risk of delinquencies.

However, delinquencies on investment loans reflect more than half of all delinquencies in the five kilometre radius of Brisbane and Melbourne CBD’s, a large share of which are on loans for apartments.

Related: Ten Lessons from Cities that Have Risen to the Affordable Housing Challenge

In the event of a downturn in housing prices, Serov says mortgage delinquencies and defaults could rise in inner-city areas due to the high share of investment and interest-only loans.

"Though in general we expect delinquencies and defaults to remain higher in outer suburbs," Serov said.